By Chadi El Adnani @SUN ZU Lab

November 2022

“In the midst of chaos, there is also opportunity”

Sun Tzu – 500 BC

This quote by our spiritual father, Sun Tzu, has never been more true in the crypto ecosystem as we all battle to survive the most significant blow ever to the nascent industry. FTX’s bankruptcy was described as crypto’s Lehman Brothers moment, or as more evidence came to light, more “Enron” than “Lehman” moment. Trying to cover this story as it unfolded before our shocked eyes was like trying to catch a bullet bare-handed. This article provides a preliminary post-mortem analysis of where the situation stands today. Unfortunately, we sincerely believe that we have only seen the tip of the iceberg, and we brace for many more casualties to be affected in the near future. We have already covered in SUN ZU Lab’s weekly insights (here & here) the story’s timeline and the significant headlines surrounding it. We will therefore move directly into a more technical analysis.

As a reminder, FTX and Alameda Research constituted the bulk of ex-crypto billionaire Sam Bankman-Fried’s empire. The former being the exchange arm and the latter being the trading firm.

Understand the man to understand his actions:

Sam Bankman-Fried (SBF) had a reputation for being very smart and a highly talented trader. However, as more revelations come to light, we are convinced now that his supposedly spectacular trading returns (as well as some of his peers) were mainly driven by 2020 and 2021’s bull run. His crypto empire’s implosion is due instead to his betting big philosophy! A leveraging strategy mainly fueled FTX and Alameda’s stratospheric rise in the last two years via deceptive fundraises and financial engineering before eventually using plain fraud, as was revealed by the preliminary investigation.

In this Twitter thread, we get an interesting glimpse of SBF’s motives behind creating FTX; he explains, among others, that he was deeply frustrated by two things in the way other crypto exchanges operated. Contrary to TradFi, where an exchange focuses on managing its order book matching engine, leaving margin handling to the clearing house, a crypto exchange has to handle both responsibilities. He was therefore losing millions from what he called “socialized losses”, where the collectivity ends up paying the losses of a liquidated negative account. The second reason was that he viewed BTC’s price as being hit every time it suffered selling pressure from a cascade of liquidated accounts, which wasn’t fair from his point of view.

He initially addressed white papers proposing new ways of functioning to other exchanges before creating FTX as a new crypto derivatives exchange where, we cite: “The entire margin system is reworked to a way almost no exchanges in crypto work. We can take huge size & also have lots of leverage & have a solid blocker against ever having clawbacks.”

A trending video of Alameda’s CEO Caroline Ellison resurfaced where she was saying: “Being comfortable with risk is very important. We tend not to have things like stop-losses, I think those aren’t necessarily a great risk-management tool. I’m trying to think of a good example of a trade where I’ve lost a ton of money … well, I don’t know, I probably don’t want to go into specifics too much.”

We can see a recipe for disaster starting to take form.

A complicated SBF-Ellison / FTX-Alameda love story

Alameda Research and FTX were supposed to be entirely separate entities in theory. We instead learn that Alameda’s CEO Caroline Ellison has dated at times SBF. More shockingly, several top execs from FTX and Alameda lived in the same luxury penthouse in the Bahamas, where Ellison was rumoured to have access to FTX screens showing client trades. A recent Wall Street Journal report indicates that Alameda was frontrunning FTX token listings. Between the start of 2021 and March 2022, the trading firm held $60 million worth of 18 different tokens that were eventually listed on FTX.

This intimacy could also explain why SBF later allowed customer funds to be used to pay for Alameda’s loans, building a software backdoor to outwit FTX compliance systems.

FTX and Alameda’s Balance Sheets were bad, very bad!

The massive bank run suffered between November 6 and 11 drove FTX and Alameda eventually to the ground, and the word bank is chosen wisely as it appears FTX was more a bank than an exchange! They suffered as much as $6 billion of withdrawals in the final 72 hours, except they didn’t have customers’ money as FTX had loaned it to Alameda, which used it to make venture capital investments!!

Let us stop a moment on the last revelation. Every first-year finance student could tell you to never, never use extra-short-term liabilities (client funds, with a theoretical maturity of 0) to finance the riskiest and most illiquid investment in the spectrum (VC investments, with an expected maturity higher than ten years).

