By Chadi El Adnani @SUN ZU Lab

January 2023

This article was part of a broader report on the following theme: “Challenges and opportunities: The future of DeFi in TradFi”. Crypto Valley Association selected it among the top 5 pieces for its 2022 Call For Papers challenge.

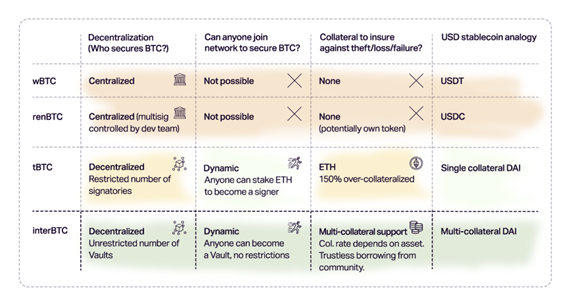

Interlay came into existence based on the observation that all current existing cross-chain Bitcoin, and other digital tokens, are all centralized and custodial, like the major USD-pegged stablecoins USDT and USDC. These bridges make users give up control over their assets and trust a third party to maintain the bridge, thus creating a weak centralized link in the overall decentralized chain. DeFi Llama data shows that several dollar billions are locked in protocols that bridge tokens from one network to another, the majority of them being centralized, custodial bridges (wBTC, renBTC…), putting the whole crypto ecosystem in a catastrophic situation in case these custodial bridges are hacked, lose keys or commit fraud. Following a previous article on how Polkadot is tackling the complex blockchain interoperability problem, we analyze in this article Interlay’s potential to deliver a rock-solid decentralized cross-chain bridge.

Questions and comments can be addressed to c.eladnani@sunzulab.com or research@sunzulab.com

Introduction:

Blockchain bridges have already suffered several hack attacks, exceeding $1 billion in cryptocurrency stolen. The latest significant episodes include Axie Infinity’s Ronin bridge $600 million hack, Harmony’s Horizon bridge hack for $100 million, and the $190 million Nomad bridge hack in August 2022, described as one of the most chaotic hacks web3 has ever seen. In a much-publicized tweet earlier in 2022, Vitalik Buterin voiced his opposition to using cross-chain solutions in the blockchain ecosystem in favour of a multi-chain future, arguing that the former increase the security risks in the process of transferring assets. Indeed, the attack vectors of the assets are increased across a more comprehensive network surface area as it is moved across an increasing number of chains and dApps with different security architectures. We believe at SUN ZU Lab that a minimum of standardization is required for blockchains to co-exist in parallel. Several organizations (IEEE, ANSI…) are doing this very well, so why shouldn’t the core blockchain teams start integrating these organizations?

We will cover in this next part the specifics of Interlay, its technical design, and how it differentiates from its centralized peers.

What is Interlay?

Interlay’s flagship product, iBTC, is a 1:1 Bitcoin-backed stablecoin that can be used to invest, earn and pay with BTC across the DeFi ecosystem on Polkadot at first, with future deployment plans on Ethereum, Cosmos and many other blockchains. Interlay also deployed Kintsugi, iBTC’s canary network, a testnet with real economic value deployed on Kusama (Polkadot’s canary network). Kintsugi and iBTC share the same code base, with the difference that the former will always be two to three releases ahead with more experimental features. Interlay won Polkadot’s 10th parachain slot auction, while Kintsugi won Kusama’s parachain slot 11.

Interlay was created in 2020 by Alexei Zamyatin and Dominik Harz, who met in October 2017 as the first two PhDs in the Imperial College’s cryptocurrency research lab. They have worked together since, publishing more than 20 papers on specific problems such as blockchain security, scalability, interoperability and DeFi.

After the successful launch of its flagship product, iBTC, the company now sets its eyes on becoming a one-stop-shop for Bitcoin DeFi with a new roadmap that includes decentralized lending, borrowing and trading for BTC.

Tokenomics:

Interlay and Kintsugi will be governed by their communities via INTR and KINT, their governance tokens on Polkadot and Kusama, respectively. INTR and KINT tokens’ primary purposes are:

- Governance: token holders vote on governance proposals.

- Staking: To participate in governance, holders stake INTR/KINT and earn INTR/KINT staking rewards in return.

- Utility: Interlay will support transaction fee payments in INTR/KINT.

- Outlook: tokens will be tightly integrated into the bridge, offering token holders additional security and product benefits.

- Collateral: INTR and KINT tokens can also be used as collateral to back iBTC and kBTC.

INTR and KINT have an unlimited supply with the following emission schedule:

- 1 billion INTR and 10 million KINT emitted over the first four years.

- 2% annual inflation afterwards, indefinitely.

The project emphasizes community, with 70% of tokens distributed as airdrops and block rewards. Moreover, starting from the 5th year, only the community will receive newly minted KINT and INTR tokens.

