This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Fiat vs Stablecoin analysis

By Chadi El Adnani and Arthur Serge, November 2022

SUN ZU Lab is delighted to present the third article of its new series of publications, inspired by NASA’s James Webb space telescope, which has recently produced the deepest and sharpest infrared images of the distant universe to date. In the same spirit, we embarked at SUN ZU Lab on a mission to decrypt and analyze the deepest and darkest corners of the Web3 ecosystem, providing in this second report an analysis of crypto trading activity between fiat (USD, EUR) and stablecoin (USDT, USDC) for the past month of September 2022.

In the following sections, we go back on three major events that marked the month of September:

The Merge

The long-awaited Merge, Ethereum’s transition from Proof-of-Work to Proof-of-stake, finally happened on September 15th, around 06:43 AM UTC. The Merge will be just the first significant update, with the roadmap only complete at 55%. There will be four major stages after this step:

- The Surge: the network’s scalability will be increased during this phase through sharding by splitting it into “shards” to create smaller, faster and more manageable pieces.

- The Verge: this phase aims to optimize storage through Verkle Trees. This should reduce node sizes and increase scalability.

- The Purge: this phase aims to reduce excess historical data and decrease the memory capacity needed to run the blockchains.

- The Splurge: the network will keep making more minor updates to ensure everything runs smoothly from previous updates.

According to Vitalik, Ethereum should be able to process 100,000 TPS by the end of the roadmap. The transition has also pushed ETH into a deflationary territory, as it had its first-ever deflationary month following the Merge.

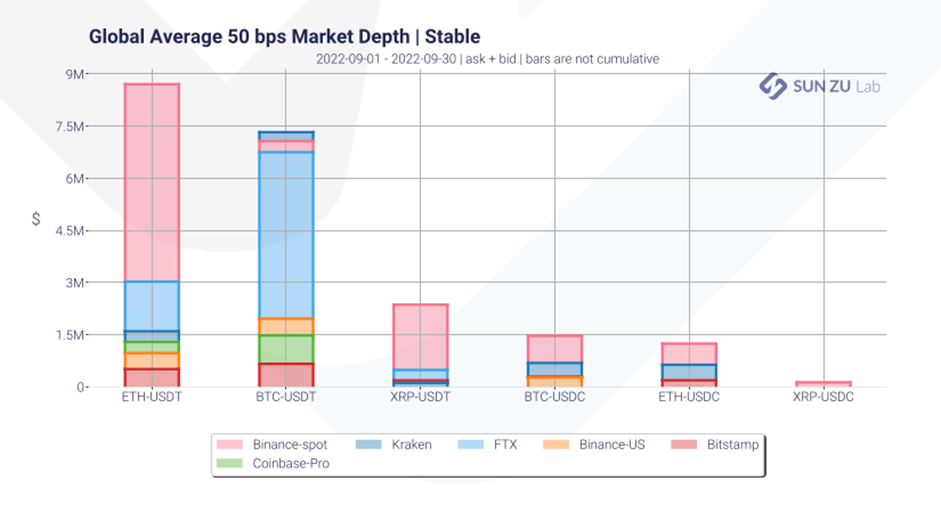

Global average 50 bps market depth levels on ETH-USDT slightly increased on Binance to c. $9 million, while it doubled on FTX to $3 million.

Binance BUSD and zero-fee policies:

Binance announced in early September that it would start auto-converting balances from major stablecoins (TUSD, USDC and USDP) to BUSD. The exchange underlyined that the move was in no way a marketing ploy to increase BUSD holders but rather to improve liquidity and provide better prices and faster order executions for its users. Users can, in fact, still deposit and withdraw any stablecoin.

Binance also suspended ETH-BUSD trading fees from August 26th to September 26th to benefit from Merge-related activity. Our data shows that more than 90% of spot ETH-USDT and ETH-USDC volumes happen on Binance.

The UK markets:

September was a hectic month for UK markets following concerns over the UK’s fiscal health after Liz Truss’s government’s proposed tax-cut plans. On September 26th, the British pound fell to an all-time low against the USD, at $1.03. Panic in the financial markets led to BTC/GBP trading volumes rising to record-high levels, surpassing the $800 million mark on the 26th alone. It remains unclear however if this activity was driven by protection incentives to hedge against the sterling slide, or rather pure speculative moves to profit from the volatility.

