By Chadi El Adnani @SUN ZU Lab

January 2023

This article was part of a broader report on the following theme: “Challenges and opportunities: The future of DeFi in TradFi”. Crypto Valley Association selected it among the top 5 pieces for its 2022 Call For Papers challenge.

Since the birth of bitcoin in 2009, the blockchain ecosystem has not stopped expanding. It is now based on multiple layer 1 (L1) blockchains, each with a different philosophy and unique infrastructure architecture. Such L1s include Bitcoin, Ethereum, Solana, Polkadot, or Cosmos. While Solana’s approach to growth focuses on the network effect of bringing many developers and users on-chain, the Ethereum community believes that mass adoption will come primarily from blockchain security and decentralization superiority. These cultural differences are reflected in how these blockchains operate and process data, making direct inter-blockchain communication very hard and creating one of the most critical challenges for the web3, and hence DeFi, ecosystems: interoperability. The following metaphor best describes this situation: imagine an internet where it was only possible to send emails within isolated platforms, Gmail to Gmail, Yahoo to Yahoo, etc. This is the case today for data and tokens stored on different blockchains.

Questions and comments can be addressed to c.eladnani@sunzulab.com or research@sunzulab.com

Introduction:

The benefits of blockchain interoperability are necessary to achieve mass adoption and an optimized user experience. It also helps avoid “winner takes all” monopolies (think about the blu-ray technology, for example). It will allow for entirely composable web3 services, with interoperable smart contracts leading to primary industries exchanging important business information between private and public networks in a completely customizable and controllable manner. Moreover, blockchain interoperability should enable multi-token transactions and wallet systems, a significant phase for DeFi’s usage growth.

Another critical benefit to blockchain interoperability is the ability to create a more decentralized ecosystem (in terms of players/actors). Instead of having one blockchain like Ethereum processing transactions of thousands of dApps, leading to recurrent congestions in the network and excessive transaction gas fees, thousands of application-specific blockchains could communicate with one another through a decentralized central hub. Enter Polkadot!

Interoperability can also be achieved through cross-chain bridges that allow for digital assets owned by someone to be locked on one chain, while an identical asset is minted on another chain and sent to an address owned by the original owner. These bridges can be decentralized blockchain ecosystems or centralized custodians. Interlay, Polkadot’s 10th parachain, is working to provide similar services for Bitcoin. We make an interesting parallel in TradFi with the concept of American Depository Receipts (ADRs); an ADR is a certificate representing shares of a foreign security. It is a form of indirect ownership of foreign securities not traded directly on a national exchange in the US. Financial institutions purchase the underlying securities on foreign exchanges through their foreign branches, and these foreign branches remain the custodians of the securities. The financial institutions hold legal title to the underlying stock through these foreign branches. This structure of indirect ownership has caused non-negligible problems in the past.

In the following parts, we will dive deeper into how Polkadot operates. We will analyze in a coming article Interlay’s specific operating model.

Polkadot – the first fully-sharded blockchain:

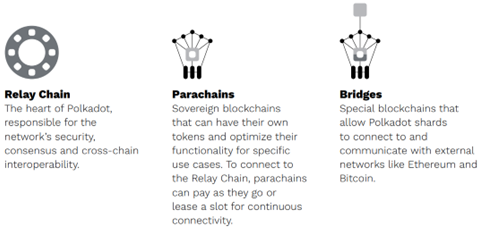

Polkadot is a layer 1, or even layer 0, nominated proof-of-stake (nPoS) blockchain protocol connecting multiple specialized blockchains into one network. It was founded by Gavin Wood, a co-founder of Ethereum and the Ethereum Foundation’s first CTO, alongside co-founders Peter Czaban and Robert Habermeier in 2016. Dr Wood has an impressive background as he invented Solidity, the language developers use to write decentralized applications (dApps) on Ethereum. He developed as well in 2015 a company called Parity Technologies that maintains Substrate, a software development framework primarily used by Polkadot developers who wish to create parachains quickly. Polkadot is run by the Web3 Foundation and developed by Parity Technologies. It uses a relay chain / parachain model, allowing multiple blockchains to communicate and securely share information. This unique model allows digital assets and data to be interchanged and transferred within a multi-chain network through efficient and secure data exchange between private/public blockchains, dApps and oracles. The parachains are entirely independent in governance but have shared security structures through the relay chain.

