This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Why will at least 80% of centralized crypto exchanges (CEXs) disappear?

By Stéphane Reverre & Chadi El Adnani @SUN ZU Lab

August 2023

TL;DR

- History in TradFi shows concentration is inevitable. It is objectively not in investors’ interest to have such a high level of fragmentation among crypto trading venues;

- Liquidity attracts liquidity! losers will die a slow death;

- Regulatory pressure will (also) determine who lives and who dies;

- The race to zero on trading fees is already here.

It was October 2022 when we published an article titled “Why has liquidity become a question of survival for crypto venues?” urging centralized crypto exchanges to consider liquidity as the “gold standard” of their future profitability and deploy all necessary resources to monitor it and understand its drivers. Little did we know that one month later, the FTX/Alameda implosion would put the entire crypto ecosystem, and mostly centralized exchanges, on the brink of collapse.

Halfway through 2023, CEXs’ order book depths and trading volumes are ~10x thinner on average than 2022 levels, prompting us to express an even more aggressive view: “Why at least 80% of centralized crypto exchanges (CEXs) are going to disappear?” Liquidity attracts more liquidity in the same way success is a magnet for even more triumphs. Add to that the looming regulatory pressure, and the bottom majority of CEXs will start falling like a domino chain, with the losers dying slowly.

Questions and comments can be addressed to c.eladnani@sunzulab.com or research@sunzulab.com

In TradFi, capital markets have been all about scale. Whether in banking, asset management, hedge fund, or trading venues sectors, the bigger are getting bigger! M&A has been one of the most significant value drivers for TradFi exchanges over the last 20 years, allowing groups to generate significant economies of scale by mutualizing costs from data centers, matching engines, and employees. Here is a selected list of the major acquisitions of the century:

- NYSE merged with Archipelago Holdings (2006, $9 bn), creating the NYSE Group;

- NYSE Group and Euronext merged (2007, $10 bn) to form NYSE Euronext;

- Intercontinental Exchange (ICE) acquired NYSE Euronext (2013, $11 bn); Euronext spun off from ICE in a $1.2 bn IPO in 2014;

- Euronext acquired Borsa Italiana from the London Stock Exchange Group (LSEG) (2021, $5 bn).

Even though it is not exactly the same industry, The FDIC’s website provides additional valuable information on the evolution of the banking industry in the US. Between 1990 and 2022, the number of commercial banks insured with the FDIC went from 12,347 to 4,136, with the number of newly issued charters virtually near zero since 2008. As the retail and corporate segments increased significantly over the same period, the major remaining banks enjoyed the full benefits of consolidation and economies of scale with minimal efforts!

The list of exchanges’ failed M&A deals is even longer:

- Deutsche Boerse offered $1.6 bn for LSE before withdrawing its proposition in 2005;

- LSE rejected a $4 bn offer from Nasdaq in 2007;

- A merger between NYSE Euronext and Deutsche Borse failed in 2011;

- A merger between LSE and TMX Group died in 2011;

- Singapore Exchange terminated its $8 bn bid for Australia’s ASX after the Australian government formally rejected the offer;

- An attempted merger between Deutsche Boerse and the LSE was struck down by EU regulators in 2017;

- Hong Kong exchange dropped its $39 bn bid to buy the LSE in 2019.

