By Stéphane Reverre and Chadi El Adnani @SUN ZU Lab

March 2023

To be clear from the start, we do not try to undermine the gravity of what happened this weekend. The implosion of Silicon Valley Bank (SVB) on Friday could have quickly turned, under other circumstances, into a full-blown banking crisis in the US and worldwide. Contagion fears are far from over, as underlined by the events around Credit Suisse yesterday. We would like, however, to share some of our thoughts to reassure and clarify some points. There is already plenty of (more or less) good analyses around the bank’s failure, so we’ll dive straight into it.

1 — Summary of the events

The US banking sector had its worst week since the GFC in 2008. In a span of 2 days, Silvergate Capital collapsed, while Silicon Valley Bank (SVB) sent chills through the industry after it launched a failed effort to raise more than $2 billion in capital to bolster its capital base. SVB worked with nearly half of US VC-backed tech companies, and VC funds responded to this news by advising portfolio companies to withdraw capital. The media reported that Founder’s Fund and a16z advised portfolio companies to take these actions. SVB responded by informing select customers that it has ~$180B of available liquidity and top-tier capital ratios relative to its peers. Later the same week, US regulators closed SVB before moving to close Signature Bank as well, the last of the three crypto-friendly banks in the US. Now, one cannot help but wonder: would such a dramatic collapse have taken place if VCs had not advised their portfolio companies to withdraw their money? Intrinsically it was in their best interest to get their money out as quickly as possible, ironically though it was probably also in their best interest not to.

From the European side, stock markets fell sharply Wednesday, with banking stocks deep in negative territory following more bad news from Credit Suisse. The bank fell 24% amid growing concerns about a run after its biggest backer, Saudi National Bank, said it would not provide any further financial support.

2 — This was a very usual bank run on a very unusual bank

While Signature Bank faced a criminal probe ahead of its collapse, according to Bloomberg, Silvergate and SVB suffered from a lack of client diversification (crypto focus for the former and VC-backed tech for the latter). The events are also causing new investor concerns about some of the US and EU’s largest financial institutions. This is linked to two main factors, rising interest rates and the inversion of the yield curve, which recently dipped below 100 bps for the first time since 1981 for the 10Y-2Y yields. The inversion significantly affects banks as they usually invest their short-term client deposits into long-term bonds. As the yield curve inverts, they have to pay more on deposits than they earn on their investments, while higher rates lower the value of their existing bonds. In this context, SVB was forced to sell all its available-for-sale bonds at a $1.8 billion loss as its startup clients withdrew deposits. This situation is not unique to SVB; many banks have parked depositor money in fixed-rate government bonds that have lost value due to the rapid rise in interest rates. The FDIC recently reported that US banks are sitting on $620 bn of combined unrealized losses in their securities portfolios. SVB would have been capable of staying afloat had there not been this panic movement that eventually caused the run. (…apparently, they were already in trouble at the end of 2022 when losses were much higher than 2 bln$)

Many economists have thoroughly studied the mechanics of a bank run, but at the core of it, a run is a self-fulfilling prophecy that could annihilate the most robust of banks. As soon as a critical mass of clients is persuaded that the bank is likely to suffer a run, a race to zero is triggered by everyone trying to pull their money in an attempt to get ahead of everyone else. It all comes down to the confidence factor, and SVB’s failure was not the first but one of the biggest. There have been more than 500 bank failures in the US alone since 2008.