SUN ZU Lab data shows that while ETH-USDT traded volumes in September stayed relatively stable at around $40bn (on the selected exchanges), BTC-USDT volumes jumped by more than $50bn over August levels to $175bn.

Access the whole report with exhaustive statistics such as price, spread and much more!

Questions and comments about “Fiat vs Stablecoin” can be addressed to research@sunzulab.com

About SUN ZU Lab

SUN ZU Lab is a leading data solutions provider based in Paris, on a mission to bring transparency to the global crypto ecosystem through independent quantitative analyses. We collect the most granular market data from major liquidity venues, analyze it, and deliver our solutions through real-time dashboard & API stream or customized reporting. SUN ZU Lab provides crypto professionals with actionable data to monitor the market and optimize investment decisions.

Bitcoin Volatility Prediction

SUN ZU Lab WEBB3 Analytics #2

By Arthur Serge, Mounir Chaabani and Chadi El Adnani

September 2022

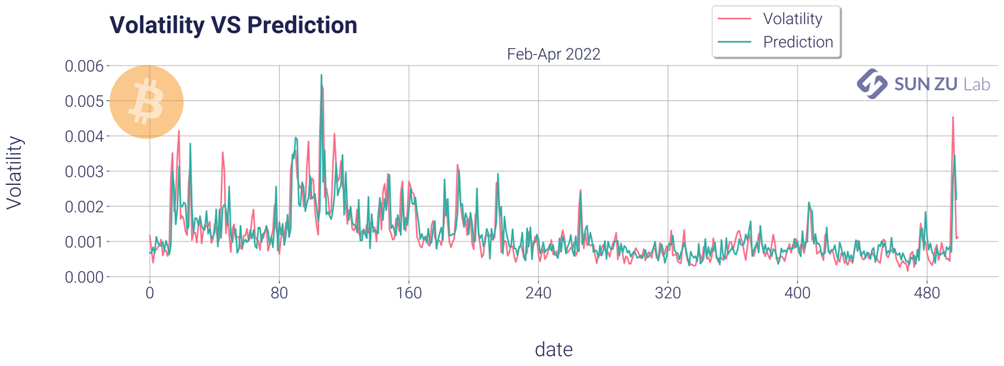

Predicting volatility is an exciting task due to its importance in creating trading signals and calibrating agents’ positions. We explored at SUN ZU Lab different methods proposed in the literature, and we propose new methods tailored for cryptocurrencies. In this article, we focus on BTC volatility forecasting. This task is non-trivial due to factors such as high noise-to-signal ratio, market microstructure, or heteroscedasticity.

Our method is mainly based on using neural networks adapted for sequential data, as is the case for time series. The advantage of neural networks is their ability to extract complex features and non-linear effects, which is not the case for the majority of statistical models applied to quantify volatility.

We use BTC-USD data from Bitstamp, focusing on transaction and order book data to compute volatility and features for our neural network. The time series runs from February 2022 to April 2022. For this task, we used the Garman-Klass proxy for volatility as we work in the context of high-frequency data, using 10-min volatility for each 5 min. The idea is to predict the volatility for the next 5 minutes based on recent volatility levels and other market indicators.

We jump directly to the conclusion and display a chart summarizing our results:

Prediction of the last 500 out of sample points

Questions and comments can be addressed to research@sunzulab.com

About SUN ZU Lab

SUN ZU Lab is a leading data solutions provider based in Paris, on a mission to bring transparency to the global crypto ecosystem through independent quantitative analyses. We collect the most granular market data from major liquidity venues, analyze it, and deliver our solutions through real-time dashboard & API stream or customized reporting. SUN ZU Lab provides crypto professionals with actionable data to monitor the market and optimize investment decisions.

Fiat vs Stablecoin Analysis

WEBB-3 Analytics #1: August 2022

By Chadi El Adnani, Crypto Research Analyst and Arthur Serge, Quantitative Analyst @SUN ZU Lab

SUN ZU Lab is delighted to present this new series of publications, inspired by NASA’s James Webb space telescope, which has recently produced the deepest and sharpest infrared images of the distant universe to date. In the same spirit, we embarked at SUN ZU Lab on a mission to decrypt and analyze the deepest and darkest corners of the Web3 ecosystem, providing in this first report an analysis of crypto trading activity between fiat (USD, EUR) and stablecoin (USDT, USDC) for the past month of August 2022.