Technology:

The Interlay network operates as follows: collateralized vaults hold BTC locked on Bitcoin, while iBTC is minted on the parachain. These vaults can be individuals or service providers who lock collateral in a MakerDAO-inspired multi-collateral system to protect users against theft and BTC loss, and receive BTC into custody for safekeeping while iBTC exists.

There are four main phases in each iBTC life-cycle:

1. Lock: users can run their vault or pick one to lock BTC. BTC is always backed by the vault’s collateral

2. Mint: iBTC is created at a 1:1 ratio to locked BTC

3. BTC DeFi: iBTC could be used as collateral for lending or yield farming, for example, on Polkadot, Kusama, Cosmos, Ethereum and other major DeFi platforms

4. Redeem: iBTC is eventually redeemed for physical BTC on Bitcoin in a trustless manner

iBTC’s main difference from existing wrapped Bitcoin products is its trustless and decentralized aspect. It is secured by insurance as vaults lock collateral on the iBTC parachain in a multi-collateral system. In case of misbehaviour, the network slashes their collateral and reimburses users. Moreover, it is radically open, meaning anyone could become a vault and help secure iBTC. However, running a vault is currently a highly technical role, requiring advanced proficiency in computer system administration, which constitutes a high barrier to entry. The Interlay team is working on democratizing this role by making it simpler to run a vault.

Comparison between different wrapped BTC asset

Source: Interlay documentation

Use case: BTC DeFi on Karura with Kintsugi:

Karura is Kusama’s central DeFi hub, built as Acala’s sister network (Polkadot’s first parachain winner). Karura offers a suite of financial primitives: a multi-collateralized stablecoin (kUSD) backed by cross-chain assets like Kusama and Bitcoin, a trustless staking derivative, and a DEX to increase liquidity.

Kintsugi suggests many use cases for using kBTC with Karura’s DeFi products, for example:

- HODLing BTC with interest: users can mint kBTC by locking BTC on the Kintsugi bridge, then transfer it to Karura and open a kUSD loan with kBTC. This kUSD amount can be put into another yield-generating DeFi protocol (Sushi LP pool on Moonriver, Basilisk LPs, …).

- Incentivizing kBTC pools on Karura’s AMM: kBTC can be traded against any other listed asset on Karura AMM DEX. Liquidity providers to kBTC pools could earn rewards in KAR and KINT.

- kBTC as kUSD Collateral: kUSD could be minted using kBTC, making it the first stablecoin backed by genuinely trustless and decentralized BTC.

- Arbitrage kBTC vs. renBTC on Karura’s DEX: renBTC will also be listed on Karura. While renBTC and kBTC are pegged to Bitcoin, they have different security properties and demands. This situation leads to slightly varying prices and offers arbitrage opportunities.

- Coming soon: Interlay is working on adding reward-general tokens (such as LP tokens) as collateral and releasing other types of wrapped BTC.

Conclusion

These were just a few examples of what is possible with Interlay products today, and use cases will explode shortly as the DotSama ecosystem continues to grow and Interlay expands to other protocols. Overall, Interlay has a promising future in tackling the complex decentralized cross-chain bridge problem within the blockchain ecosystem. Its founders’ solid research background, combined with its unique decentralized and trustless network, gives it a considerable advantage over its peers. However, it still has a long way to go to compete against centralized, custodial wrapped bitcoin leaders wBTC and hBTC.

References

- Understanding Crypto Bridges and $1 Billion in Thefts, by Olga Kharif (link)

- Interlay & Kintsugi Documentation (link)

- From Academia to Start-up — Looking back at 2020, by Alexei Zamyatin (link)

- Featured Use Case: Chaotic BTC DeFi with Kintsugi & Karura (link)

- Interlay FAQ (link)

Disclaimer

No Investment Advice

The contents of this document are for informational purposes only and do not constitute an offer or solicitation to invest in units of a fund. They do not constitute investment advice or a proposal for financial advisory services and are subject to correction and modification. They do not constitute trading advice or any advice about cryptocurrencies or digital assets. SUN ZU Lab does not recommend that any cryptocurrency should be bought, sold, or held by you. You are strongly advised to conduct due diligence and consult your financial advisor before making investment decisions.

Accuracy of Information

SUN ZU Lab will strive to ensure the accuracy of the information in this report, although it will not hold any responsibility for any missing or wrong information. SUN ZU Lab provides all information in this report and on its website.

You understand that you are using any information available here at your own risk.

Non Endorsement

The appearance of third-party advertisements and hyperlinks in this report or on SUN ZU Lab’s website does not constitute an endorsement, guarantee, warranty, or recommendation by SUN ZU Lab. You are advised to conduct your due diligence before using any third-party services.

About SUN ZU Lab

SUN ZU Lab is a leading data solutions provider based in Paris, on a mission to bring transparency to the global crypto ecosystem through independent quantitative analyses. We collect the most granular market data from major liquidity venues, analyze it, and deliver our solutions through real-time dashboards & API streams or customized reporting. SUN ZU Lab provides crypto professionals with actionable data to monitor the market and optimize investment decisions.