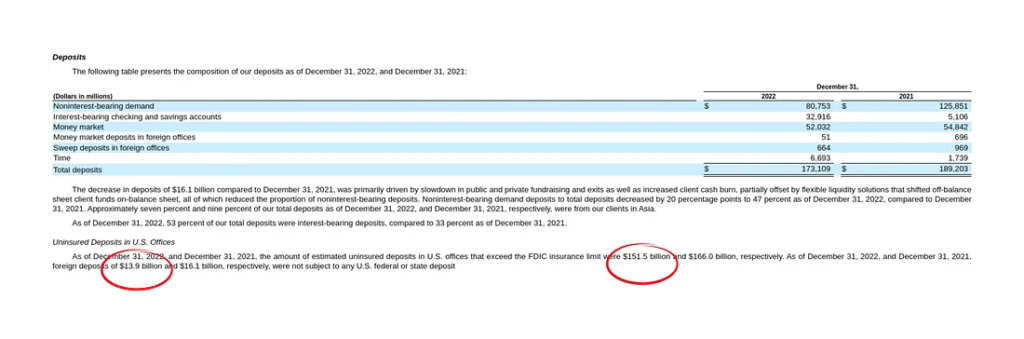

To prevent this vicious circle from getting into action, the FDIC in the US insures all accounts up to $250,000, which for a standard bank should amount to around 50% of the client base. The problem was that most of the deposits in SVB (c. 95%) were not FDIC insured as they were over the $250,000 limit. This is maybe the biggest cause of SVB’s woes: lack of client diversification outside the tech VC-backed startup base. It also needs to be clarified why so many startups were incentivized to use SVB as a bank instead of relying on a more classic and robust choice, such as JPM or BoA. Some plausible explanation would be that SVB was a primary lender to these startups, with the condition to keep their money in the bank. From this point, all it took was a bunch of prominent VCs, led by Peter Thiel’s Founders’ Fund, advising their portfolio companies to pull their money out of SVB to run the bank in less than two days.

3 — The worst is never certain — “Le pire n’est jamais certain”

Over the weekend, much speculation existed about whether the US government would intervene to save the situation. Sunday evening, the Treasury, the Fed, and the FDIC released a joint statement to inform SVB depositors that they would have access to all their money on Monday. The US startup ecosystem was saved from an “extinction-level” event, but there was little doubt that the US government would allow something this dramatic to happen.

Secretary of the Treasury Janet Yellen set things straight over the weekend: “Let me be clear that, during the financial crisis, there were investors and owners of systemic large banks that were bailed out . . . and the reforms that have been put in place means we are not going to do that again…”. The released joint statement later added that “Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.”

Regarding the CS situation, Switzerland’s Central Bank pledged to fund the bank with liquidity “if necessary,” a first for a global bank since the GFC. In a joint statement with FINMA, they insisted that CS was sound and “meets the capital and liquidity requirements imposed on systemically important banks. Later the same day, we learned that CS would borrow around CHF 50 bn from a Swiss National Bank liquidity facility and repurchase certain OpCo senior debt securities of up to CHF 3 bn.

4 — Who lost what exactly?

Officials insisted this was NOT a bailout, as only the banks’ clients were getting their money back. President Biden later added, “That’s how capitalism works, “ referring to SVB and Signature Bank investors who lost their money.

As a reminder, the Basel III accord raised banks’ minimum total capital requirements to 8%, as a percentage of the bank’s risk-weighted assets (RWA), with a minimum Tier 1 capital ratio of 6%. Tier 1 refers to a bank’s core capital, equity, and the disclosed reserves that appear on the bank’s financial statements. Here, major US banks maintain Tier 1 capital ratios well above 10%. The Basel accords also require a minimum of 100% LCR ratios as of 2019 (The Liquidity Coverage Ratio (LCR) refers to the proportion of highly liquid assets held by banks to ensure their ability to meet short-term obligations). SVB was a category IV bank; although it was the 16th largest bank, it was never subjected to the Fed’s LCR requirements.

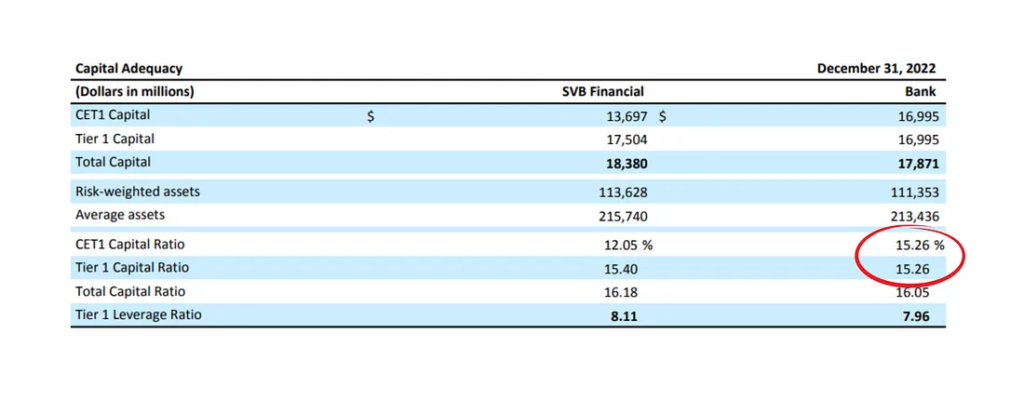

SVB’s regulatory disclosures at the end of 2022 show the following:

The bank shows $17 bn of Tier 1 Capital and $111.4 bn of Risk-Weighted Assets for a CET1 capital ratio of 15.26%.