Just for the pleasure of the eyes, here is Webb’s first released image, on July 12th, 2022, at approximately 10:39 AM EDT, showing the galaxy cluster SMACS 0723 as it appeared 4.6 billion years ago. This slice of the vast universe is roughly the size of a grain of sand held at arm’s length by someone on the ground!

Discover the full report here!

This report focuses on crypto market leaders BTC and ETH (59% of global crypto market capitalization as of September 2022). The duo stands out from other altcoins both in terms of traded volumes and order book market depth, as shown by our data over H1 22.

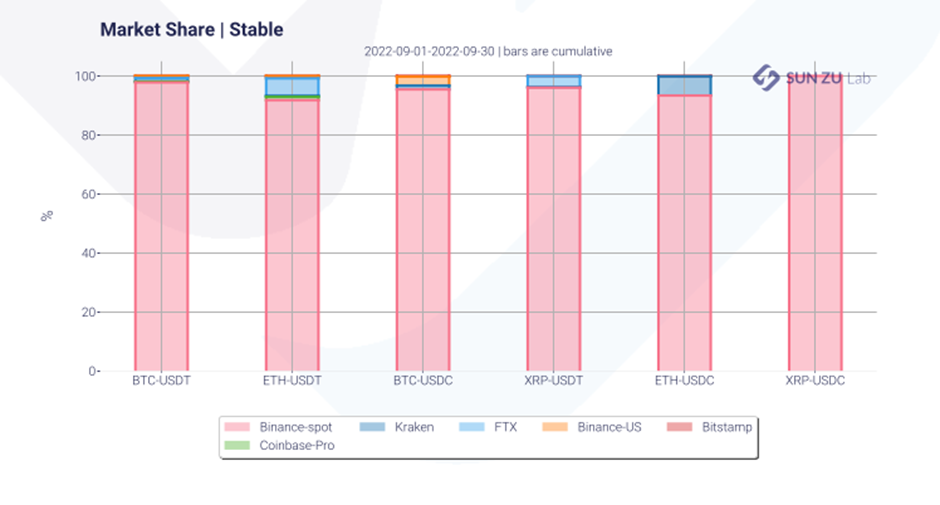

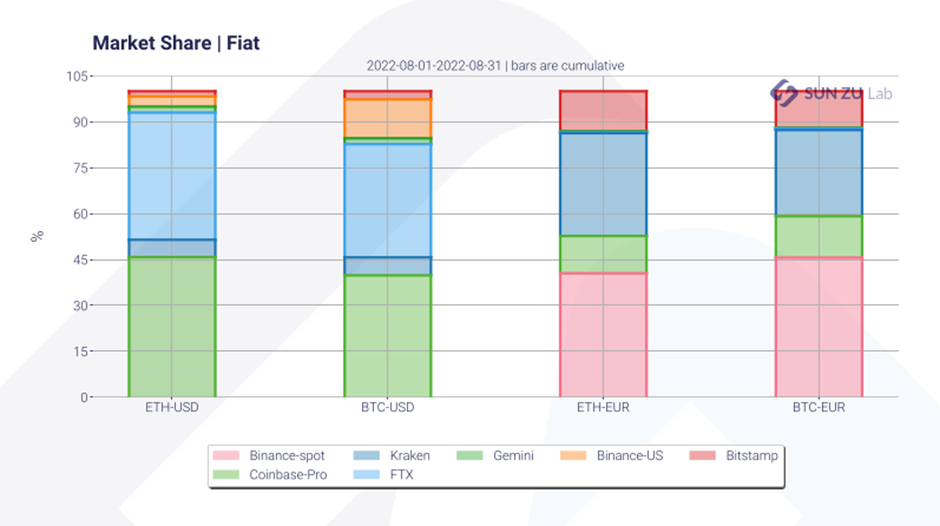

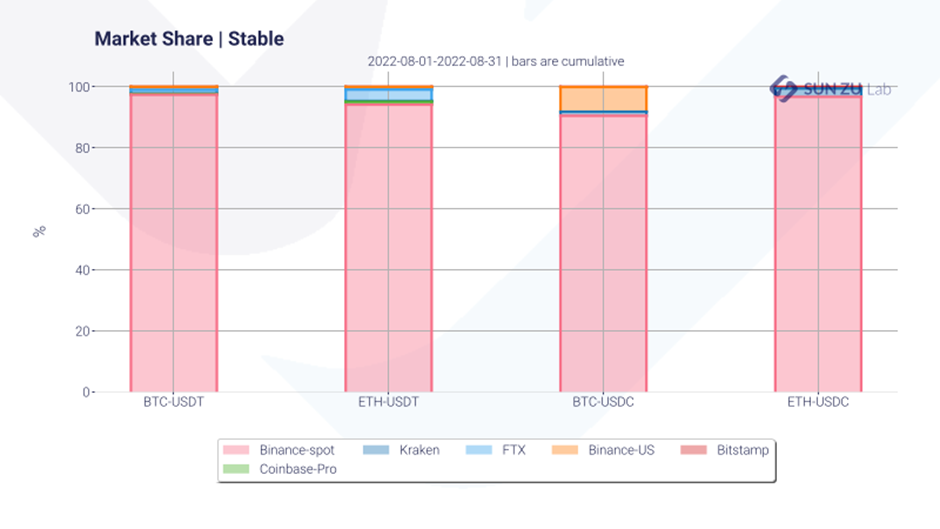

Starting with market shares between the leading CeFi exchanges, we notice that BTC/ETH trading against stablecoins is much more concentrated than fiat trading. More than 90% of volumes for pairs involving stablecoins happen on Binance-spot. Regarding trading concentration for fiat markets, we notice a dominance of Coinbase-Pro and FTX over the pairs BTC-ETH/USD, while Binance and Kraken control over 75% of the BTC-ETH/EUR market share.

