This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

SUN ZU Lab & OKX: Our first Exchange Liquidity Analysis report

By Chadi El Adnani @SUN ZU Lab

April 2024

We are proud to announce that OKX has partnered with SUN ZU Lab to bring you their first Exchange Liquidity Analysis report. This report focuses on OKX spot and perpetual futures liquidity, providing valuable insights to navigate the dynamic landscape of trading on OKX.

“During this period, the crypto market experienced a significant upswing, and OKX showed considerable trading volume and healthy order books in February 2024”, according to the analysis by SUN ZU Lab.

Link to the official announcement!

Download full report to uncover more insights

Questions and comments can be addressed to c.eladnani@sunzulab.com or research@sunzulab.com.

Disclaimer

No Investment Advice

The contents of this document are for informational purposes only and do not constitute an offer or solicitation to invest in units of a fund. They do not constitute investment advice or a proposal for financial advisory services and are subject to correction and modification. They do not constitute trading advice or any advice about cryptocurrencies or digital assets. SUN ZU Lab does not recommend that any cryptocurrency should be bought, sold, or held by you. You are strongly advised to conduct due diligence and consult your financial advisor before making investment decisions.

Accuracy of Information

SUN ZU Lab will strive to ensure the accuracy of the information in this report, although it will not hold any responsibility for any missing or wrong information. SUN ZU Lab provides all information in this report and on its website.

You understand that you are using any information available here at your own risk.

Non Endorsement

The appearance of third-party advertisements and hyperlinks in this report or on SUN ZU Lab’s website does not constitute an endorsement, guarantee, warranty, or recommendation by SUN ZU Lab. You are advised to conduct your due diligence before using any third-party services.

About SUN ZU Lab

SUN ZU Lab is a leading data solutions provider based in Paris, on a mission to bring transparency to the global crypto ecosystem through independent quantitative analyses. We collect the most granular market data from major liquidity venues, analyze it, and deliver our solutions through real-time dashboards & API streams or customized reporting. SUN ZU Lab provides Token Issuers & Market Makers with institutional standard actionable data solutions to improve the transparency and fairness of Crypto markets.

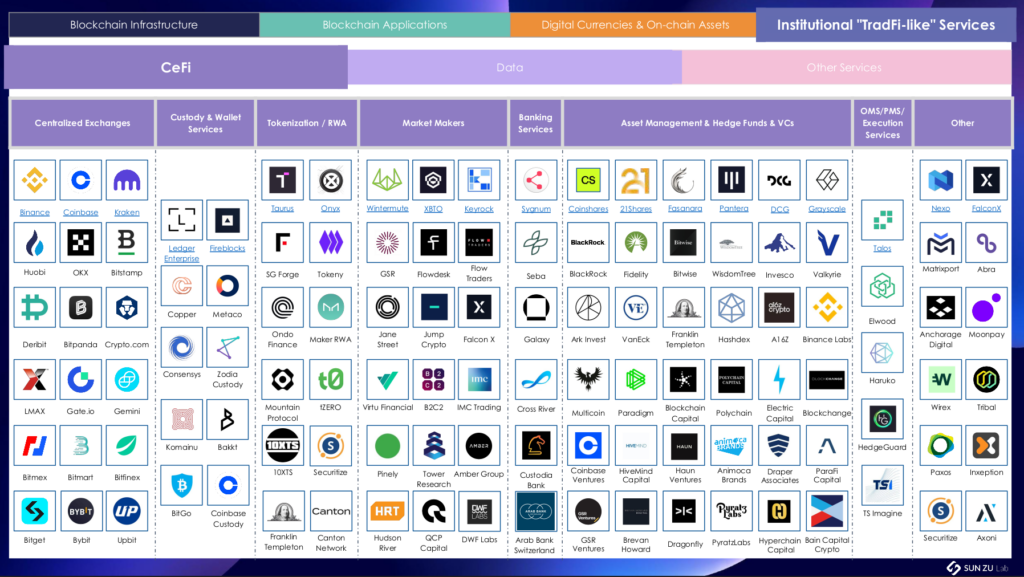

The Complete Web3 Ecosystem Mapping

By Chadi El Adnani @SUN ZU Lab

April 2024

We publish today the results of our (almost) Complete Mapping of The Web3 Ecosystem, after months of research and screening the market.