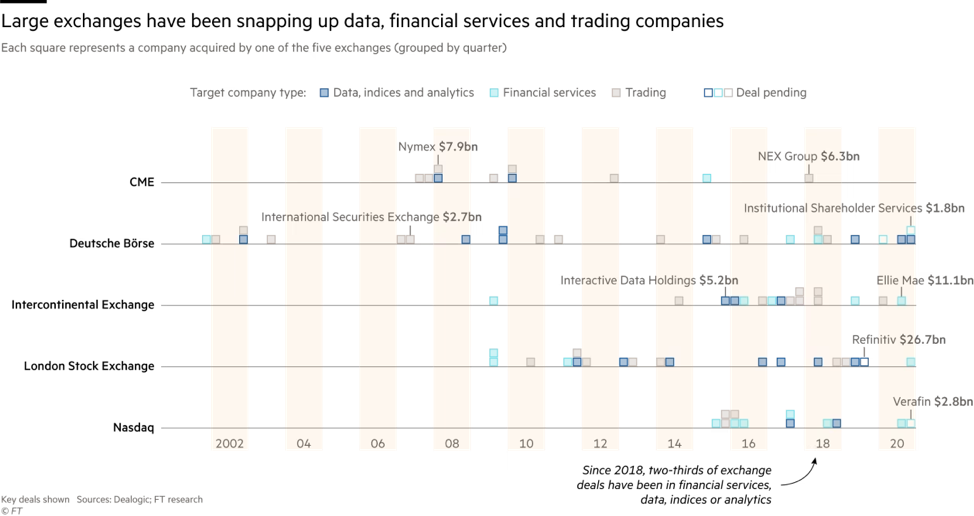

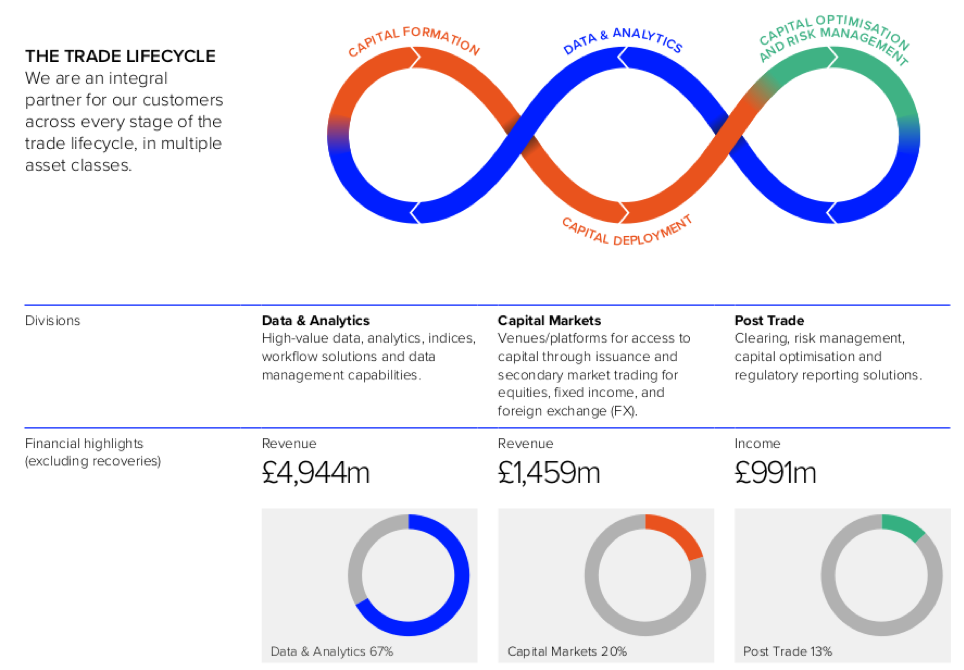

The remaining big five exchanges have also gone on an acquisition spree for data, analytics, indices, execution, settlement, and other infrastructure providers, as can be seen in the graph below, with the crown going to LSEG for its $27 bn acquisition of data and trading group Refinitiv, approved by EU regulators in 2021.

Overall, the exchange business in Tradfi has seen many agitations up to the 2000s. This was followed by an accelerated consolidation wave, leading to the current market state post-2008’s GFC (“Global Financial Crisis”), where there is virtually no room for another newcomer due to the heavy regulation and high cost of capital (unless through an acquisition). The exact cause having the same effects, we expect the same level of consolidation to happen over the next couple of years for centralized crypto exchanges. This trend should be accelerated with the recent rise of “institutional” crypto trading venues, the latest being the launch of EDX Markets, backed by Citadel Securities, Charles Schwab, & Fidelity. EDX will operate as a non-custodial exchange, serving only institutional clients with plans to launch EDX Clearing to settle trades matched on the exchange, a feature still absent from nearly all CEXs.

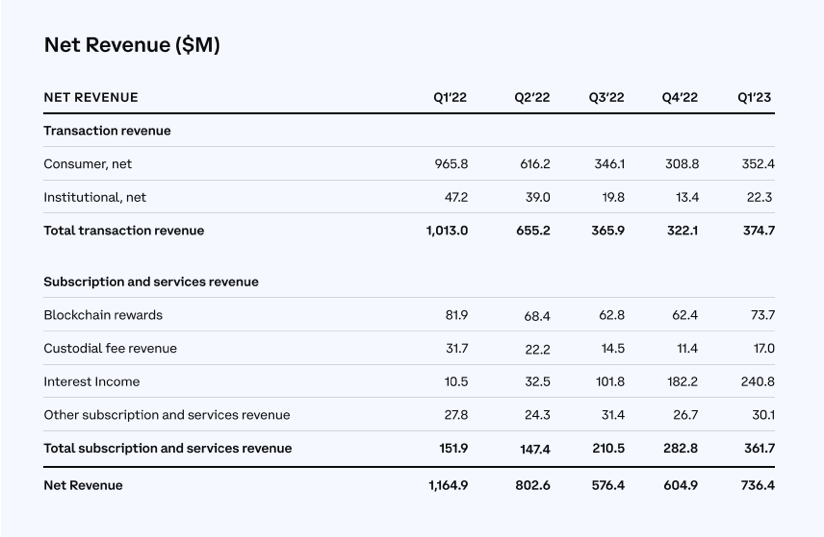

Coinbase, the first crypto exchange to go public, provides us with a valuable sneak peek into its financials through regulatory filings:

We can notice that, disregarding a slight uptick in Q1 23, transaction revenues have been free-falling since 2022, with total revenues divided by three over the period. However, revenues from subscriptions and other services more than doubled to $362 million. The compensation from diversification channels wasn’t enough to compensate for the loss from transaction revenues, as Net Revenue fell 37% YoY. Coinbase also introduced in May 2023 a new subscription service called “Coinbase One,” available for a monthly fee of $29.99 and providing a range of features that include zero trading fees, increased staking rewards, and round-the-clock customer support. The service was launched in the US, UK, Ireland, and Germany, with plans to extend its availability to 35 countries. Coinbase’s race and doubling down on revenue diversification is a strong distress signal for all other centralized crypto exchanges, which we are sure are in a far worse state than the leader Coinbase.