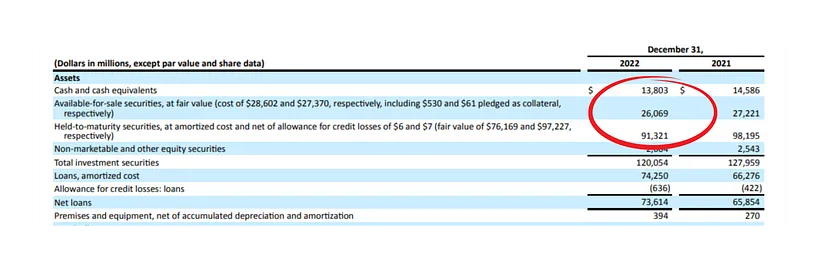

SVB Financial Group’s consolidated balance sheet is detailed below:

Was the bank solvent? Theoretically, yes! as of the end of 2022 it held:

- $14 bn in cash and cash equivalents

- $26 bn in Available-for-sale (AFS) securities

- $91 bn in Held-to-maturity (HTM) securities, invested in government-guaranteed Mortgage and Commercial Backed Securities.

- $74 bn of loans accorded to clients

These securities offer all the liquidity guarantees since they are HQLA-eligible (High-Quality Liquid Assets) and guaranteed by US state agencies. However, these securities are bonds whose value falls mathematically when rates rise, and the Fed’s rates have increased dramatically and faster than anyone had expected last year from 0.25% to 4.5%.

Moreover, the necessary disposal of part of the AFS securities to ensure the bank’s liquidity generated the aforementioned $1.8 bn in losses. The bank also disclosed in a footnote of its December 10-K Form that the HTM book had $15 bn of unrealized losses. Considering that SVB’s capital stood at $16 bn at the end of 2022, the bank only had limited capital to absorb the losses even before the run began. On paper, everything looked ok, but in reality, the rapid rise in interest rates had devastated SVB’s capital buffer (Before Collapse of Silicon Valley Bank, the Fed Spotted Big Problems). The fair conclusion is that we’re facing a massive failure of risk management, nothing more, nothing less. It is a failure of senior management to adjust its practices and business mix and to assess the implication of the yet all-too-visible inflationary pressures with its train of rate hikes.

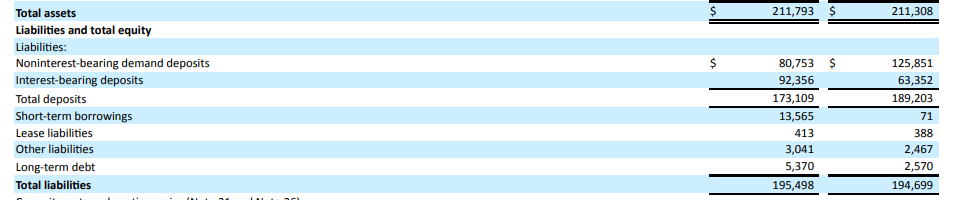

Here lies another important part of the problem. In a recent article following the events, the CFA Institute criticized HTM accounting, calling it “Hide-Til-Maturity” and advising FASB to eliminate it. They continue to precise that “Overall, SVB’s total assets at 12/31/2022 were $211.8 billion of which only approximately $40 billion (cash and available-for-sale (AFS) securities) were at fair value and immediately available to pay the $173 billion in deposit liabilities — which are all due within the next year, according to SVB’s contractual obligations table.”

Another interesting observation, rather than selling its securities on the market, SVB has liquidity lines in the form of repo agreements with bank counterparties, the FHLB, or the Fed, allowing it to collateralize its investment-grade bonds with cash. However, the management has decided to sell part of its bond portfolio quickly. We still need a convincing reason as to why they took this decision.