With a total of more than 500 companies/projects listed, we cover the bulk of the ecosystem in terms of the relevant metrics in each category: Market cap, TVL, AUM, fees, volumes, revenue, user adoption…

The mapping’s structure is inspired by some established industry segmentations (e.g., CeFi vs. DeFi, fiat-backed stablecoins vs. crypto-backed stablecoins, on-chain vs. off-chain…), as well as our own understanding and interactions with the ecosystem’s key players.

A total of 4 high-level categories: Blockchain Infrastructure; Blockchain Applications; Digital Currencies & On-chain Assets; Institutional “TradFi-like” Services, divided into sub-categories (e.g., Blockchain Infrastructure > Blockchain Services) and further down into sub-sub-categories (e.g., Blockchain Applications > DeFi > Decentralized Exchanges)

Questions and comments can be addressed to c.eladnani@sunzulab.com or research@sunzulab.com.

Link to the Complete Mapping

Disclaimer

No Investment Advice

The contents of this document are for informational purposes only and do not constitute an offer or solicitation to invest in units of a fund. They do not constitute investment advice or a proposal for financial advisory services and are subject to correction and modification. They do not constitute trading advice or any advice about cryptocurrencies or digital assets. SUN ZU Lab does not recommend that any cryptocurrency should be bought, sold, or held by you. You are strongly advised to conduct due diligence and consult your financial advisor before making investment decisions.

Accuracy of Information

SUN ZU Lab will strive to ensure the accuracy of the information in this report, although it will not hold any responsibility for any missing or wrong information. SUN ZU Lab provides all information in this report and on its website.

You understand that you are using any information available here at your own risk.

Non Endorsement

The appearance of third-party advertisements and hyperlinks in this report or on SUN ZU Lab’s website does not constitute an endorsement, guarantee, warranty, or recommendation by SUN ZU Lab. You are advised to conduct your due diligence before using any third-party services.

About SUN ZU Lab

SUN ZU Lab is a leading data solutions provider based in Paris, on a mission to bring transparency to the global crypto ecosystem through independent quantitative analyses. We collect the most granular market data from major liquidity venues, analyze it, and deliver our solutions through real-time dashboards & API streams or customized reporting. SUN ZU Lab provides Token Issuers & Market Makers with institutional standard actionable data solutions to improve the transparency and fairness of Crypto markets.

The Future of Trustless and Decentralized Cross-Chain DeFi – Focus on Interlay

By Chadi El Adnani @SUN ZU Lab

January 2023

This article was part of a broader report on the following theme: “Challenges and opportunities: The future of DeFi in TradFi”. Crypto Valley Association selected it among the top 5 pieces for its 2022 Call For Papers challenge.

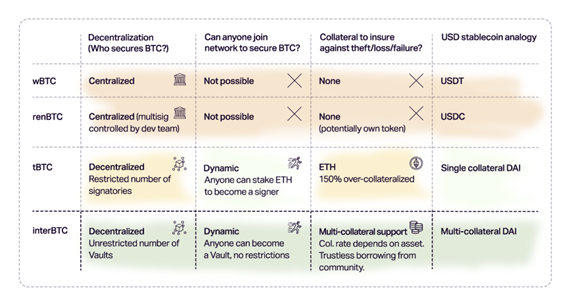

Interlay came into existence based on the observation that all current existing cross-chain Bitcoin, and other digital tokens, are all centralized and custodial, like the major USD-pegged stablecoins USDT and USDC. These bridges make users give up control over their assets and trust a third party to maintain the bridge, thus creating a weak centralized link in the overall decentralized chain. DeFi Llama data shows that several dollar billions are locked in protocols that bridge tokens from one network to another, the majority of them being centralized, custodial bridges (wBTC, renBTC…), putting the whole crypto ecosystem in a catastrophic situation in case these custodial bridges are hacked, lose keys or commit fraud. Following a previous article on how Polkadot is tackling the complex blockchain interoperability problem, we analyze in this article Interlay’s potential to deliver a rock-solid decentralized cross-chain bridge.