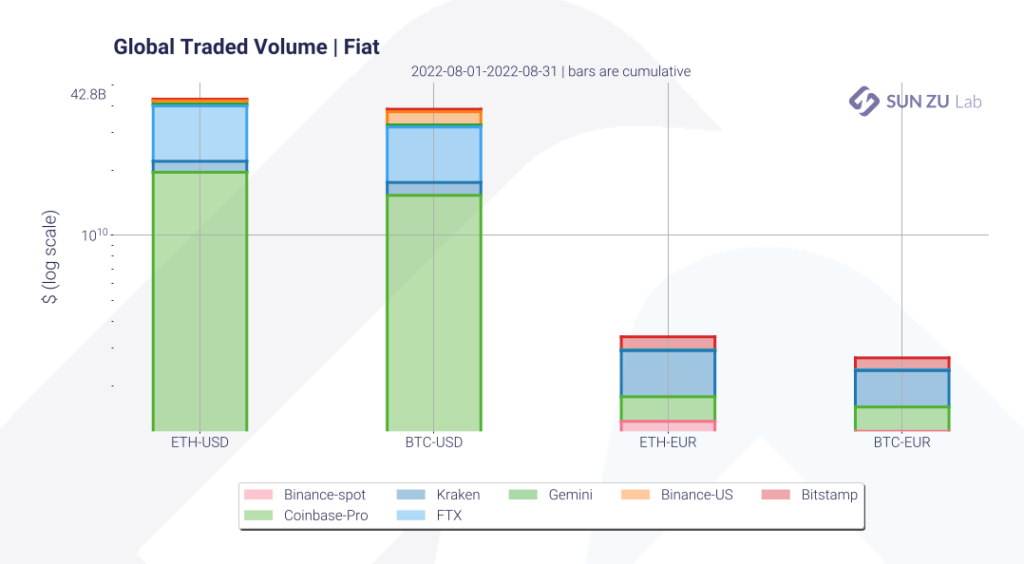

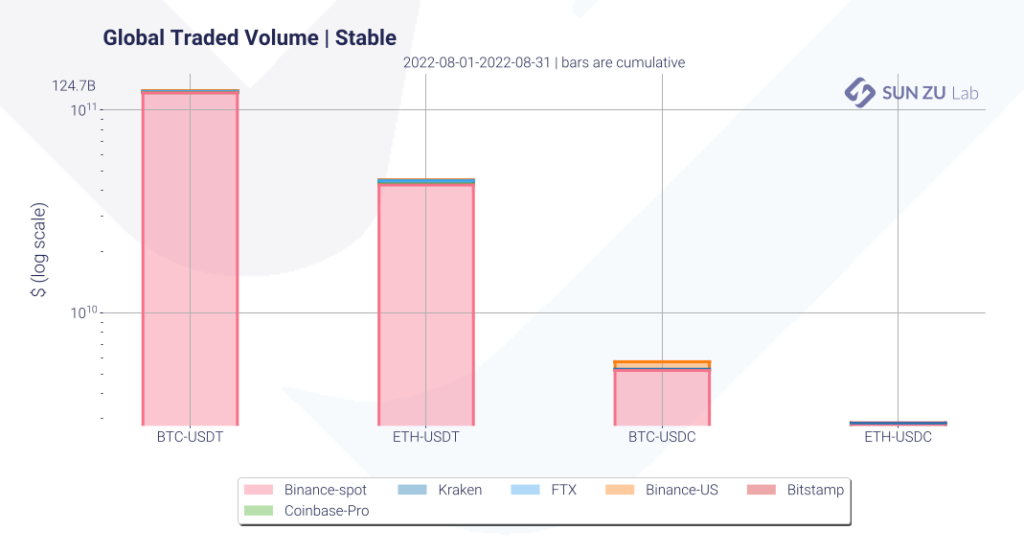

BTC-USDT traded volumes over the selected CEXs reached $125 billion, c. 3x the levels of BTC-USD volumes. On the other hand, the pairs ETH-USD and ETH-USDT presented similar levels, around $43 billion. USD-denominated volumes are more than 10x higher than EUR transactions, and trading against USDT shows volumes 20x higher than USDC.

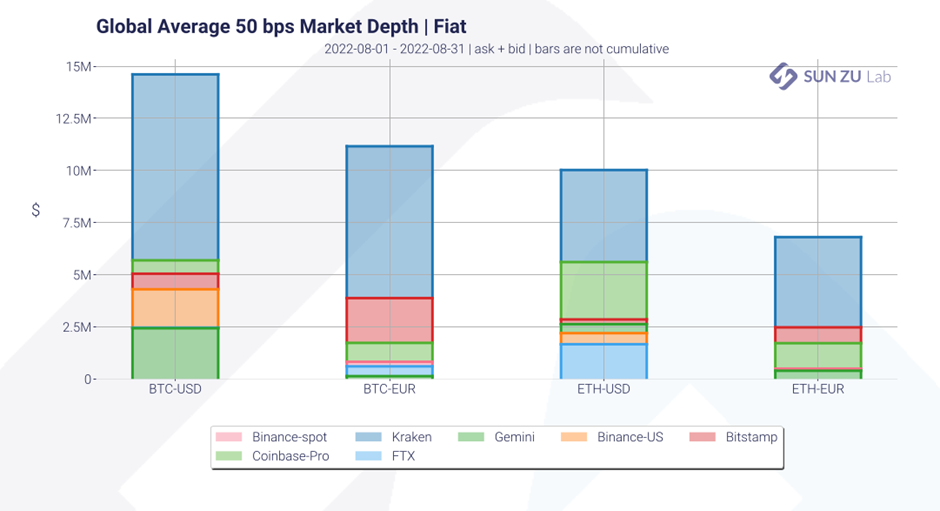