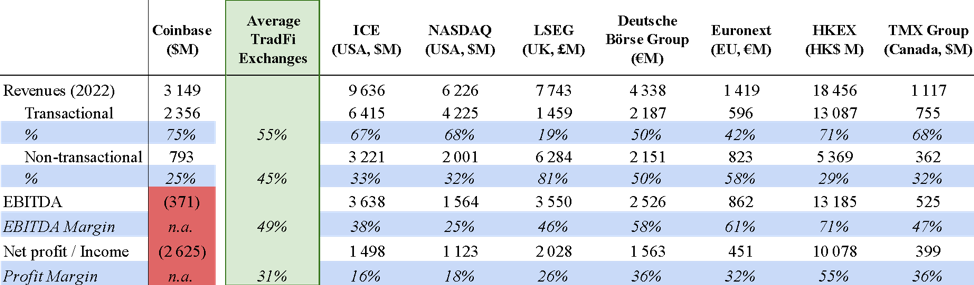

To put matters into perspective, here is a financial performance comparison in 2022 between Coinbase and the major TradFi exchanges around the world:

The proportion of non-transactional revenues for TradFi exchanges (45% on average) is way higher than Coinbase’s figure. TradFi exchanges are also impressive cash cows, with an average EBITDA margin of 49% and an average profit margin of 31%. The fact that the leader of crypto centralized exchanges is nowhere near these profitability levels is one major alarming sign for the whole sector. The only path to recovery is through revenue diversification, and one surprisingly unexplored gold mine is data monetization!

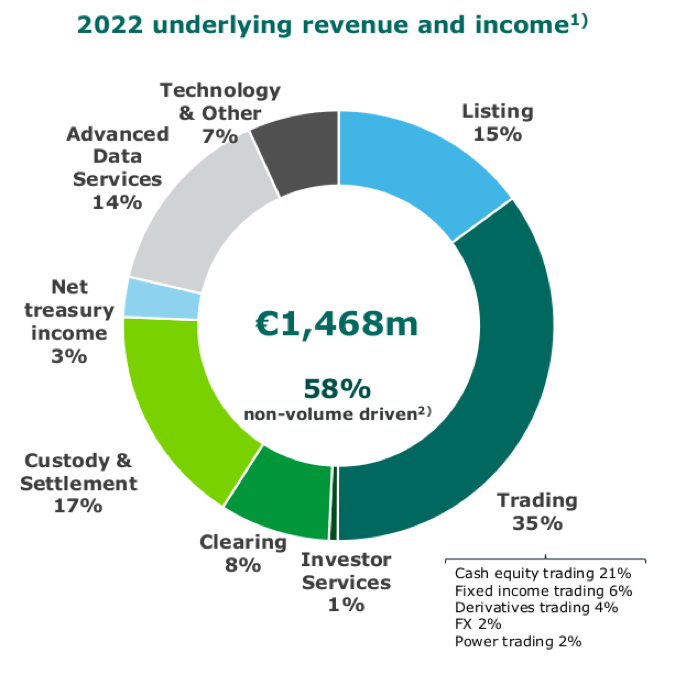

Below are two examples of how Euronext and LSEG diversify their revenue streams:

Centralized crypto venues should realize the magnitude of the problem and face the fact: if the market leader still hasn’t found a magic formula to profitability, maybe the solution isn’t different from what has been a major success in TradFi for years!

The path to recovery and survival, in our view, starts with asking the right questions:

- Do you know your client base?

- Do you know your liquidity patterns and those of your competitors?

- Do you know the strength and limits of your technology?

- Do you do what it takes to improve the quality of your data and monetize it?

A thorough internal process revue around the previous questions should give the first movers among CEXs the opportunity to:

- Adapt your marketing efforts to attract investors according to their trading patterns (retail, institutional, high frequency, etc.);

- Adapt your commission schedule to your clients’ trading patterns;

- Attract the structure and mandate of market makers on your platform;

- Diversify revenue: one natural resource still not explored by many CEXs is to make your market data valuable and find the business model to monetize it;

- Anticipate regulators’ questions about governance and manipulation;

- Position for industry concentration, as an acquirer or as a target. The few exchanges that make it through this harsh consolidation period will be profitable beyond their wildest dreams, but you must take action today!

We have been connected to 40+ major centralized crypto exchanges at SUN ZU Lab for years. Our cutting-edge technology and deep market microstructure expertise provide us with a sharp view of tick-level order book activity in these exchanges, most often giving us a better understanding of their trading dynamics than management teams lacking internal resources. We have the right combination to accompany a centralized crypto venue to answer the previous problems before it is too late!

Let’s discuss

About SUN ZU Lab:

SUN ZU Lab is a leading data solutions provider based in Paris, on a mission to bring better data to the global crypto ecosystem through independent quantitative analyses. We collect the most granular market data from major liquidity venues, analyze it, and deliver our solutions through real-time dashboards, API streams, and historical files. SUN ZU Lab provides crypto professionals with actionable data to monitor the market.

FTX Post-Mortem Analysis – Why Transparency Matters?