Questions and comments can be addressed to c.eladnani@sunzulab.com or research@sunzulab.com

Introduction:

Blockchain bridges have already suffered several hack attacks, exceeding $1 billion in cryptocurrency stolen. The latest significant episodes include Axie Infinity’s Ronin bridge $600 million hack, Harmony’s Horizon bridge hack for $100 million, and the $190 million Nomad bridge hack in August 2022, described as one of the most chaotic hacks web3 has ever seen. In a much-publicized tweet earlier in 2022, Vitalik Buterin voiced his opposition to using cross-chain solutions in the blockchain ecosystem in favour of a multi-chain future, arguing that the former increase the security risks in the process of transferring assets. Indeed, the attack vectors of the assets are increased across a more comprehensive network surface area as it is moved across an increasing number of chains and dApps with different security architectures. We believe at SUN ZU Lab that a minimum of standardization is required for blockchains to co-exist in parallel. Several organizations (IEEE, ANSI…) are doing this very well, so why shouldn’t the core blockchain teams start integrating these organizations?

We will cover in this next part the specifics of Interlay, its technical design, and how it differentiates from its centralized peers.

What is Interlay?

Interlay’s flagship product, iBTC, is a 1:1 Bitcoin-backed stablecoin that can be used to invest, earn and pay with BTC across the DeFi ecosystem on Polkadot at first, with future deployment plans on Ethereum, Cosmos and many other blockchains. Interlay also deployed Kintsugi, iBTC’s canary network, a testnet with real economic value deployed on Kusama (Polkadot’s canary network). Kintsugi and iBTC share the same code base, with the difference that the former will always be two to three releases ahead with more experimental features. Interlay won Polkadot’s 10th parachain slot auction, while Kintsugi won Kusama’s parachain slot 11.

Interlay was created in 2020 by Alexei Zamyatin and Dominik Harz, who met in October 2017 as the first two PhDs in the Imperial College’s cryptocurrency research lab. They have worked together since, publishing more than 20 papers on specific problems such as blockchain security, scalability, interoperability and DeFi.

After the successful launch of its flagship product, iBTC, the company now sets its eyes on becoming a one-stop-shop for Bitcoin DeFi with a new roadmap that includes decentralized lending, borrowing and trading for BTC.

Tokenomics:

Interlay and Kintsugi will be governed by their communities via INTR and KINT, their governance tokens on Polkadot and Kusama, respectively. INTR and KINT tokens’ primary purposes are:

- Governance: token holders vote on governance proposals.

- Staking: To participate in governance, holders stake INTR/KINT and earn INTR/KINT staking rewards in return.

- Utility: Interlay will support transaction fee payments in INTR/KINT.

- Outlook: tokens will be tightly integrated into the bridge, offering token holders additional security and product benefits.

- Collateral: INTR and KINT tokens can also be used as collateral to back iBTC and kBTC.

INTR and KINT have an unlimited supply with the following emission schedule:

- 1 billion INTR and 10 million KINT emitted over the first four years.

- 2% annual inflation afterwards, indefinitely.

The project emphasizes community, with 70% of tokens distributed as airdrops and block rewards. Moreover, starting from the 5th year, only the community will receive newly minted KINT and INTR tokens.

Technology:

The Interlay network operates as follows: collateralized vaults hold BTC locked on Bitcoin, while iBTC is minted on the parachain. These vaults can be individuals or service providers who lock collateral in a MakerDAO-inspired multi-collateral system to protect users against theft and BTC loss, and receive BTC into custody for safekeeping while iBTC exists.

There are four main phases in each iBTC life-cycle:

1. Lock: users can run their vault or pick one to lock BTC. BTC is always backed by the vault’s collateral

2. Mint: iBTC is created at a 1:1 ratio to locked BTC

3. BTC DeFi: iBTC could be used as collateral for lending or yield farming, for example, on Polkadot, Kusama, Cosmos, Ethereum and other major DeFi platforms

4. Redeem: iBTC is eventually redeemed for physical BTC on Bitcoin in a trustless manner

iBTC’s main difference from existing wrapped Bitcoin products is its trustless and decentralized aspect. It is secured by insurance as vaults lock collateral on the iBTC parachain in a multi-collateral system. In case of misbehaviour, the network slashes their collateral and reimburses users. Moreover, it is radically open, meaning anyone could become a vault and help secure iBTC. However, running a vault is currently a highly technical role, requiring advanced proficiency in computer system administration, which constitutes a high barrier to entry. The Interlay team is working on democratizing this role by making it simpler to run a vault.