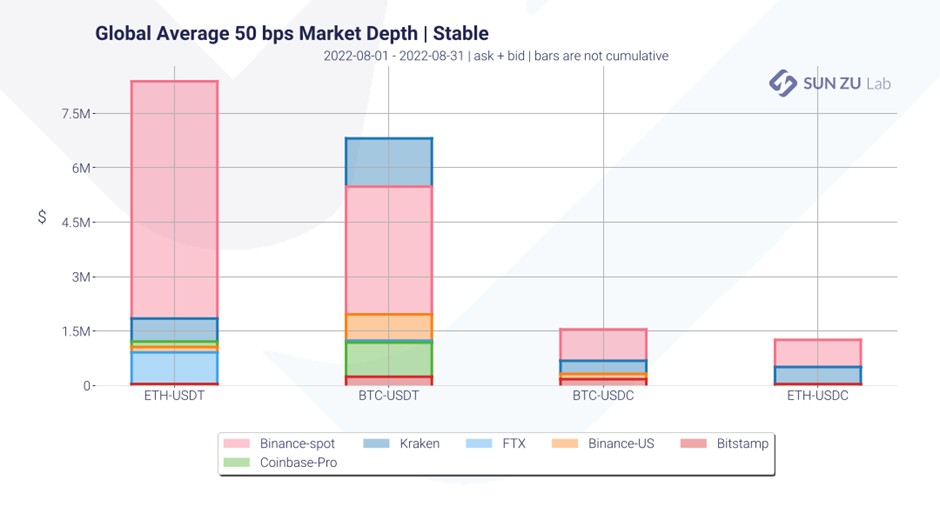

However, the previous trend is inverted regarding 50bps order book market depths: except for Binance-spot, where the majority of trading against USDT is taking place, major exchanges overall display market depth levels 2-3 times higher for USD/EUR than USDT/USDC. Kraken shows the most elevated market depth levels, with as much as $15 million in average 50bps market depths over August 2022.