Ellison explains in an interview with the New York Times that lenders moved to recall their loans around the time the crypto market crashed this spring. But as the funds that Alameda had spent were no longer easily available, the company used FTX customer funds in an emergency procedure to make the payments.

Let’s go back first to where troubles began to appear. Anyone remotely familiar with the hedge fund space knows that the financials (P&L and Balance Sheet, among others) are protected at all costs. The fact that Coindesk managed to put their hands on that “secret sauce” leaves a place for a plethora of conspiracy theories. We refrain from venturing into that territory.

On November 2, CoinDesk published an article highlighting the following facts from a private document they reviewed:

- As of June 30, 2022, Alameda’s assets amounted to $14.6 billion. Its single most significant asset was a $3.7 billion pile of “unlocked FTT” and $2.2 billion of “FTT collateral”.

- Its c. $8 billion of liabilities are dominated by $7.4 billion of loans, but we also find $292 million of “locked FTT”.

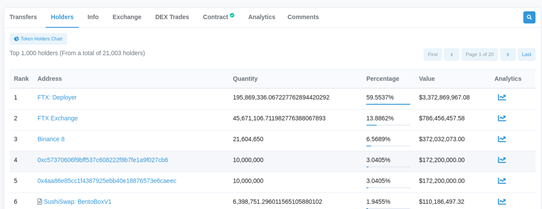

To put things into perspective, this puts a total of $5.8 billion in FTT tokens on Alameda’s balance sheet as of June 30. The market capitalization of circulating FTT was around $3.3 billion that day. Indeed, a quick look at FTT’s page on Etherscan shows that over 74% of the token’s total supply is held by two addresses belonging to FTX and Alameda.

This partial information meant that most of Alameda’s net equity was comprised of FTT tokens, printed out of “thin air” by its sister company FTX.

In a volatile and fragile global crypto environment, rumours were quickly forming about how SBF could be just another flywheel / Ponzi scheme magician! Here is what we mean by a flywheel scheme in crypto:

- Create a token

- Artificially pump its price (wash trading through a market maker)

- Mark the artificial gains in the balance sheet

- lure the community and investors with “realized” gains

- Raise capital through equity sales, ICOs or loans

- the hype continues to fuel the token’s price, and the loop continues!

The fears were extreme, especially since the Celsius bankruptcy and the CEL token explosion still haunt most of us. Celsius was a multi-billion dollar crypto lending firm, or Ponzi scheme, which was destroyed in part by its own token, CEL!

As it appears, this is exactly what SBF was doing with some of his investments, known as “Sam coins”, including Serum, Raydium and FTT.

The way it would work with our exchange/trading firm duo is that Alameda would fund a project at a $50 million fully diluted valuation (considering the total number of tokens to be issued) with $5 million, for example. FTX would then list the token on its exchange, releasing only a tiny fraction of the total tokens to the market. Given the illiquidity of this token, Alameda could easily deploy a few millions to artificially inflate the fully diluted valuation 100x, increasing the stake’s value on its books to $500 million. This inflated figure is then used as collateral for borrowing purposes.

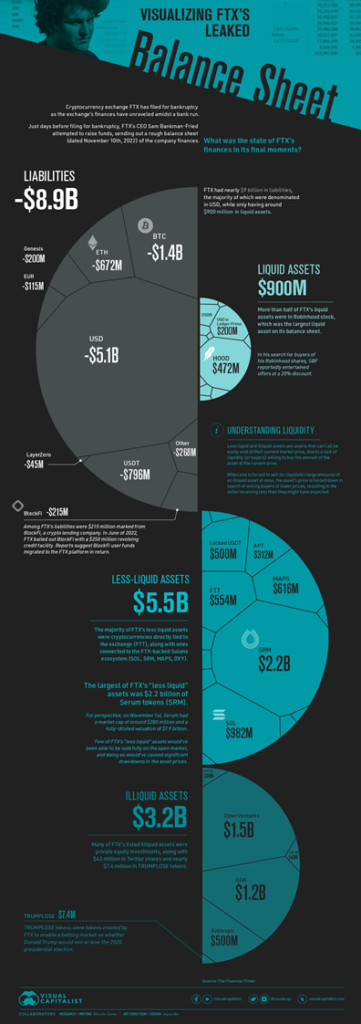

The Financial Times shared a copy of an FTX balance sheet dated November 10, shared with prospective investors one day before the company filed for bankruptcy.

