SUN ZU Lab WEBB3 Analytics #4

By Arthur Serge, November 2022

SUN ZU Lab is delighted to present the fourth article of its latest series of publications, inspired by NASA’s James Webb space telescope, which has recently produced the deepest and sharpest infrared images of the distant universe to date. In the same spirit, we embarked at SUN ZU Lab on a mission to decrypt and analyze the deepest and darkest corners of the Web3 ecosystem, providing an overview of Limit Order Book Distribution.

Introduction

Limit order books are used by the majority of electronic marketplaces throughout the world, and cryptocurrency exchanges are no exception. A limit order is an order to purchase or sell a stock at a certain price or better. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher.

Hence, limit orders are not guaranteed to be executed and can only be filled if the stock’s market price hits the limit price. While limit orders do not guarantee execution, they help ensure that an investor does not spend more than a predetermined price for a stock. This article attempts to study the impact of aggregation on some limit order book (LOB) stylized facts in the cryptocurrency market based on public order book market data. For this analysis, we will use the order book (1 snapshot every 30 seconds) and trade data from December 2021, on two different venues: FTX and Bitstamp, which have significantly different tick sizes ($0.1 for Bitstamp and $1 for FTX) and on two cryptocurrencies: Bitcoin (BTC) and Ethereum (ETH).

Historically, exchanges have reduced tick sizes and imposed fixed values depending on stock prices to minimize transaction costs and improve liquidity. For exchanges in North America, Europe, and Asia, the influence of smaller tick sizes on market quality has been thoroughly examined. Market quality is generally described as two things: price efficiency and market liquidity. The first represents a market in which prices more accurately reflect economic reality. In contrast, the second defines a market where a decent quantity may be traded with minimum price movement.

Furthermore, the ideal tick size and the effects of changing the tick size for market quality have been studied theoretically. Still, because empirical work has primarily focused on stock markets, we lack a comprehensive understanding of the tick size for other markets.

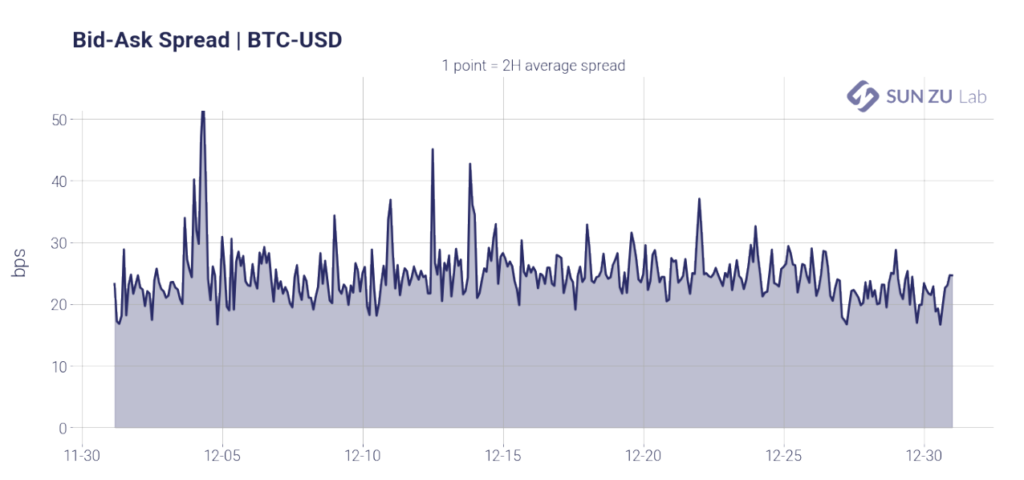

It is necessary to have a large tick market with an average market spread lesser than 1.4 ticks (as defined in [DR13]) to use some order book models (e.g. Uncertainty Zone model, Queue-reactive model). However, most digital asset markets do not meet this condition. For example, the BTC-USD spread is, on average greater than $0.3 while all the considered markets have a tick size smaller than or equal to $0.1.

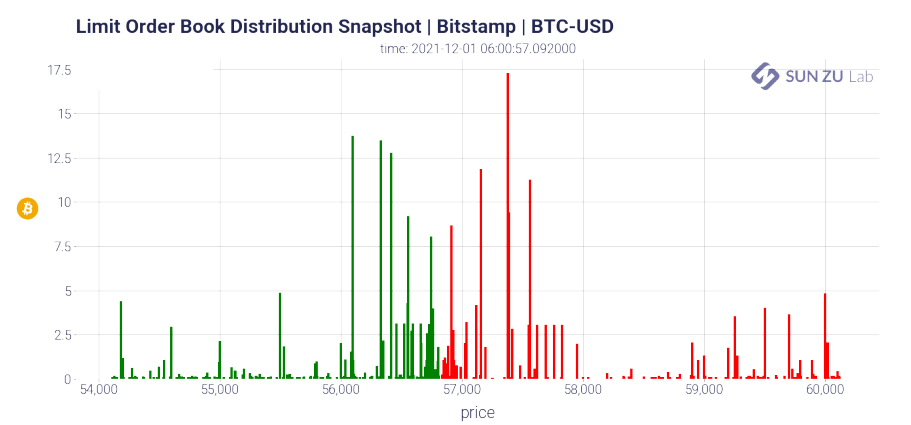

Moreover, the visualization of Limit Order Books can be a problem when the tick size is too small, as shown below. Aggregating the order books is a natural solution to this problem.

Questions and comments about “Limit Order Book Distribution” can be addressed to research@sunzulab.com

About SUN ZU Lab

SUN ZU Lab is a leading data solutions provider based in Paris, on a mission to bring transparency to the global crypto ecosystem through independent quantitative analyses. We collect the most granular market data from major liquidity venues, analyze it, and deliver our solutions through real-time dashboard & API stream or customized reporting. SUN ZU Lab provides crypto professionals with actionable data to monitor the market and optimize investment decisions.