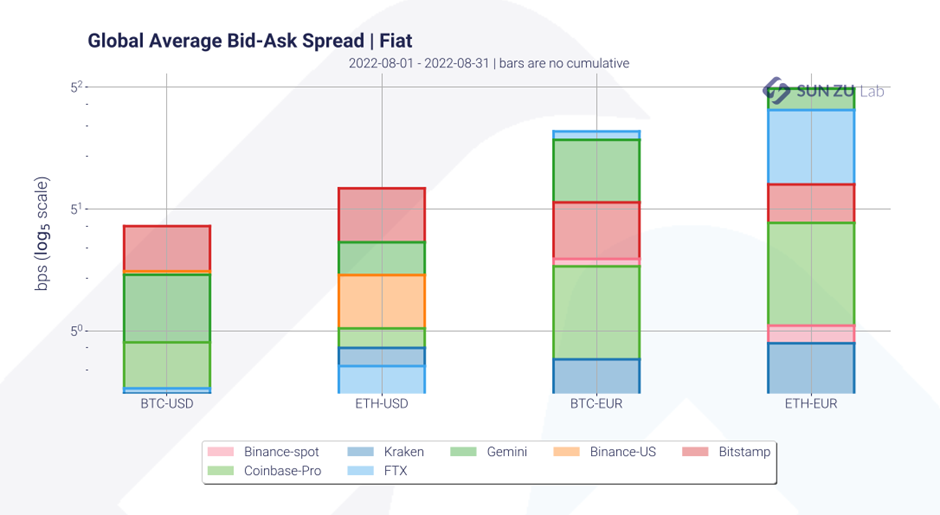

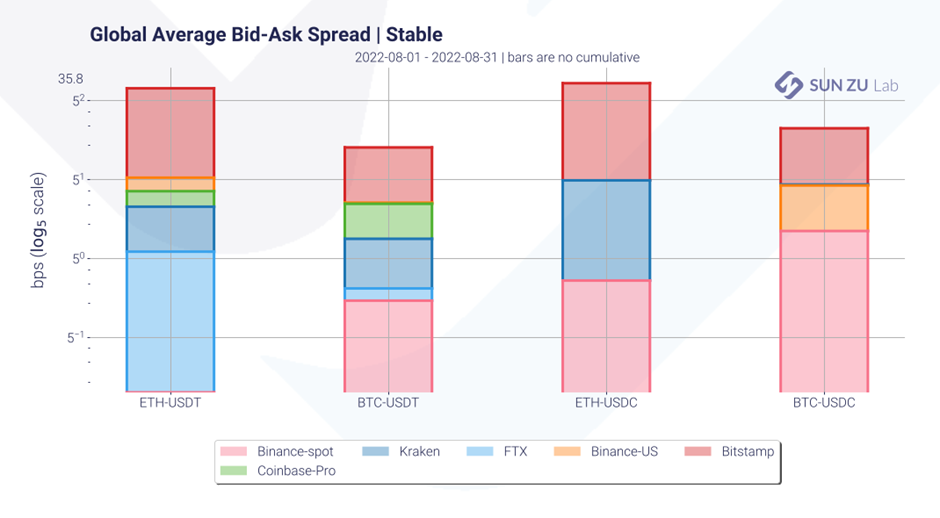

Bid-Ask spread analysis shows that Bitstamp still has some of the highest spreads relative to other CEXs, between 5 and 40bps. Binance-spot, on the other hand, displays spreads as low as 0.05bps for ETH/USDT and 0.4bps for BTC/USDT. EUR-denominated pairs show spread levels 3-5x higher than USD pairs.