By Chadi El Adnani @SUN ZU Lab

November 2022

“In the midst of chaos, there is also opportunity”

Sun Tzu – 500 BC

This quote by our spiritual father, Sun Tzu, has never been more true in the crypto ecosystem as we all battle to survive the most significant blow ever to the nascent industry. FTX’s bankruptcy was described as crypto’s Lehman Brothers moment, or as more evidence came to light, more “Enron” than “Lehman” moment. Trying to cover this story as it unfolded before our shocked eyes was like trying to catch a bullet bare-handed. This article provides a preliminary post-mortem analysis of where the situation stands today. Unfortunately, we sincerely believe that we have only seen the tip of the iceberg, and we brace for many more casualties to be affected in the near future. We have already covered in SUN ZU Lab’s weekly insights (here & here) the story’s timeline and the significant headlines surrounding it. We will therefore move directly into a more technical analysis.

As a reminder, FTX and Alameda Research constituted the bulk of ex-crypto billionaire Sam Bankman-Fried’s empire. The former being the exchange arm and the latter being the trading firm.

Understand the man to understand his actions:

Sam Bankman-Fried (SBF) had a reputation for being very smart and a highly talented trader. However, as more revelations come to light, we are convinced now that his supposedly spectacular trading returns (as well as some of his peers) were mainly driven by 2020 and 2021’s bull run. His crypto empire’s implosion is due instead to his betting big philosophy! A leveraging strategy mainly fueled FTX and Alameda’s stratospheric rise in the last two years via deceptive fundraises and financial engineering before eventually using plain fraud, as was revealed by the preliminary investigation.

In this Twitter thread, we get an interesting glimpse of SBF’s motives behind creating FTX; he explains, among others, that he was deeply frustrated by two things in the way other crypto exchanges operated. Contrary to TradFi, where an exchange focuses on managing its order book matching engine, leaving margin handling to the clearing house, a crypto exchange has to handle both responsibilities. He was therefore losing millions from what he called “socialized losses”, where the collectivity ends up paying the losses of a liquidated negative account. The second reason was that he viewed BTC’s price as being hit every time it suffered selling pressure from a cascade of liquidated accounts, which wasn’t fair from his point of view.

He initially addressed white papers proposing new ways of functioning to other exchanges before creating FTX as a new crypto derivatives exchange where, we cite: “The entire margin system is reworked to a way almost no exchanges in crypto work. We can take huge size & also have lots of leverage & have a solid blocker against ever having clawbacks.”

A trending video of Alameda’s CEO Caroline Ellison resurfaced where she was saying: “Being comfortable with risk is very important. We tend not to have things like stop-losses, I think those aren’t necessarily a great risk-management tool. I’m trying to think of a good example of a trade where I’ve lost a ton of money … well, I don’t know, I probably don’t want to go into specifics too much.”

We can see a recipe for disaster starting to take form.

A complicated SBF-Ellison / FTX-Alameda love story

Alameda Research and FTX were supposed to be entirely separate entities in theory. We instead learn that Alameda’s CEO Caroline Ellison has dated at times SBF. More shockingly, several top execs from FTX and Alameda lived in the same luxury penthouse in the Bahamas, where Ellison was rumoured to have access to FTX screens showing client trades. A recent Wall Street Journal report indicates that Alameda was frontrunning FTX token listings. Between the start of 2021 and March 2022, the trading firm held $60 million worth of 18 different tokens that were eventually listed on FTX.

This intimacy could also explain why SBF later allowed customer funds to be used to pay for Alameda’s loans, building a software backdoor to outwit FTX compliance systems.

FTX and Alameda’s Balance Sheets were bad, very bad!

The massive bank run suffered between November 6 and 11 drove FTX and Alameda eventually to the ground, and the word bank is chosen wisely as it appears FTX was more a bank than an exchange! They suffered as much as $6 billion of withdrawals in the final 72 hours, except they didn’t have customers’ money as FTX had loaned it to Alameda, which used it to make venture capital investments!!

Let us stop a moment on the last revelation. Every first-year finance student could tell you to never, never use extra-short-term liabilities (client funds, with a theoretical maturity of 0) to finance the riskiest and most illiquid investment in the spectrum (VC investments, with an expected maturity higher than ten years).

Ellison explains in an interview with the New York Times that lenders moved to recall their loans around the time the crypto market crashed this spring. But as the funds that Alameda had spent were no longer easily available, the company used FTX customer funds in an emergency procedure to make the payments.

Let’s go back first to where troubles began to appear. Anyone remotely familiar with the hedge fund space knows that the financials (P&L and Balance Sheet, among others) are protected at all costs. The fact that Coindesk managed to put their hands on that “secret sauce” leaves a place for a plethora of conspiracy theories. We refrain from venturing into that territory.

On November 2, CoinDesk published an article highlighting the following facts from a private document they reviewed:

- As of June 30, 2022, Alameda’s assets amounted to $14.6 billion. Its single most significant asset was a $3.7 billion pile of “unlocked FTT” and $2.2 billion of “FTT collateral”.

- Its c. $8 billion of liabilities are dominated by $7.4 billion of loans, but we also find $292 million of “locked FTT”.

