Central banks routinely issue money without any reserve backing it. Could Tether do the same and become the first decentralized central bank?

I have expressed before skepticism about Tether (a.k.a USDT) and the fact that a high level of uncertainty still exists on the actual level of reserves backing the token issuance. For all the bad press this uncertainty has created however, a similar situation has occurred regularly in history. Before central banks became the norm, many commercial banks and governments took liberties in issuing money, if only to finance recurring war efforts here and there. In fact couldn’t the same be said of central banks today after the financial crisis of 2008 and the COVID economic disaster of early 2020?

At the end of WWII, to avoid a repeat of past monetary crises and install stable foundations for reconstruction and international commerce, governments of developed economies formed and adhered to a new monetary pact, the Bretton-Woods system.

The idea was simple: fix exchange rates between the most important currencies, and back every dollar in circulation with a measurable and controllable inventory of physical asset, and you immediately choke inflationary pressures. Furthermore you prevent political agendas to interfere with monetary policy (in the form of trade wars for example).

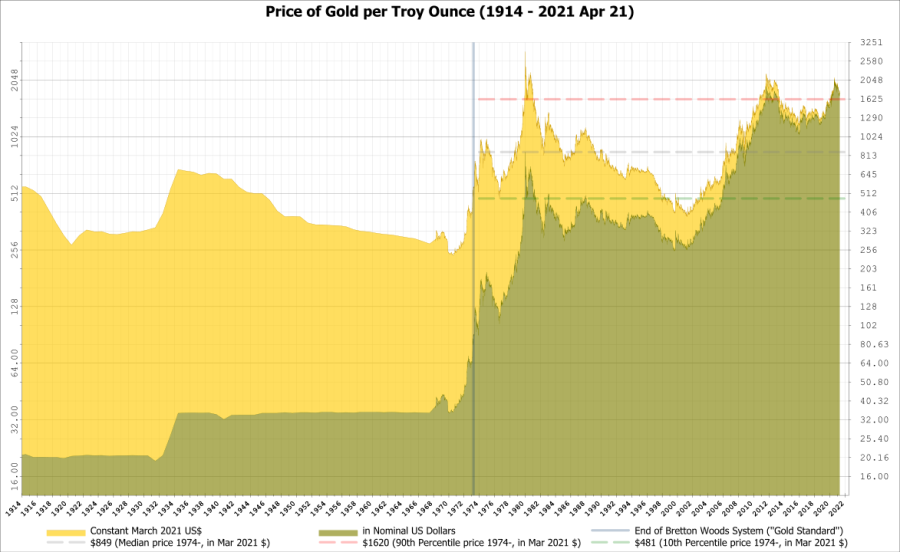

The asset chosen for Bretton-Woods was gold, a natural choice at the time. With significant yet slow-growing supply, gold was already a commodity actively traded, and for which trade and storage were already well organized. The final element in the equation was convertibility: anybody in possession of gold could obtain dollars (or any other currency) and vice-versa, at a fixed exchange rate. In reality only governments and central banks were able to convert, a restriction which de factor created two distinct marketplaces for gold: one for central bankers, one for private participants. Convertibility was not an easy feat: it took more than 10 years to fully deploy because of its impact on each participant’s ablitity to control its flow of capital on international markets. Western European economies enforced convertibility in 1958, only when they were strong enough to accomodate free-floating capital flows.

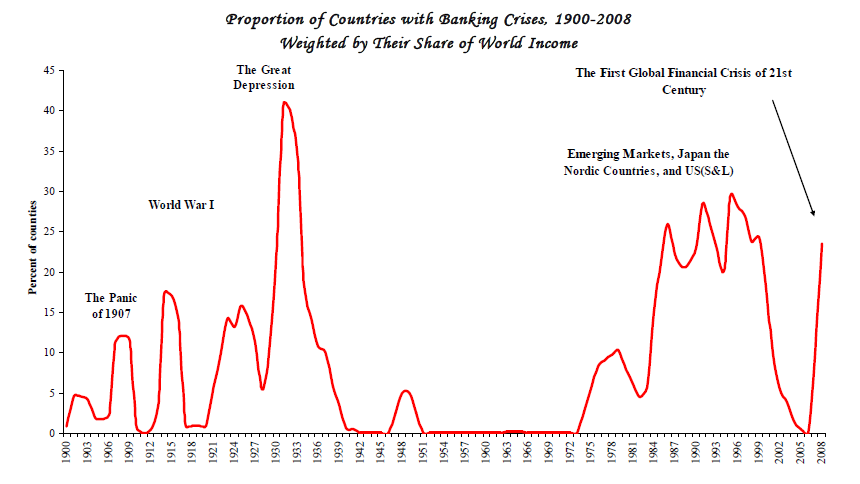

The result was quite remarkable, a period of previously unknown financial stability which in turn paved the way for massive economic growth. For 30 years, the world enjoyed exceptional growth and a quasi-absence of financial crises:

Imbalances were quick to appear though, for reasons intuitively simple: the dollar effectively became the currency of reference and was in high demand. That demand was not fulfilled by a rise in gold supply. The gap between the two created an arbitrage between prices for central bank gold vs. private markets and an unsustainable drain on the US gold reserves:

In 1971 Nixon unilateraly suspended the gold/dollar convertibility and a system of floating exchange rates progressively imposed itself.