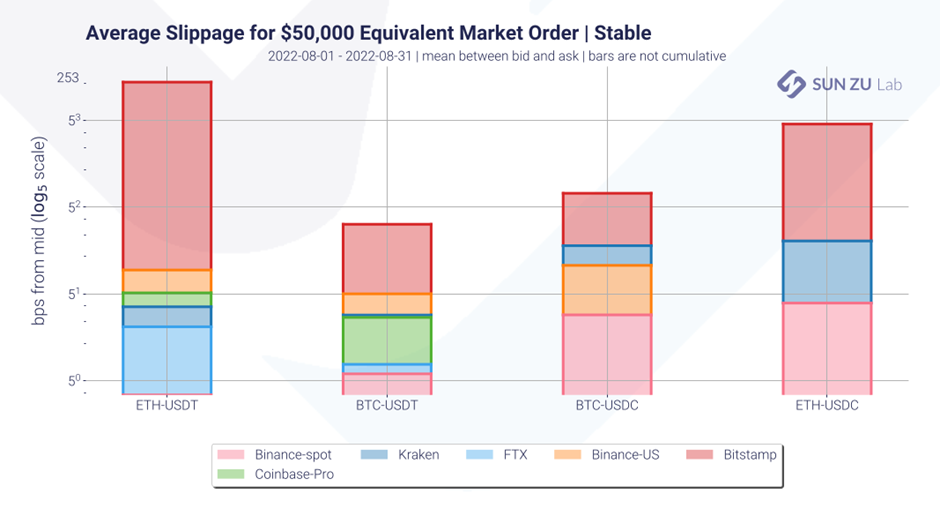

We next analyze average slippage levels from the mid-price for $50,000 equivalent market orders. Our data shows that BTC-ETH trading against USDT/USDC gives place to higher slippage than USD trading on major exchanges. Bitstamp and Binance-US have the highest slippage levels for USDT, USDC and USD pairs, while FTX and Gemini have slippage levels above 20bps for transactions against EUR.

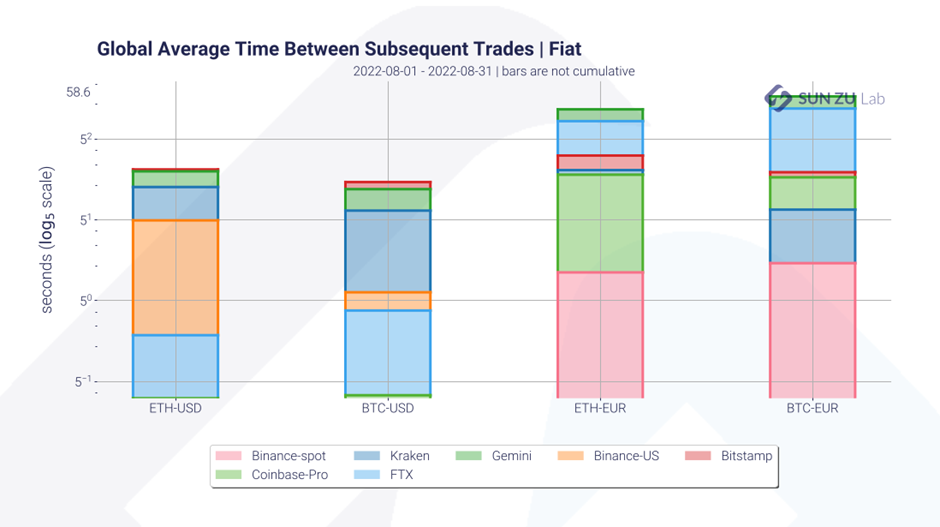

Finally, an analysis of the average time between subsequent trades shows that BTC-ETH/USD trades take place 2x faster than BTC-ETH/USDT-USDC trades on the selected exchanges. The average time between BTC-ETH/USDT trades on Binance-spot is less than 200 milliseconds. On the other hand, Bitstamp and Kraken display average times between USDT trades higher than 25 seconds, with the same being effective for EUR trades on FTX and Gemini.

Conclusion

Many differences arise from our analysis of fiat vs stablecoin crypto trading. Trading against stablecoin is much more concentrated in specific venues than fiat trading, whereas bid-ask spreads depend mainly on the exchange’s liquidity. Trading against stablecoin also shows higher volumes than fiat for BTC and ETH. Tax purposes could explain this; in many countries such as France, only trading against fiat creates a taxable event, incentivising traders to execute more crypto to crypto trades.

Questions and comments can be addressed to c.eladnani@sunzulab.com, or research@sunzulab.com

About SUN ZU Lab

SUN ZU Lab is a French Fintech that aims to become the leading independent provider of digital asset market quantitative analytics tools and services. Leveraging the founding team’s 70+ years of experience in international capital markets and trading technology, SUN ZU Lab provides crypto professionals with unprecedented liquidity analytics in the form of quant reports, dashboards, real-time augmented data feeds, and bespoke studies.