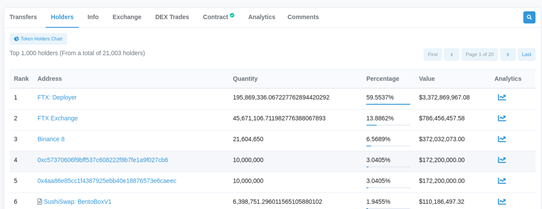

To put things into perspective, this puts a total of $5.8 billion in FTT tokens on Alameda’s balance sheet as of June 30. The market capitalization of circulating FTT was around $3.3 billion that day. Indeed, a quick look at FTT’s page on Etherscan shows that over 74% of the token’s total supply is held by two addresses belonging to FTX and Alameda.

This partial information meant that most of Alameda’s net equity was comprised of FTT tokens, printed out of “thin air” by its sister company FTX.

In a volatile and fragile global crypto environment, rumours were quickly forming about how SBF could be just another flywheel / Ponzi scheme magician! Here is what we mean by a flywheel scheme in crypto:

- Create a token

- Artificially pump its price (wash trading through a market maker)

- Mark the artificial gains in the balance sheet

- lure the community and investors with “realized” gains

- Raise capital through equity sales, ICOs or loans

- the hype continues to fuel the token’s price, and the loop continues!

The fears were extreme, especially since the Celsius bankruptcy and the CEL token explosion still haunt most of us. Celsius was a multi-billion dollar crypto lending firm, or Ponzi scheme, which was destroyed in part by its own token, CEL!

As it appears, this is exactly what SBF was doing with some of his investments, known as “Sam coins”, including Serum, Raydium and FTT.

The way it would work with our exchange/trading firm duo is that Alameda would fund a project at a $50 million fully diluted valuation (considering the total number of tokens to be issued) with $5 million, for example. FTX would then list the token on its exchange, releasing only a tiny fraction of the total tokens to the market. Given the illiquidity of this token, Alameda could easily deploy a few millions to artificially inflate the fully diluted valuation 100x, increasing the stake’s value on its books to $500 million. This inflated figure is then used as collateral for borrowing purposes.

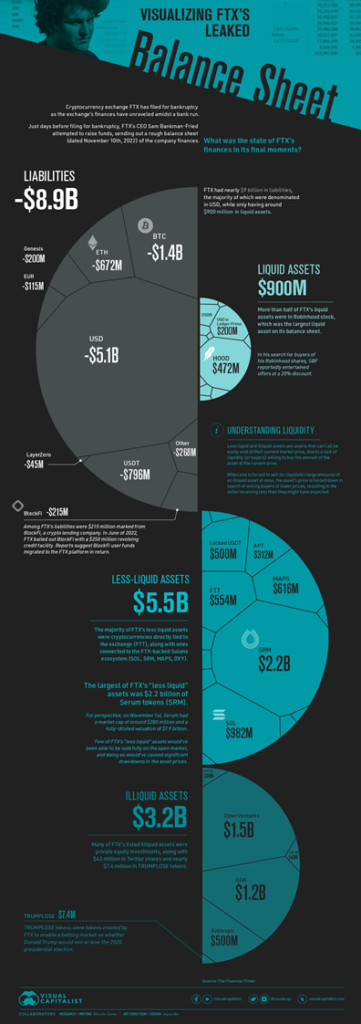

The Financial Times shared a copy of an FTX balance sheet dated November 10, shared with prospective investors one day before the company filed for bankruptcy.

Here is a visualization of this balance sheet provided by Visual Capitalist:

We fell from our seats when we first saw this balance sheet! And we wouldn’t put it better than Bloomberg’s Matt Levine:

“It’s an Excel file full of the howling of ghosts and the shrieking of tortured souls. If you look too long at that spreadsheet, you will go insane.”

Citing the FT, we learn that “A spreadsheet listing FTX international’s assets and liabilities, seen by the Financial Times, point at the issues that brought Bankman-Fried crashing back down to earth. It references $5bn of withdrawals last Sunday, and a negative $8bn entry described as “hidden, poorly internally labled ‘fiat@’ account”.

“Bankman-Fried told the Financial Times the $8bn related to funds “accidentally” extended to his trading firm, Alameda, but declined to comment further.”

When we look at the “less-liquid assets” category, the most considerable number is $2.2 billion of SRM, the Serum DEX native token (we will talk later about Serum). This is a clear example of the flywheel scheme described above in the article. As of November 17, CoinMarketCap shows a $70 million market cap for SRM (market cap of circulating tokens) against a $2.7 billion fully diluted market cap (theoretical figure taking into account the token’s max supply). The FTX team are basing their $2.2 billion valuation on an impossible illiquid scenario.

Okay, but one big question remains: how did they manage to burn through more than $10-15 billion of “realized” profits?

In our eyes, the bad VC investments and mishandling of client funds don’t explain alone the $8 billion hole in the balance sheet, especially when taking into account FTX and Alameda’s extremely profitable history due to high trading fees and lucrative venture deals. The only plausible explanation we see is that Alameda was bleeding money for a long time in 2022’s harsh bear market and possibly long before that, slowly decaying from its market-neutral market-making strategies into taking losing directional bets.

This seems to be exactly what we learned from a recent motion filed in the Delaware district court handling the bankruptcy procedure. The entities’ 2021 tax returns collectively showed a net operating loss carryover of $3.7 billion, meaning that the main entities (FTX & Alameda) had posted that much in losses since their inception. This completely contradicts the image SBF was circulating of his businesses and is quite shocking when considering that several competing crypto exchanges and trading firms, such as Wintermute or Coinbase, have realized significant gains over 2020 and 2021’s roaring crypto bull runs!

