This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Fiat vs Stablecoin analysis

By Chadi El Adnani and Arthur Serge, November 2022

SUN ZU Lab is delighted to present the third article of its new series of publications, inspired by NASA’s James Webb space telescope, which has recently produced the deepest and sharpest infrared images of the distant universe to date. In the same spirit, we embarked at SUN ZU Lab on a mission to decrypt and analyze the deepest and darkest corners of the Web3 ecosystem, providing in this second report an analysis of crypto trading activity between fiat (USD, EUR) and stablecoin (USDT, USDC) for the past month of September 2022.

In the following sections, we go back on three major events that marked the month of September:

The Merge

The long-awaited Merge, Ethereum’s transition from Proof-of-Work to Proof-of-stake, finally happened on September 15th, around 06:43 AM UTC. The Merge will be just the first significant update, with the roadmap only complete at 55%. There will be four major stages after this step:

- The Surge: the network’s scalability will be increased during this phase through sharding by splitting it into “shards” to create smaller, faster and more manageable pieces.

- The Verge: this phase aims to optimize storage through Verkle Trees. This should reduce node sizes and increase scalability.

- The Purge: this phase aims to reduce excess historical data and decrease the memory capacity needed to run the blockchains.

- The Splurge: the network will keep making more minor updates to ensure everything runs smoothly from previous updates.

According to Vitalik, Ethereum should be able to process 100,000 TPS by the end of the roadmap. The transition has also pushed ETH into a deflationary territory, as it had its first-ever deflationary month following the Merge.

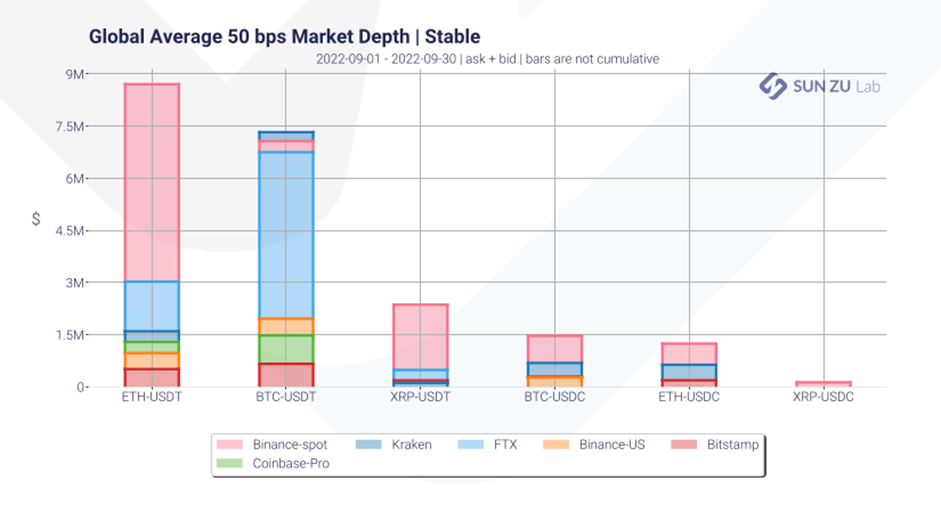

Global average 50 bps market depth levels on ETH-USDT slightly increased on Binance to c. $9 million, while it doubled on FTX to $3 million.

Binance BUSD and zero-fee policies:

Binance announced in early September that it would start auto-converting balances from major stablecoins (TUSD, USDC and USDP) to BUSD. The exchange underlyined that the move was in no way a marketing ploy to increase BUSD holders but rather to improve liquidity and provide better prices and faster order executions for its users. Users can, in fact, still deposit and withdraw any stablecoin.

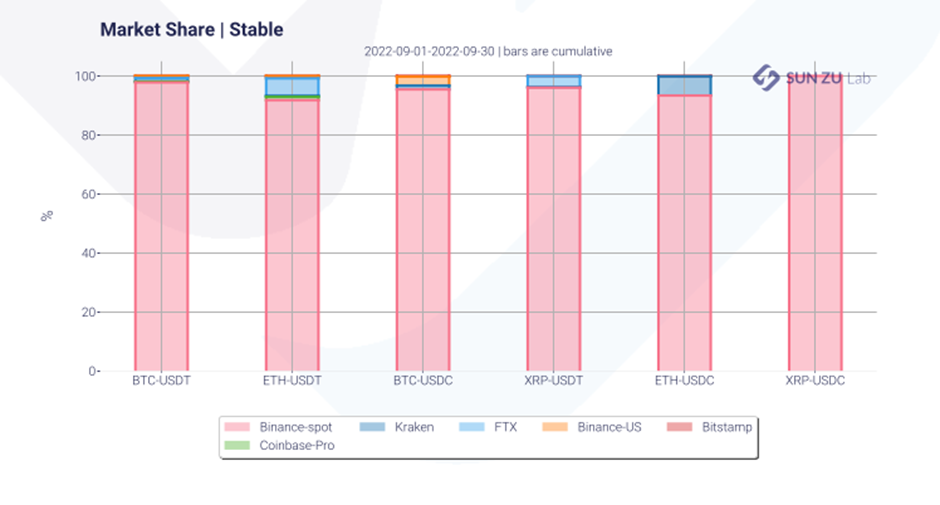

Binance also suspended ETH-BUSD trading fees from August 26th to September 26th to benefit from Merge-related activity. Our data shows that more than 90% of spot ETH-USDT and ETH-USDC volumes happen on Binance.

The UK markets:

September was a hectic month for UK markets following concerns over the UK’s fiscal health after Liz Truss’s government’s proposed tax-cut plans. On September 26th, the British pound fell to an all-time low against the USD, at $1.03. Panic in the financial markets led to BTC/GBP trading volumes rising to record-high levels, surpassing the $800 million mark on the 26th alone. It remains unclear however if this activity was driven by protection incentives to hedge against the sterling slide, or rather pure speculative moves to profit from the volatility.

SUN ZU Lab data shows that while ETH-USDT traded volumes in September stayed relatively stable at around $40bn (on the selected exchanges), BTC-USDT volumes jumped by more than $50bn over August levels to $175bn.

Access the whole report with exhaustive statistics such as price, spread and much more!

Questions and comments about “Fiat vs Stablecoin” can be addressed to research@sunzulab.com

About SUN ZU Lab

SUN ZU Lab is a leading data solutions provider based in Paris, on a mission to bring transparency to the global crypto ecosystem through independent quantitative analyses. We collect the most granular market data from major liquidity venues, analyze it, and deliver our solutions through real-time dashboard & API stream or customized reporting. SUN ZU Lab provides crypto professionals with actionable data to monitor the market and optimize investment decisions.