Comparison between different wrapped BTC asset

Source: Interlay documentation

Use case: BTC DeFi on Karura with Kintsugi:

Karura is Kusama’s central DeFi hub, built as Acala’s sister network (Polkadot’s first parachain winner). Karura offers a suite of financial primitives: a multi-collateralized stablecoin (kUSD) backed by cross-chain assets like Kusama and Bitcoin, a trustless staking derivative, and a DEX to increase liquidity.

Kintsugi suggests many use cases for using kBTC with Karura’s DeFi products, for example:

- HODLing BTC with interest: users can mint kBTC by locking BTC on the Kintsugi bridge, then transfer it to Karura and open a kUSD loan with kBTC. This kUSD amount can be put into another yield-generating DeFi protocol (Sushi LP pool on Moonriver, Basilisk LPs, …).

- Incentivizing kBTC pools on Karura’s AMM: kBTC can be traded against any other listed asset on Karura AMM DEX. Liquidity providers to kBTC pools could earn rewards in KAR and KINT.

- kBTC as kUSD Collateral: kUSD could be minted using kBTC, making it the first stablecoin backed by genuinely trustless and decentralized BTC.

- Arbitrage kBTC vs. renBTC on Karura’s DEX: renBTC will also be listed on Karura. While renBTC and kBTC are pegged to Bitcoin, they have different security properties and demands. This situation leads to slightly varying prices and offers arbitrage opportunities.

- Coming soon: Interlay is working on adding reward-general tokens (such as LP tokens) as collateral and releasing other types of wrapped BTC.

Conclusion

These were just a few examples of what is possible with Interlay products today, and use cases will explode shortly as the DotSama ecosystem continues to grow and Interlay expands to other protocols. Overall, Interlay has a promising future in tackling the complex decentralized cross-chain bridge problem within the blockchain ecosystem. Its founders’ solid research background, combined with its unique decentralized and trustless network, gives it a considerable advantage over its peers. However, it still has a long way to go to compete against centralized, custodial wrapped bitcoin leaders wBTC and hBTC.

References

- Understanding Crypto Bridges and $1 Billion in Thefts, by Olga Kharif (link)

- Interlay & Kintsugi Documentation (link)

- From Academia to Start-up — Looking back at 2020, by Alexei Zamyatin (link)

- Featured Use Case: Chaotic BTC DeFi with Kintsugi & Karura (link)

- Interlay FAQ (link)

Disclaimer

No Investment Advice

The contents of this document are for informational purposes only and do not constitute an offer or solicitation to invest in units of a fund. They do not constitute investment advice or a proposal for financial advisory services and are subject to correction and modification. They do not constitute trading advice or any advice about cryptocurrencies or digital assets. SUN ZU Lab does not recommend that any cryptocurrency should be bought, sold, or held by you. You are strongly advised to conduct due diligence and consult your financial advisor before making investment decisions.

Accuracy of Information

SUN ZU Lab will strive to ensure the accuracy of the information in this report, although it will not hold any responsibility for any missing or wrong information. SUN ZU Lab provides all information in this report and on its website.

You understand that you are using any information available here at your own risk.

Non Endorsement

The appearance of third-party advertisements and hyperlinks in this report or on SUN ZU Lab’s website does not constitute an endorsement, guarantee, warranty, or recommendation by SUN ZU Lab. You are advised to conduct your due diligence before using any third-party services.

About SUN ZU Lab

SUN ZU Lab is a leading data solutions provider based in Paris, on a mission to bring transparency to the global crypto ecosystem through independent quantitative analyses. We collect the most granular market data from major liquidity venues, analyze it, and deliver our solutions through real-time dashboards & API streams or customized reporting. SUN ZU Lab provides crypto professionals with actionable data to monitor the market and optimize investment decisions.

On Blockchain Interoperability — Focus On The Polkadot Ecosystem

By Chadi El Adnani @SUN ZU Lab

January 2023

This article was part of a broader report on the following theme: “Challenges and opportunities: The future of DeFi in TradFi”. Crypto Valley Association selected it among the top 5 pieces for its 2022 Call For Papers challenge.