Here is a visualization of this balance sheet provided by Visual Capitalist:

We fell from our seats when we first saw this balance sheet! And we wouldn’t put it better than Bloomberg’s Matt Levine:

“It’s an Excel file full of the howling of ghosts and the shrieking of tortured souls. If you look too long at that spreadsheet, you will go insane.”

Citing the FT, we learn that “A spreadsheet listing FTX international’s assets and liabilities, seen by the Financial Times, point at the issues that brought Bankman-Fried crashing back down to earth. It references $5bn of withdrawals last Sunday, and a negative $8bn entry described as “hidden, poorly internally labled ‘fiat@’ account”.

“Bankman-Fried told the Financial Times the $8bn related to funds “accidentally” extended to his trading firm, Alameda, but declined to comment further.”

When we look at the “less-liquid assets” category, the most considerable number is $2.2 billion of SRM, the Serum DEX native token (we will talk later about Serum). This is a clear example of the flywheel scheme described above in the article. As of November 17, CoinMarketCap shows a $70 million market cap for SRM (market cap of circulating tokens) against a $2.7 billion fully diluted market cap (theoretical figure taking into account the token’s max supply). The FTX team are basing their $2.2 billion valuation on an impossible illiquid scenario.

Okay, but one big question remains: how did they manage to burn through more than $10-15 billion of “realized” profits?

In our eyes, the bad VC investments and mishandling of client funds don’t explain alone the $8 billion hole in the balance sheet, especially when taking into account FTX and Alameda’s extremely profitable history due to high trading fees and lucrative venture deals. The only plausible explanation we see is that Alameda was bleeding money for a long time in 2022’s harsh bear market and possibly long before that, slowly decaying from its market-neutral market-making strategies into taking losing directional bets.

This seems to be exactly what we learned from a recent motion filed in the Delaware district court handling the bankruptcy procedure. The entities’ 2021 tax returns collectively showed a net operating loss carryover of $3.7 billion, meaning that the main entities (FTX & Alameda) had posted that much in losses since their inception. This completely contradicts the image SBF was circulating of his businesses and is quite shocking when considering that several competing crypto exchanges and trading firms, such as Wintermute or Coinbase, have realized significant gains over 2020 and 2021’s roaring crypto bull runs!

We end this paragraph on the wise words of newly appointed FTX CEO John Ray III: “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.”

The biggest winners & losers:

Losers:

It is tough to choose one big loser from the FTX fiasco. There is obviously SBF himself, whose net fortune went from $26 billion at its peak to less than $1 billion. FTX employees are set to lose big, having most of their wealth linked to the exchange. VC and institutional investors have bet big on the disgraced young prodigy: between 2021 and 2022, SBF raised more than $1.5 billion from esteemed investors such as SoftBank, Sequoia Capital, Temasek, Tiger Global Management, Paradigm or the Ontario Teachers’ Pension Plan. Without forgetting the more than a million creditors still waiting to see how this insolvency will be unpicked. It was typically revealed in a court filing that FTX owes almost $3.1 billion to its top 50 creditors.

We want to focus on the Solana ecosystem as one major casualty. The Solana Foundation declared days after the bankruptcy that it held 134.54m SRM tokens and 3.43m FTT tokens on FTX when withdrawals went dark on November 6. Those assets were worth around $107m and $83m one day before the freeze. It also held a 3.2 million common stock ownership in FTX.

As we can see, Solana and FTX maintained deep financial ties. The problem gets bigger when considering Serum, a DEX created by SBF and at the centre of much of Solana-based DeFi. SBF even went on to call Serum the “truly, fully trustless” backbone of Defi on the Solana blockchain. DeFi protocols across the Solana ecosystem were rushing to unplug from Serum after the post-bankruptcy hack at FTX. It was reported that the true power over Serum rested with FTX and SBF, which continue to hold the program update authority keys. This led the Solana community to move to create a new version of Serum that they could govern without influence from FTX.

The total value locked (TVL) on the Solana network has seen a 70% drop in November 2022 alone, reaching lows of $300 million from a $10 billion peak in November 2021. SOL is down more than 60% since the start of the month and the Coindesk article release.