We end this paragraph on the wise words of newly appointed FTX CEO John Ray III: “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.”

The biggest winners & losers:

Losers:

It is tough to choose one big loser from the FTX fiasco. There is obviously SBF himself, whose net fortune went from $26 billion at its peak to less than $1 billion. FTX employees are set to lose big, having most of their wealth linked to the exchange. VC and institutional investors have bet big on the disgraced young prodigy: between 2021 and 2022, SBF raised more than $1.5 billion from esteemed investors such as SoftBank, Sequoia Capital, Temasek, Tiger Global Management, Paradigm or the Ontario Teachers’ Pension Plan. Without forgetting the more than a million creditors still waiting to see how this insolvency will be unpicked. It was typically revealed in a court filing that FTX owes almost $3.1 billion to its top 50 creditors.

We want to focus on the Solana ecosystem as one major casualty. The Solana Foundation declared days after the bankruptcy that it held 134.54m SRM tokens and 3.43m FTT tokens on FTX when withdrawals went dark on November 6. Those assets were worth around $107m and $83m one day before the freeze. It also held a 3.2 million common stock ownership in FTX.

As we can see, Solana and FTX maintained deep financial ties. The problem gets bigger when considering Serum, a DEX created by SBF and at the centre of much of Solana-based DeFi. SBF even went on to call Serum the “truly, fully trustless” backbone of Defi on the Solana blockchain. DeFi protocols across the Solana ecosystem were rushing to unplug from Serum after the post-bankruptcy hack at FTX. It was reported that the true power over Serum rested with FTX and SBF, which continue to hold the program update authority keys. This led the Solana community to move to create a new version of Serum that they could govern without influence from FTX.

The total value locked (TVL) on the Solana network has seen a 70% drop in November 2022 alone, reaching lows of $300 million from a $10 billion peak in November 2021. SOL is down more than 60% since the start of the month and the Coindesk article release.

In a previous article by SUN ZU Lab titled “What is Tokenomics and why does it matter?”, we interestingly took the Solana case study to highlight the importance of good governance practices that protect users. One of the main questions we left our readers to reflect upon was the following: Is it really that decentralized? – We now have our answer!

Winners:

There aren’t many winners from this situation, except maybe DEX’s, which are seeing an impressive peak in interest since FTX’s implosion. Uniswap, in particular, has risen to become the world’s second-largest venue for trading Ethereum, having recorded more than $1 billion in ETH trades in 24h, surpassing Coinbase (c. $0.6bn). Since the news that Binance was about to bail out FTX, DEXs around the crypto ecosystem saw $31 billion in trade volumes, with Uniswap alone accounting for $20 billion.

We want to highlight, however, that while DeFi’s “permissionless, trustless self-custody” ideology seems to be winning short term, we don’t bet a lot on new institutional money going directly into DeFi, mainly for KYC and AML reasons, among others.

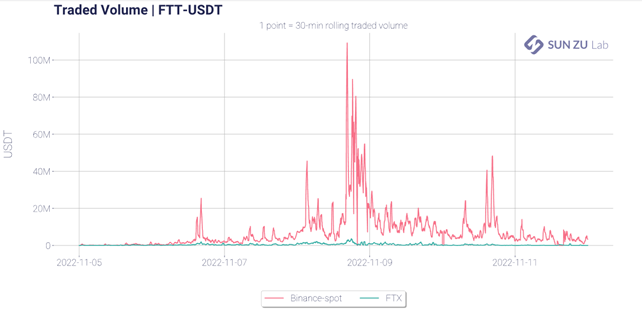

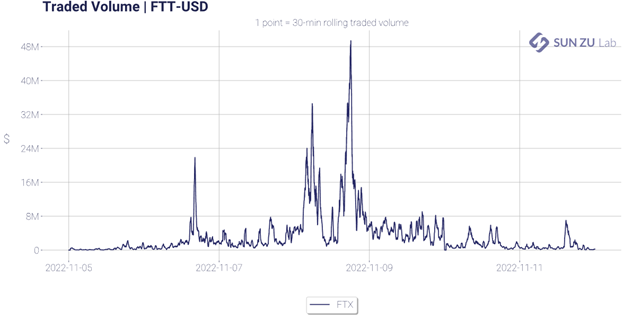

How did crypto markets react to all this?

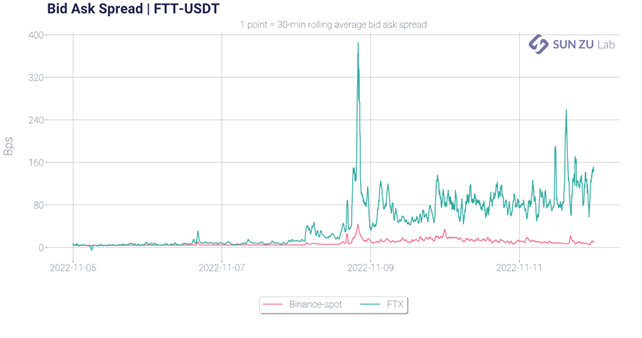

Whether we analyze crypto markets from a price, bid-ask spread or volume perspective, we see that the turning point in FTX’s downfall was the announcement of Binance’s non-binding offer to buy its rival (11/08/22 around 5 PM UTC). It was the first major event that worried the markets that something was off. FTT’s price dropped by more than 80% in the following hours, while bid-ask spreads on FTT briefly reached 400 bps.