Since the birth of bitcoin in 2009, the blockchain ecosystem has not stopped expanding. It is now based on multiple layer 1 (L1) blockchains, each with a different philosophy and unique infrastructure architecture. Such L1s include Bitcoin, Ethereum, Solana, Polkadot, or Cosmos. While Solana’s approach to growth focuses on the network effect of bringing many developers and users on-chain, the Ethereum community believes that mass adoption will come primarily from blockchain security and decentralization superiority. These cultural differences are reflected in how these blockchains operate and process data, making direct inter-blockchain communication very hard and creating one of the most critical challenges for the web3, and hence DeFi, ecosystems: interoperability. The following metaphor best describes this situation: imagine an internet where it was only possible to send emails within isolated platforms, Gmail to Gmail, Yahoo to Yahoo, etc. This is the case today for data and tokens stored on different blockchains.

Questions and comments can be addressed to c.eladnani@sunzulab.com or research@sunzulab.com

Introduction:

The benefits of blockchain interoperability are necessary to achieve mass adoption and an optimized user experience. It also helps avoid “winner takes all” monopolies (think about the blu-ray technology, for example). It will allow for entirely composable web3 services, with interoperable smart contracts leading to primary industries exchanging important business information between private and public networks in a completely customizable and controllable manner. Moreover, blockchain interoperability should enable multi-token transactions and wallet systems, a significant phase for DeFi’s usage growth.

Another critical benefit to blockchain interoperability is the ability to create a more decentralized ecosystem (in terms of players/actors). Instead of having one blockchain like Ethereum processing transactions of thousands of dApps, leading to recurrent congestions in the network and excessive transaction gas fees, thousands of application-specific blockchains could communicate with one another through a decentralized central hub. Enter Polkadot!

Interoperability can also be achieved through cross-chain bridges that allow for digital assets owned by someone to be locked on one chain, while an identical asset is minted on another chain and sent to an address owned by the original owner. These bridges can be decentralized blockchain ecosystems or centralized custodians. Interlay, Polkadot’s 10th parachain, is working to provide similar services for Bitcoin. We make an interesting parallel in TradFi with the concept of American Depository Receipts (ADRs); an ADR is a certificate representing shares of a foreign security. It is a form of indirect ownership of foreign securities not traded directly on a national exchange in the US. Financial institutions purchase the underlying securities on foreign exchanges through their foreign branches, and these foreign branches remain the custodians of the securities. The financial institutions hold legal title to the underlying stock through these foreign branches. This structure of indirect ownership has caused non-negligible problems in the past.

In the following parts, we will dive deeper into how Polkadot operates. We will analyze in a coming article Interlay’s specific operating model.

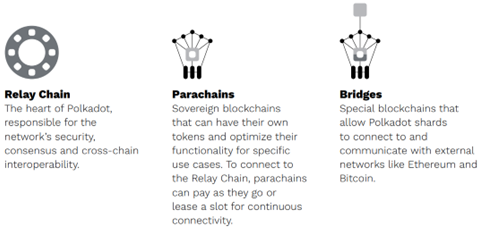

Polkadot – the first fully-sharded blockchain:

Polkadot is a layer 1, or even layer 0, nominated proof-of-stake (nPoS) blockchain protocol connecting multiple specialized blockchains into one network. It was founded by Gavin Wood, a co-founder of Ethereum and the Ethereum Foundation’s first CTO, alongside co-founders Peter Czaban and Robert Habermeier in 2016. Dr Wood has an impressive background as he invented Solidity, the language developers use to write decentralized applications (dApps) on Ethereum. He developed as well in 2015 a company called Parity Technologies that maintains Substrate, a software development framework primarily used by Polkadot developers who wish to create parachains quickly. Polkadot is run by the Web3 Foundation and developed by Parity Technologies. It uses a relay chain / parachain model, allowing multiple blockchains to communicate and securely share information. This unique model allows digital assets and data to be interchanged and transferred within a multi-chain network through efficient and secure data exchange between private/public blockchains, dApps and oracles. The parachains are entirely independent in governance but have shared security structures through the relay chain.

Polkadot’s functioning structure is best explained by the United States model: each state (parachain) has its sovereignty and rights but must rely on the federal government (relay chain) for governance and security. To be more precise, parachains remain fully independent governance entities, with the relay chain only governing block production, DOT treasury or parachain slot auctions, among others. Parachains connect to Polkadot by leasing a slot on the relay chain for a renewable period of 96 weeks. Parachain slots are assigned through auctions, and auction winners lock up a bond in DOT for the duration of the lease.