Polkadot’s functioning structure is best explained by the United States model: each state (parachain) has its sovereignty and rights but must rely on the federal government (relay chain) for governance and security. To be more precise, parachains remain fully independent governance entities, with the relay chain only governing block production, DOT treasury or parachain slot auctions, among others. Parachains connect to Polkadot by leasing a slot on the relay chain for a renewable period of 96 weeks. Parachain slots are assigned through auctions, and auction winners lock up a bond in DOT for the duration of the lease.

As of January 2023, the Polkadot network is ranked at the 13th position on Coinmarketcap, being the eleventh-largest blockchain in terms of its native token DOT’s market capitalization ($5.4bn), behind Dogecoin ($9.6bn), Cardano ($9.2bn), and Polygon ($7.0bn). Polkadot runs parallel to its twin canary network, Kusama, where teams and developers can build and deploy parachains or try out Polkadot’s governance, staking, nomination and validation functionalities in a living environment.

Polkadot’s technical documentation provides a good description of its architecture. There are three fundamental roles in the upkeep of the Polkadot network: collators, nominators and validators:

- Collators: they maintain a full node of the parachain blockchain and the relay chain, thus facilitating the different parachains’ transactions. The parachains must incentivize collators to be rewarded for their services. Rewards could include parachain-specific tokens or transaction fees, as the Polkadot system has not set rules on how collators should be incentivized.

- Validators: they verify the blocks and provide consensus in the staking mechanism. They must run a validator node and bond DOT tokens to be selected and participate in staking.

- Nominators: they are DOT token holders that wish to participate in the staking mechanism but do not have the technical means or do not wish to bear the responsibilities of maintaining a validator node.

Polkadot’s architecture

Source: Polkadot lightpaper

For the main differences between Polkadot and Ethereum, let’s look at Polkadot’s wiki page. Here is an extract:

“There are two main differences between Ethereum 2.0 and Polkadot consensus:

- Ethereum 2.0 finalizes batches of blocks according to periods of time called “epochs”. The current plan is to have 32 blocks per epoch, and finalize them all in one round. With a predicted block time of 12 seconds, this means the expected time to finality is 6 minutes (12 minutes maximum). [3] Polkadot’s finality protocol, GRANDPA, finalizes batches of blocks based on availability and validity checks that happen as the proposed chain grows. The time to finality varies with the number of checks that need to be performed (and invalidity reports cause the protocol to require extra checks). The expected time to finality is 12-60 seconds.

- Ethereum 2.0 requires a large number of validators per shard to provide strong validity guarantees. Polkadot can provide stronger guarantees with fewer validators per shard. Polkadot achieves this by making validators distribute an erasure coding to all validators in the system, such that anyone – not only the shard’s validators – can reconstruct a parachain’s block and test its validity. The random parachain-validator assignments and secondary checks performed by randomly selected validators make it impossible for the small set of validators on each parachain to collude.”

Polkadot parachains started going live in December 2021. As of January 2023, 36 parachains have secured auction slots. These parachains include DeFi chains (Acala, Parallel, Centrifuge, Interlay), smart contract platforms (Moonbeam, Astar and Clover), and web3 infrastructure (Efinity, Nodle).

Moreover, a significant milestone was crossed in May 2022, with Polkadot finally enabling the Cross-Consensus Message Format (XCM). XCM is a communication language allowing parachains to exchange messages with other parachains, similar to Inter-Blockchain Communication (IBC) on Cosmos. At the close of Q2 2022, 16 parachains began opening bi-directional Horizontal Relay-routed Message Passing (HRMP) channels with other parachains to start communicating with each other, as can be seen via the following link.

XCM is designed around four principles:

- Asynchronous: XCM messages are sent fire-and-forget, making them unsuitable for critical information such as liquidation orders.

- Absolute: XCM messages are guaranteed to be delivered in a timely manner, and interpreted accurately.

- Asymmetric: XCM messages do not have results.

- Agnostic: XCM makes no assumptions about the Consensus System between which messages are being passed.

The agnostic aspect allows XCM to be suitable for messages between disparate chains connected through one or more bridges and even for messages between smart contracts. For example, a smart contract, hosted on a Polkadot parachain, may transfer a non-fungible asset it owns using XCM through Polkadot to an Ethereum-mainnet bridge located on another parachain, into an account controlled on the Ethereum mainnet.

