Whoever has been working in an investment bank knows that regulation is a big deal, even more so after 2008. By contrast, the world of digital assets is largely unregulated.

What is regulation anyway, why does it even exist? It could be argued that regulators worldwide have a single objective: to protect investors, small and big alike. What do investors need protection from? For the sake of simplicity let’s abstract this to the simplest notion : “information asymmetry”. Financial markets deal with information, assimilating information into price to obtain the “fair price” of a product or service. Information asymmetry means that one of the parties to a transaction knows more (or understands better) than the other, and as a result the price formed during that transaction is biased, resulting in a transfer of wealth from the less knowledgeable to the more knowledgeable.

“For those tempted to believe morons should lose their shirt, let me offer the following proposition: you always are somebody else’s moron.“

The information or knowledge we are talking about is somewhat specific. Two investors may differ in their belief that a particular situation will occur (for example XYZ stock price will go up), as a result will take different risks. Fine. But if a trader sells a complex product to a retail investor, it is most certain that the former has much better understanding of the associated risks, and may not be entirely forthcoming about those. This is the kind of asymmetry regulation is meant to address.

Coming back to the above transfer of wealth, one might argue the “fairness” of that transfer – which may or may not be part of the regulator’s mandate. What is beyond doubt however is that the global allocation of resources in the economy will be biased as well, resulting in inefficient and sub-optimal development (or unacceptable risks for unsophisticated investors). It comes as no surprise then that regulators’ first weapon is transparency, expressed as a disclosure obligation. After all the best way to make sure that everybody is on the same page is to force the more knowledgeable party to share information. That is exactly what has happened in the past 10 years in the realm of traditional markets. Disclosure goes a long way: from traders having to disclose their profit margin to clients, to financial institutions having to disclose employee compensation.

* * *

If we turn to the mostly unregulated digital eco-system, we should certainly ask the same question: if regulation served a purpose in traditional markets, specifically around the theme of transparency, shouldn’t we apply the same standards for the benefit of the largest number of investors? Presumably those would feel better protected and would increase their activity. In addition this sense of security would probably convince “by-standers” to join in.

Many argue regulation stifles innovation. But would transparency stifle innovation?

Well I confess that in my view transparency, whether volontary or imposed, is a fundamental component of “fair and orderly” markets, so I certainly hope we’ll see more of it. And in fact we might as well start looking for it right away.

If you were a trader in an investment bank, trying to become member of a new exchange, you would face a barrage of questions from all fronts: management, risk and compliance, even tax and accounting. Have you asked your crypto exchange the same questions? If those are legitimate for a regular exchange, why wouldn’t they be for any kind of marketplace? So what kind of information would a trader want to acquire i.e. what kind of question would you be wise to ask your crypto exchange (or any other intermediary for that matter)?

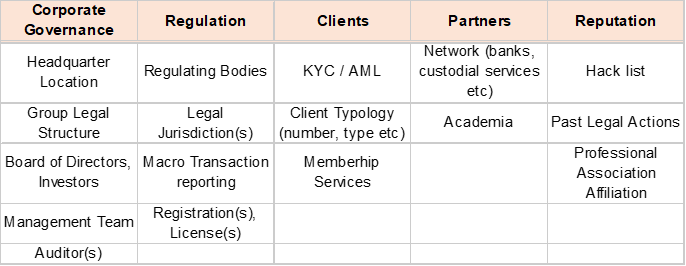

Let’s distinguish trading and non-trading. The table below gives a non-exhaustive list of non-trading relevant information:

It all has to do with common sense curiosity: who am I dealing with? what economic interests am I facing, what kind of legal protection am I entitled to (if any)? Does the exchange have a history of reputational issues such as hacking? What is the qualification of the management team and what governance are they facing?

It is not the point here to detail all the items, but to give a sense of the extent of information regulators would want you to have under the “disclosure” obligation before you open a new business relationship. By the way exchanges also want to know who they’re dealing with, that’s the point of KYC investigation. It’s only fair you/we return the questions.

One item might be surprising: “academia”. Well, believe it or not it is far-reaching. Many scandals in financial markets (and elsewhere) have emerged from the work of independent researchers. Exchanges worldwide routinely provide confidential trading data to the academic world to facilitate applied financial research. Such data is incidentally also made available to national regulators.

Is that mass of information readily available from traditional exchanges? Absolutely, it may not be 100% present on their web site (here or here for example), but it is available to clients and qualified prospects. Is it readily available for crypto exchanges? No, not by a long stretch. Should it be? Well, in the absence of legal obligation, it is anybody’s call. One could argue however that disclosure goes a long way in establishing trust.

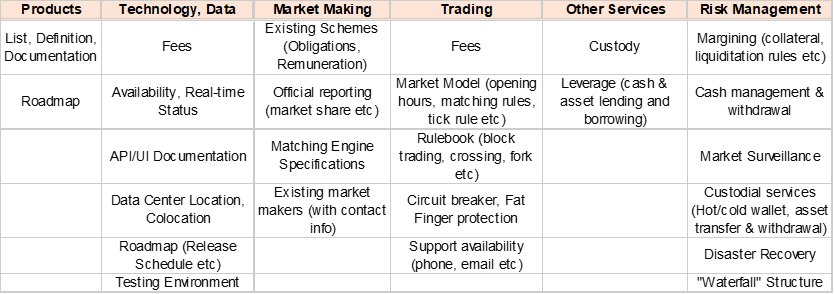

Next chapter, trading. Surely one needs to be well-informed about an exchange to be able to trade smartly. Like before, below is a non-exhaustive list of things you might want to know before transacting:

All in all, we are getting to the core of what an exchange is. There are very few cells in that table that are not highly relevant to the quality of service the exchange is able to deliver its clients. You might be tempted to consider some of those buckets are for professionals only, and that is indeed absolutely true. Then again, if professional traders conclude their due diligence favorably, chances are that any and all market participants will experience a higher quality of service.

Is that mass of information readily available from traditional exchanges? Absolutely, it may not be 100% present on their web site, but it is available to clients and qualified prospects. Is it readily available for crypto exchanges? No, not by a long stretch. Should it be? Insofar as it directly relates to the way orders, executions, risks are handled, there is little doubt here — it should be timely, accurate and exhaustive.