As of January 2023, the Polkadot network is ranked at the 13th position on Coinmarketcap, being the eleventh-largest blockchain in terms of its native token DOT’s market capitalization ($5.4bn), behind Dogecoin ($9.6bn), Cardano ($9.2bn), and Polygon ($7.0bn). Polkadot runs parallel to its twin canary network, Kusama, where teams and developers can build and deploy parachains or try out Polkadot’s governance, staking, nomination and validation functionalities in a living environment.

Polkadot’s technical documentation provides a good description of its architecture. There are three fundamental roles in the upkeep of the Polkadot network: collators, nominators and validators:

- Collators: they maintain a full node of the parachain blockchain and the relay chain, thus facilitating the different parachains’ transactions. The parachains must incentivize collators to be rewarded for their services. Rewards could include parachain-specific tokens or transaction fees, as the Polkadot system has not set rules on how collators should be incentivized.

- Validators: they verify the blocks and provide consensus in the staking mechanism. They must run a validator node and bond DOT tokens to be selected and participate in staking.

- Nominators: they are DOT token holders that wish to participate in the staking mechanism but do not have the technical means or do not wish to bear the responsibilities of maintaining a validator node.

Polkadot’s architecture

Source: Polkadot lightpaper

For the main differences between Polkadot and Ethereum, let’s look at Polkadot’s wiki page. Here is an extract:

“There are two main differences between Ethereum 2.0 and Polkadot consensus:

- Ethereum 2.0 finalizes batches of blocks according to periods of time called “epochs”. The current plan is to have 32 blocks per epoch, and finalize them all in one round. With a predicted block time of 12 seconds, this means the expected time to finality is 6 minutes (12 minutes maximum). [3] Polkadot’s finality protocol, GRANDPA, finalizes batches of blocks based on availability and validity checks that happen as the proposed chain grows. The time to finality varies with the number of checks that need to be performed (and invalidity reports cause the protocol to require extra checks). The expected time to finality is 12-60 seconds.

- Ethereum 2.0 requires a large number of validators per shard to provide strong validity guarantees. Polkadot can provide stronger guarantees with fewer validators per shard. Polkadot achieves this by making validators distribute an erasure coding to all validators in the system, such that anyone – not only the shard’s validators – can reconstruct a parachain’s block and test its validity. The random parachain-validator assignments and secondary checks performed by randomly selected validators make it impossible for the small set of validators on each parachain to collude.”

Polkadot parachains started going live in December 2021. As of January 2023, 36 parachains have secured auction slots. These parachains include DeFi chains (Acala, Parallel, Centrifuge, Interlay), smart contract platforms (Moonbeam, Astar and Clover), and web3 infrastructure (Efinity, Nodle).

Moreover, a significant milestone was crossed in May 2022, with Polkadot finally enabling the Cross-Consensus Message Format (XCM). XCM is a communication language allowing parachains to exchange messages with other parachains, similar to Inter-Blockchain Communication (IBC) on Cosmos. At the close of Q2 2022, 16 parachains began opening bi-directional Horizontal Relay-routed Message Passing (HRMP) channels with other parachains to start communicating with each other, as can be seen via the following link.

XCM is designed around four principles:

- Asynchronous: XCM messages are sent fire-and-forget, making them unsuitable for critical information such as liquidation orders.

- Absolute: XCM messages are guaranteed to be delivered in a timely manner, and interpreted accurately.

- Asymmetric: XCM messages do not have results.

- Agnostic: XCM makes no assumptions about the Consensus System between which messages are being passed.

The agnostic aspect allows XCM to be suitable for messages between disparate chains connected through one or more bridges and even for messages between smart contracts. For example, a smart contract, hosted on a Polkadot parachain, may transfer a non-fungible asset it owns using XCM through Polkadot to an Ethereum-mainnet bridge located on another parachain, into an account controlled on the Ethereum mainnet.