Now what does it all have to do with Tether? Well, Tether is effectively used as a settlement currency for bitcoin transactions. Many crypto exchanges do not even list BTC pairs against fiat money. The rise of bitcoin to $60,000 was accompanied by a massive issuance of Tether (and other stable coins incidentally). [NB: there are two reasons for this: one is technical (it is far easier to settle a BTC/USDT transaction than a BTC/USD one), the other reglementary: USDT being totally unregulated, anybody can conduct business using it, whereas conducting business in USD immediately puts you in the perimeter of US regulators].

In the crypto eco-system, Tether is the equivalent of the US dollar in the financial system at the end of WWII: it is the currency that flows throughout the system and enables participants to trade when and where they want. The actual US dollar is the equivalent of gold in Bretton Woods: the undisputed store of value, from which all other currency units draw their value. We have a fixed exchange rate (1 tether = 1 USD) and convertibility at will: look no further, this is a mini-Bretton Woods.

What if Tether announced tomorrow that they don’t want to enforce convertibility anymore, and oh by the way, “we don’t really have a 1-to-1 reserve pool”? The company could keep issuing USDT as it sees fit, feeding the marketplace with enough liquidity to “keep it going”. If indeed all USDT holders consider they have good reasons to hold Tether, because it helps them trade, there’s is really no reason for them to dispose of it. A “Nixon shock” whereby Tether would announce it will not enforce the 1-to-1 parity anymore could be followed by a new rule of floating exchange rate. Would there be a fundamental problem with that? Abolutely not. When Nixon announced the US would not enforce parity anymore it was a unilateral decision, and there’s no doubt there were immediate winners and losers. It was a shock, economically and politically, yet it was not the end of world. The resulting role of Tether would be that of a de-facto all-powerful central bank, controling the reference currency of the crypto eco-system. Quite an enviable position if you ask me.

So why don’t they? As interesting as it sounds, this idea raises a few issues:

- a floating exchange rate means that some people will have lost a lot of money. Contrary to Bretton Woods populated by Secretaries of State and Central Bankers, Tether is a private company and unpegging its USDT from the dollar would amount to nothing less than a fraud if the company was not in a position to repay USDT holders according to the original promise. Now of course, how is that original promise contractualized? What is its legal strength, what could an individual do in front of such a situation? This is difficult to say with certainty, it depends (surprise surprise) on the specifics of Tether situation and on the wording of the (legally binding?) documents behind its token.

- Bretton-Woods was a matter of international public policy, Tether is an unregulated private agent. How trustworthy is it? If it changed the rules once, could it do it again?

- Central banks are extraordinarily transparent. Their charter dictates what they can and cannot do, their operations are usually referred to as “open market” because they are indeed performed in plain sight on open markets. Rules are disclosed, available to all and applicable to all. Their balance sheet is also pubicly available (even though it is after the fact, but it is difficult to operate otherwise). The standard of transparency is so high because of the power they hold over the economy. Would Tether, entrusted with such power, be willing to hold itself to such a standard? Track record so far is not great to say the least.

- In the end, the Federal Reserve is chartered by its national government (the same is true of all central banks). I honestly don’t know if the notion of “public good” is explicit in its charter, but certainly enforcing monetary stability and acting as a lender of last resort both serve public interest. The role of central banks in 2008 and post-COVID is an undeniable testimony to that. Would Tether be willing to commit itself to the promotion of a greater good — as opposed to the promotion of personal interests, whatever those might be? How would we convince ourselves once and for all that it is indeed the case?

- The Federal Reserve draws its legitimacy from the confidence the general pbulic puts in the rule of law and military power of the US (the same goes for the US dollar). Where would Tether draw its legitimacy from? Not quite an easy answer there.

A central bank is the ultimate government-sponsored trusted third party. The crypto eco-system was born in part on the rejection of the “government-sponsored” part, on the idea that it would be possible to build an “algorithmic” trusted third party bypassing the existing financial system and devoid of interference from governments. Can Tether rise to the challenge?