Could we have seen this coming?

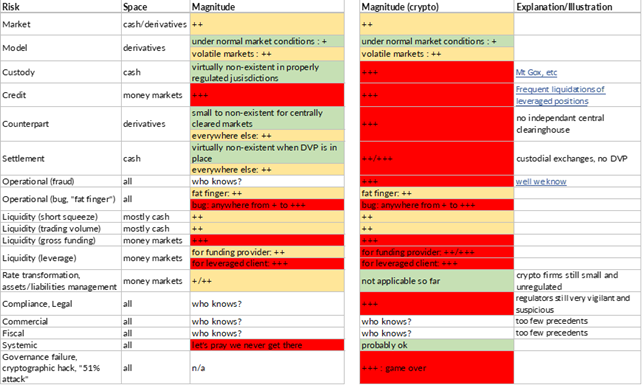

Yes! We have already voiced our opinions and concerns over crypto risk assessment in general and how crypto venues should be managed and audited in these previous articles: “Everything you’ve always wanted to ask your crypto exchange” and “Crypto Risk Assessment: Way to Go“. FTX was ranked among the top crypto exchanges, just days before its fall, by major industry players, non of which were able to underline the significant governance, operational or counterpart risks surrounding FTX and Alameda. We believe the crypto industry now has few shots “to get this right” after this spectacular failure.

We put the emphasis again on this table from the Crypto Risk Assessment article, which summarizes, in our opinion, the significant risks that should be closely monitored and audited regarding crypto exchanges.

The magnitude scale is as follows (applied to capital at risk, whether it is a nominal amount for cash products or notional amounts for derivatives):

+ (very small to small): a fraction of a percent to a few percents

++ (medium to significant): a few percents to a few tens of percents

+++ (high to very high): up to 100% and beyond. The vital prognostic of the firm may be engaged

who knows? This one is exactly what it reads; possible losses range from trivial to life-threatening

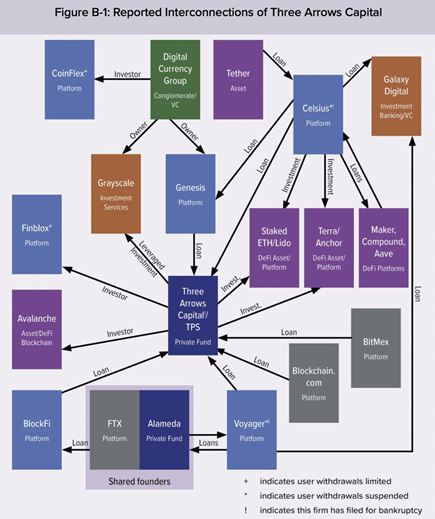

We also highlight this chart from the Financial Stability Oversight Council’s (FSOC) latest report, released in early October 2022. It highlights the major parties related to loans or investments made by 3AC, where we can see all the now-troubled actors following the explosion of the Terra ecosystem.

Where do we see things going from here?

For one thing, the FTX and Alameda implosion will hurt crypto liquidity badly. Alameda was one of the largest market makers in a space dominated by a handful of actors, among which we can cite Wintermute, B2C2 or Genesis. More disturbing, 56 market makers and fund managers reported FTX exposures of up to $500 million in an invite-only Telegram chat reviewed by TechCrunch.

As of November 24, the expanding list of FTX casualties now accounts for crypto-giants Genesis and Grayscale, BlockFi, Gemini, Multicoin and CoinHouse to cite a few. Genesis Global announced having lent around $2.8 billion to various crypto firms, including large loans to its parent company DCG. It confirmed that it had hired investment bank Moelis & Co to explore how to shore up its crypto-lending business’ liquidity and address clients’ needs days after halting withdrawals.

The bankruptcy procedure will surely be a long, drawn-out court case in which depositors will try to recoup their losses. But at which cost and after how many years?

FTX’s failure is unsurprisingly sparking a massive regulatory response, with several US state and federal agencies launching or expanding investigations into the company, including the DoJ, the SEC, the Securities Commission of the Bahamas and the Bahamas’ Financial Crimes Investigation Branch. More globally, crypto regulation in most markets has been slow to materialize. We see that changing in the wake of these recent events, with MiCA regulation in Europe heading for final approvals in 2023.

As this situation continues to evolve, we can’t yet draw final lessons and conclusions, except repeating our core message and belief at SUN ZU Lab: liquidity and transparency are core constituents to every efficient market worthy of the name. Remove one or both, and even “Too Big To Fail” giants start to shake.

We would be happy to hear your thoughts. You can address questions and comments to c.eladnani@sunzulab.com or research@sunzulab.com

About SUN ZU Lab

SUN ZU Lab is a leading data solutions provider based in Paris, on a mission to bring transparency to the global crypto ecosystem through independent quantitative analyses. We collect the most granular market data from major liquidity venues, analyze it, and deliver our solutions through real-time dashboard & API stream or customized reporting. SUN ZU Lab provides crypto professionals with actionable data to monitor the market and optimize investment decisions.