The deposits’ details were the following:

From the $173.1 bn in total deposits, $165.4 bn (95%) exceeded the FDIC insurance limit.

5 — What now?

Now that the FDIC controls SVB, its assets will be sold to the highest bidder. An auction on the assets already started Sunday, but there are very few banks capable of absorbing the significant quantity, and a deal has yet to be reached. SVB did not pose a systemic risk, and the US government’s quick actions over the weekend ensured the contagion didn’t spread. The events still negatively influence sentiment towards the financial sector, particularly US regional banks.

On the other hand, Credit Suisse is part of the closed club of Bulge Bracket banks imposing a global systemic-level risk. The fact that quotes for Credit Suisse’s 1yr CDS exceeded 3000 bps on Wednesday is historic and approaching a rarely-seen level that typically signals serious investor concerns.

Circle’s USDC was one of SVB’s most significant casualties over the weekend, as the firm confirmed having $3.3 bn of its $40 bn reserves in the failed bank. Over the weekend, USDC lost over 10% of its value, trading as low as $0.87 before regaining its peg on relatively joyful news Sunday evening. It is interesting to note the parallel with Tether’s USDT, which was trading at a premium for most of the weekend. In times of crisis, the market preferred Tether’s opacity to Circle’s mishandled communication. Some argued that trusting one entity with 8% of the stablecoin’s reserves was a strategic mistake.

The closure of Silvergate, SVB, and Signature, the last of the three crypto-friendly banks, creates a significant gap in the market as the industry lost 3 of its major fiat on-ramp/off-ramp partners. This will create a considerable liquidity decrease in the ecosystem, and other banks and financial intermediaries will have to step in to fill this gap.

Before last week, Fed Chair Jerome Powell seemed determined to continue hiking rates until inflation returns to a long-lost 2% threshold. With the second and third largest bank failures in US history happening in less than two days, some economists predict that Powell will change his strategy to put the health of banks above all other considerations. Goldman Sachs no longer expects a rate increase at the Fed’s meeting next week, while Nomura made an even bolder prediction of a rate cut. According to Bloomberg, The ECB will forgo earlier guidance for a half-point interest-rate increase at this week’s meeting and only hike by half that amount amid concerns over the financial sector’s health. The European Central Bank should either delay or pare back this week’s planned interest-rate increase to avoid a policy error reminiscent of 2011, added former executive board member Lorenzo Bini Smaghi.

We have indeed avoided, for now, a 2008-level crisis. Still, the events will not go unnoticed, with many debates underway regarding the utility and threshold of the FDIC insurance, regulation of mid-sized banks, and the Fed’s monetary policies in times of crisis. One thing is clear; we should, at all costs, avoid creating unnecessary panic given the current fragility of the world economy.

Disclaimer

No Investment Advice

The contents of this document are for informational purposes only and do not constitute an offer or solicitation to invest in units of a fund. They do not constitute investment advice or a proposal for financial advisory services and are subject to correction and modification. They do not constitute trading advice or any advice about cryptocurrencies or digital assets. SUN ZU Lab does not recommend that any cryptocurrency should be bought, sold, or held by you. You are strongly advised to conduct due diligence and consult your financial advisor before making investment decisions.

Accuracy of Information

SUN ZU Lab will strive to ensure the accuracy of the information in this report, although it will not hold any responsibility for any missing or wrong information. SUN ZU Lab provides all information in this report and on its website.

You understand that you are using any information available here at your own risk.

Non Endorsement

The appearance of third-party advertisements and hyperlinks in this report or on SUN ZU Lab’s website does not constitute an endorsement, guarantee, warranty, or recommendation by SUN ZU Lab. You are advised to conduct your due diligence before using any third-party services.

About SUN ZU Lab

SUN ZU Lab is a leading data solutions provider based in Paris, on a mission to bring transparency to the global crypto ecosystem through independent quantitative analyses. We collect the most granular market data from major liquidity venues, analyze it, and deliver our solutions through real-time dashboards & API streams or customized reporting. SUN ZU Lab provides crypto professionals with actionable data to monitor the market and optimize investment decisions.