In a previous article by SUN ZU Lab titled “What is Tokenomics and why does it matter?”, we interestingly took the Solana case study to highlight the importance of good governance practices that protect users. One of the main questions we left our readers to reflect upon was the following: Is it really that decentralized? – We now have our answer!

Winners:

There aren’t many winners from this situation, except maybe DEX’s, which are seeing an impressive peak in interest since FTX’s implosion. Uniswap, in particular, has risen to become the world’s second-largest venue for trading Ethereum, having recorded more than $1 billion in ETH trades in 24h, surpassing Coinbase (c. $0.6bn). Since the news that Binance was about to bail out FTX, DEXs around the crypto ecosystem saw $31 billion in trade volumes, with Uniswap alone accounting for $20 billion.

We want to highlight, however, that while DeFi’s “permissionless, trustless self-custody” ideology seems to be winning short term, we don’t bet a lot on new institutional money going directly into DeFi, mainly for KYC and AML reasons, among others.

How did crypto markets react to all this?

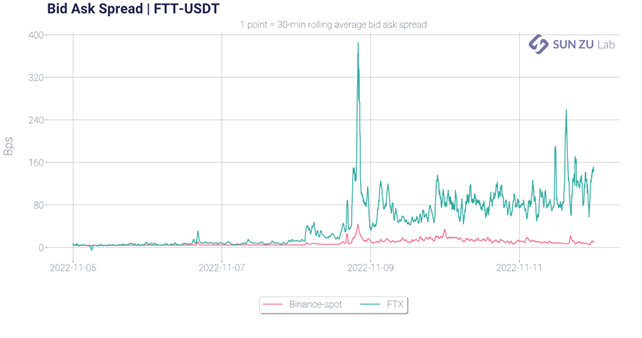

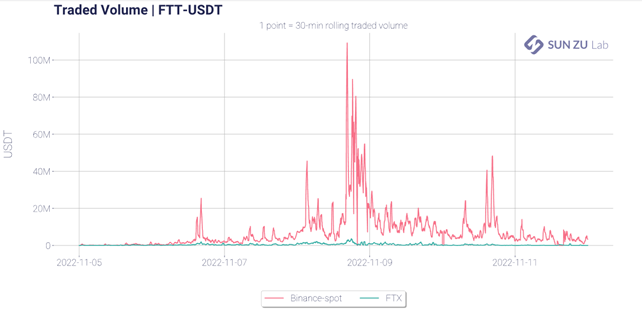

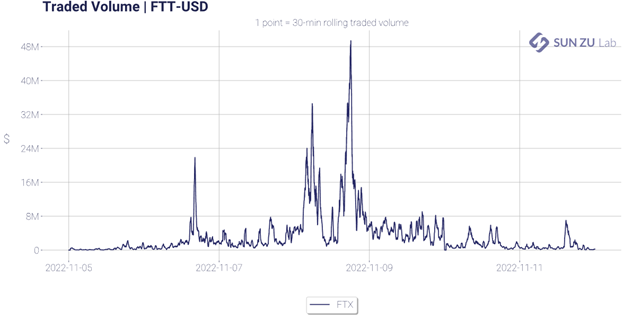

Whether we analyze crypto markets from a price, bid-ask spread or volume perspective, we see that the turning point in FTX’s downfall was the announcement of Binance’s non-binding offer to buy its rival (11/08/22 around 5 PM UTC). It was the first major event that worried the markets that something was off. FTT’s price dropped by more than 80% in the following hours, while bid-ask spreads on FTT briefly reached 400 bps.

Could we have seen this coming?

Yes! We have already voiced our opinions and concerns over crypto risk assessment in general and how crypto venues should be managed and audited in these previous articles: “Everything you’ve always wanted to ask your crypto exchange” and “Crypto Risk Assessment: Way to Go“. FTX was ranked among the top crypto exchanges, just days before its fall, by major industry players, non of which were able to underline the significant governance, operational or counterpart risks surrounding FTX and Alameda. We believe the crypto industry now has few shots “to get this right” after this spectacular failure.