Opinion article: Why has liquidity become a question of survival for crypto venues?

By Stéphane Reverre and Chadi El Adnani @SUN ZU Lab

October 2022

Having already covered in this previous article the basics of market liquidity, with a focus on crypto markets, we decided to turn our attention to a new question: Has crypto liquidity become a question of survival for crypto venues? Indeed, the current harsh global macro environment has caused a liquidity crunch across all asset classes, especially risk-on assets such as cryptocurrencies. This situation has left crypto venues with no choice but to enter a race-to-zero on trading commissions to try and protect their market share, at the expense of revenues. Is this situation sustainable? When and how is this deadly spiral going to end? This is indeed a question of survival: trading venues and intermediaries cannot afford not to monitor their liquidity against their competitors. It is fast becoming a significant competitive advantage, probably the only one that will allow a favorable re-pricing of commissions.

Amid an overall bearish year for cryptocurrencies and other risk assets, Binance-US “surprised” the crypto ecosystem recently by adopting a zero-commission policy for BTC and other cryptos. The announcement led to an all-time high of more than 600K BTC traded on Binance the day the policy took effect, while Coinbase shares fell by almost 10%.

The effect on Coinbase’s shares is not a surprise. Like any exchange, it has historically relied heavily on fees from trading volumes. Unfortunately, those have declined in sync with prices, creating instantaneous and significant pain, leading all crypto exchanges to look for ways to diversify their revenue streams.

The zero-fee trading phenomenon is not an innovation by Binance; US neo-broker Robinhood first introduced it a few years ago. Major stock brokers soon adopted the disruptive business model shift, including Charles Schwab, Fidelity Investments or E*Trade Financial. Presumably, the measure will generalize in the crypto space, which will also create tremendous revenue pressure on non-exchange liquidity providers.

In TradFi this cannibalization of revenues has been addressed in different ways. For example, large established brokers are offering premium services such as wealth management. By contrast, Robinhood is a bare-bone online broker without much in terms of service to make up for zero-fee transactions. It had to implement Payment For Order Flow (PFOF) to generate revenues.

In the PFOF model, a broker routes its clients’ orders to market makers. The market maker earns a profit by collecting a spread between buying and selling prices, paying the broker in return for the right to fill the investors’ orders. PFOF came under a harsh spotlight in early 2021 after chaotic trading by a group of retail investors on Reddit led to the spectacular GameStop short-squeeze. This episode put Citadel Securities and Robinhood on the SEC’s radar for potential conflicts of interest on how retail investors’ order flow data is being used against them. According to Bloomberg, the largest US brokerage firms earned a combined $3.8bn in 2021 for selling their customers’ stock and options orders. Interestingly even service-rich brokers adopted PFOF: Charles Schwab racked up $1.7bn, followed by Robinhood with $974m, for which Citadel Securities accounted for 22% according to the company’s 2021 annual report (34% in 2020).

Two things should be noted about PFOF:

- Firstly, it is somewhat counter-intuitive. Market-makers provide liquidity, and as such take on risk in the form of inventory. To carry this risk, they are usually compensated by the beneficiaries. For example, EUREX (a European derivatives exchange) offers market makers commission rebates, which is equivalent to outright payments. The fact that Citadel and others are willing to pay to get the flow suggests that their liquidity-providing algorithm is entirely different from that of traditional market markers. Indeed it most probably doesn’t incorporate the same constraints. The natural question then becomes: who benefits most?

- Secondly, even if it’s an impressive number ($3.8bn), we don’t know enough to assess the economic value of PFOF to parties involved. Suffice it to say that retail trading flow is indeed a very rich source of information, as “bankable” as it comes. Capital market professionals have known for long that it is the “gold standard” of un-informed trading, offering tremendous low-risk opportunities.

What’s the relationship of the above with the original crypto introduction? Well, we venture one recommendation and one supposition. Under pressure on commissions, exchanges should consider liquidity as the “gold standard” of their future profitability. Hence the recommendation: “know thy liquidity”. Monitoring it and measuring it to assess, for example, its robustness across different market regimes should become a strategic objective.

As for the supposition: the same cause having the same effects, we should expect some form of PFOF to emerge in crypto markets sooner rather than later. All of which raises again the question of value creation, repartition and eventually transparency: of the value extracted, what should the “fair” partition be? Regulators in traditional markets have looked hard at this question, and no doubt they will also consider crypto soon enough – an excellent reason to look at it beforehand.

References:

- Crypto Exchanges Cut Fees to Gain Market Share From Rivals (WSJ)

- Coinbase shares fall after rival Binance.US drops spot bitcoin trading fees (CNBC)

- Charles Schwab, Citadel Securities, Robinhood report windfall on sales of investors’ order flow (Financial News)

- Robinhood Markets 2021 Annual Report

Questions and comments can be addressed to research@sunzulab.com

About SUN ZU Lab

SUN ZU Lab is a leading data solutions provider based in Paris, on a mission to bring transparency to the global crypto ecosystem through independent quantitative analyses. We collect the most granular market data from major liquidity venues, analyze it, and deliver our solutions through real-time dashboard & API stream or customized reporting. SUN ZU Lab provides crypto professionals with actionable data to monitor the market and optimize investment decisions.