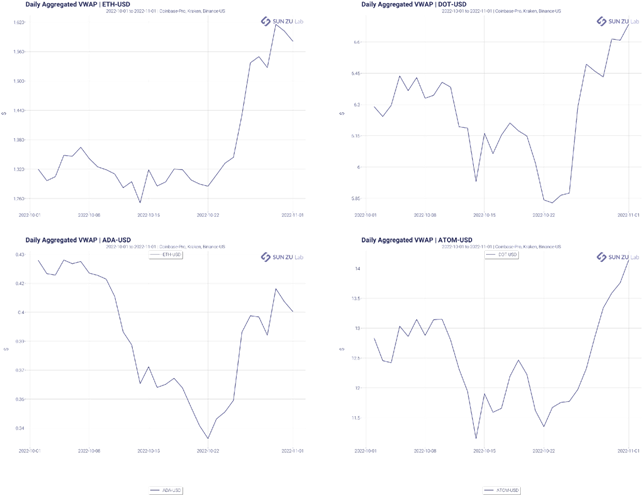

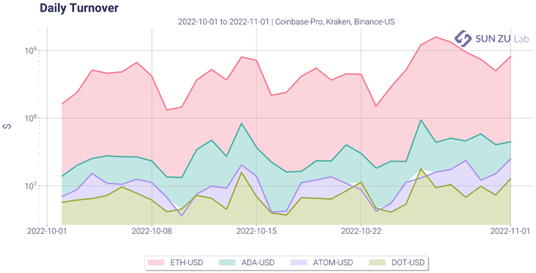

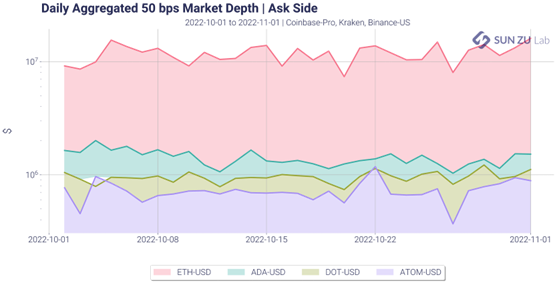

Market adoption charts:

We provide in the following section a comparison over October 2022 of different trading metrics between the following tokens: ETH (Ethereum), DOT (Polkadot), ADA (Cardano) and ATOM (Cosmos). The latter three are blockchains focused on tackling the interoperability problem.

Over October 22, DOT price-performance was +4%, against +20% for ETH, -7% for ADA and +11% for ATOM.

Conclusion

With the launch of XCM, DOT will finally be ready to be traded, sent, and composed across all parachains on the Polkadot network. The passage of this milestone represents a massive leap in blockchain interoperability. We will see in a future article how Interlay, Polkadot’s 10th parachain, has a promising future in tackling the complex decentralized cross-chain bridge problem within the blockchain ecosystem. Nevertheless, it is still unclear whether the web3 ecosystem’s future will be cross-chain or multi-chain.

References

- Polkadot: Vision For a Heterogenous Multi-Chain Framework, by Dr Gavin Wood (link)

- Polkadot Lightpaper, An Introduction to Polkadot (link)

- Chain Interoperability, by Vitalik Buterin (link)

- XCM: The Cross-Consensus Message Format, by Gavin Wood (link)

- Will the future be multi-chain or cross-chain? Tweet by Vitalik Buterin (link)

Disclaimer

No Investment Advice

The contents of this document are for informational purposes only and do not constitute an offer or solicitation to invest in units of a fund. They do not constitute investment advice or a proposal for financial advisory services and are subject to correction and modification. They do not constitute trading advice or any advice about cryptocurrencies or digital assets. SUN ZU Lab does not recommend that any cryptocurrency should be bought, sold, or held by you. You are strongly advised to conduct due diligence and consult your financial advisor before making investment decisions.

Accuracy of Information

SUN ZU Lab will strive to ensure the accuracy of the information in this report, although it will not hold any responsibility for any missing or wrong information. SUN ZU Lab provides all information in this report and on its website.

You understand that you are using any information available here at your own risk.

Non Endorsement

The appearance of third-party advertisements and hyperlinks in this report or on SUN ZU Lab’s website does not constitute an endorsement, guarantee, warranty, or recommendation by SUN ZU Lab. You are advised to conduct your due diligence before using any third-party services.

About SUN ZU Lab

SUN ZU Lab is a leading data solutions provider based in Paris, on a mission to bring transparency to the global crypto ecosystem through independent quantitative analyses. We collect the most granular market data from major liquidity venues, analyze it, and deliver our solutions through real-time dashboards & API streams or customized reporting. SUN ZU Lab provides crypto professionals with actionable data to monitor the market and optimize investment decisions.