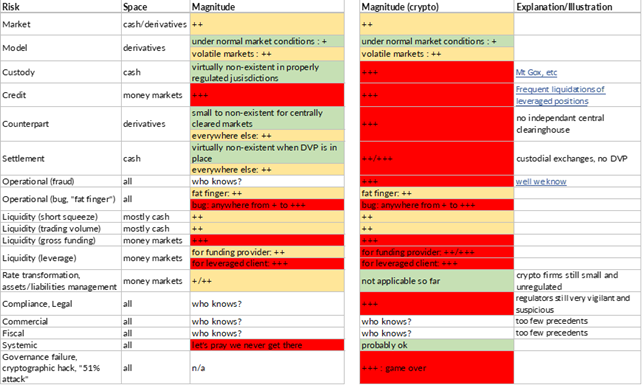

We put the emphasis again on this table from the Crypto Risk Assessment article, which summarizes, in our opinion, the significant risks that should be closely monitored and audited regarding crypto exchanges.

The magnitude scale is as follows (applied to capital at risk, whether it is a nominal amount for cash products or notional amounts for derivatives):

+ (very small to small): a fraction of a percent to a few percents

++ (medium to significant): a few percents to a few tens of percents

+++ (high to very high): up to 100% and beyond. The vital prognostic of the firm may be engaged

who knows? This one is exactly what it reads; possible losses range from trivial to life-threatening

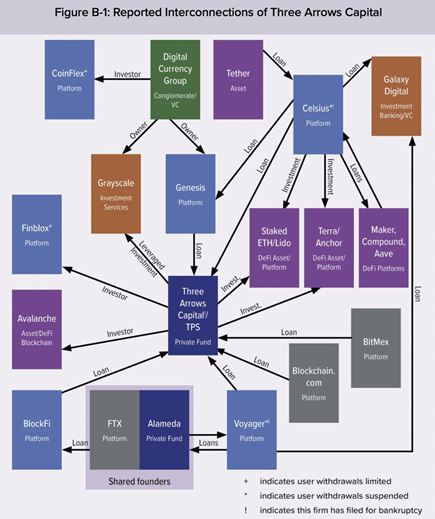

We also highlight this chart from the Financial Stability Oversight Council’s (FSOC) latest report, released in early October 2022. It highlights the major parties related to loans or investments made by 3AC, where we can see all the now-troubled actors following the explosion of the Terra ecosystem.

Where do we see things going from here?

For one thing, the FTX and Alameda implosion will hurt crypto liquidity badly. Alameda was one of the largest market makers in a space dominated by a handful of actors, among which we can cite Wintermute, B2C2 or Genesis. More disturbing, 56 market makers and fund managers reported FTX exposures of up to $500 million in an invite-only Telegram chat reviewed by TechCrunch.

As of November 24, the expanding list of FTX casualties now accounts for crypto-giants Genesis and Grayscale, BlockFi, Gemini, Multicoin and CoinHouse to cite a few. Genesis Global announced having lent around $2.8 billion to various crypto firms, including large loans to its parent company DCG. It confirmed that it had hired investment bank Moelis & Co to explore how to shore up its crypto-lending business’ liquidity and address clients’ needs days after halting withdrawals.

The bankruptcy procedure will surely be a long, drawn-out court case in which depositors will try to recoup their losses. But at which cost and after how many years?

FTX’s failure is unsurprisingly sparking a massive regulatory response, with several US state and federal agencies launching or expanding investigations into the company, including the DoJ, the SEC, the Securities Commission of the Bahamas and the Bahamas’ Financial Crimes Investigation Branch. More globally, crypto regulation in most markets has been slow to materialize. We see that changing in the wake of these recent events, with MiCA regulation in Europe heading for final approvals in 2023.

As this situation continues to evolve, we can’t yet draw final lessons and conclusions, except repeating our core message and belief at SUN ZU Lab: liquidity and transparency are core constituents to every efficient market worthy of the name. Remove one or both, and even “Too Big To Fail” giants start to shake.

We would be happy to hear your thoughts. You can address questions and comments to c.eladnani@sunzulab.com or research@sunzulab.com

About SUN ZU Lab

SUN ZU Lab is a leading data solutions provider based in Paris, on a mission to bring transparency to the global crypto ecosystem through independent quantitative analyses. We collect the most granular market data from major liquidity venues, analyze it, and deliver our solutions through real-time dashboard & API stream or customized reporting. SUN ZU Lab provides crypto professionals with actionable data to monitor the market and optimize investment decisions.