Market adoption charts:

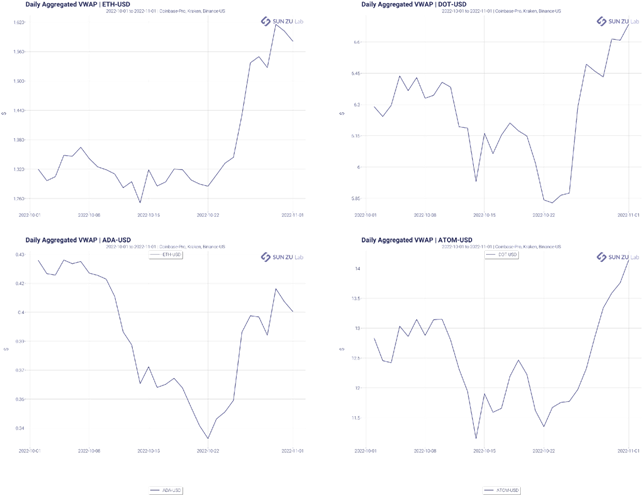

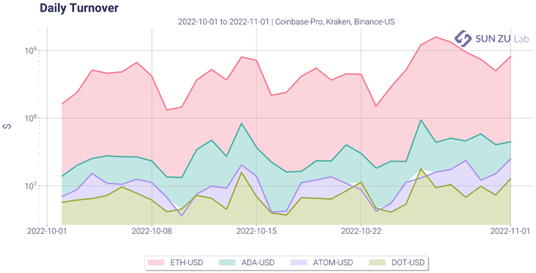

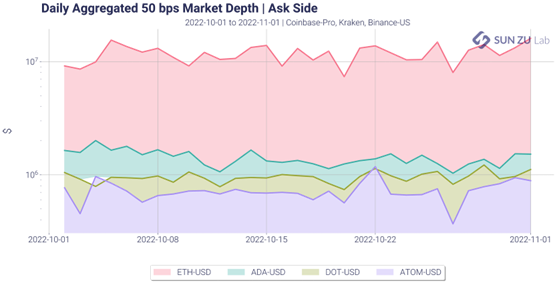

We provide in the following section a comparison over October 2022 of different trading metrics between the following tokens: ETH (Ethereum), DOT (Polkadot), ADA (Cardano) and ATOM (Cosmos). The latter three are blockchains focused on tackling the interoperability problem.

Over October 22, DOT price-performance was +4%, against +20% for ETH, -7% for ADA and +11% for ATOM.

Conclusion

With the launch of XCM, DOT will finally be ready to be traded, sent, and composed across all parachains on the Polkadot network. The passage of this milestone represents a massive leap in blockchain interoperability. We will see in a future article how Interlay, Polkadot’s 10th parachain, has a promising future in tackling the complex decentralized cross-chain bridge problem within the blockchain ecosystem. Nevertheless, it is still unclear whether the web3 ecosystem’s future will be cross-chain or multi-chain.

References

- Polkadot: Vision For a Heterogenous Multi-Chain Framework, by Dr Gavin Wood (link)

- Polkadot Lightpaper, An Introduction to Polkadot (link)

- Chain Interoperability, by Vitalik Buterin (link)

- XCM: The Cross-Consensus Message Format, by Gavin Wood (link)

- Will the future be multi-chain or cross-chain? Tweet by Vitalik Buterin (link)

Disclaimer

No Investment Advice

The contents of this document are for informational purposes only and do not constitute an offer or solicitation to invest in units of a fund. They do not constitute investment advice or a proposal for financial advisory services and are subject to correction and modification. They do not constitute trading advice or any advice about cryptocurrencies or digital assets. SUN ZU Lab does not recommend that any cryptocurrency should be bought, sold, or held by you. You are strongly advised to conduct due diligence and consult your financial advisor before making investment decisions.

Accuracy of Information

SUN ZU Lab will strive to ensure the accuracy of the information in this report, although it will not hold any responsibility for any missing or wrong information. SUN ZU Lab provides all information in this report and on its website.

You understand that you are using any information available here at your own risk.

Non Endorsement

The appearance of third-party advertisements and hyperlinks in this report or on SUN ZU Lab’s website does not constitute an endorsement, guarantee, warranty, or recommendation by SUN ZU Lab. You are advised to conduct your due diligence before using any third-party services.

About SUN ZU Lab

SUN ZU Lab is a leading data solutions provider based in Paris, on a mission to bring transparency to the global crypto ecosystem through independent quantitative analyses. We collect the most granular market data from major liquidity venues, analyze it, and deliver our solutions through real-time dashboards & API streams or customized reporting. SUN ZU Lab provides crypto professionals with actionable data to monitor the market and optimize investment decisions.