By Stéphane Reverre & Chadi El Adnani @SUN ZU Lab

August 2023

TL;DR

- History in TradFi shows concentration is inevitable. It is objectively not in investors’ interest to have such a high level of fragmentation among crypto trading venues;

- Liquidity attracts liquidity! losers will die a slow death;

- Regulatory pressure will (also) determine who lives and who dies;

- The race to zero on trading fees is already here.

It was October 2022 when we published an article titled “Why has liquidity become a question of survival for crypto venues?” urging centralized crypto exchanges to consider liquidity as the “gold standard” of their future profitability and deploy all necessary resources to monitor it and understand its drivers. Little did we know that one month later, the FTX/Alameda implosion would put the entire crypto ecosystem, and mostly centralized exchanges, on the brink of collapse.

Halfway through 2023, CEXs’ order book depths and trading volumes are ~10x thinner on average than 2022 levels, prompting us to express an even more aggressive view: “Why at least 80% of centralized crypto exchanges (CEXs) are going to disappear?” Liquidity attracts more liquidity in the same way success is a magnet for even more triumphs. Add to that the looming regulatory pressure, and the bottom majority of CEXs will start falling like a domino chain, with the losers dying slowly.

Questions and comments can be addressed to c.eladnani@sunzulab.com or research@sunzulab.com

In TradFi, capital markets have been all about scale. Whether in banking, asset management, hedge fund, or trading venues sectors, the bigger are getting bigger! M&A has been one of the most significant value drivers for TradFi exchanges over the last 20 years, allowing groups to generate significant economies of scale by mutualizing costs from data centers, matching engines, and employees. Here is a selected list of the major acquisitions of the century:

- NYSE merged with Archipelago Holdings (2006, $9 bn), creating the NYSE Group;

- NYSE Group and Euronext merged (2007, $10 bn) to form NYSE Euronext;

- Intercontinental Exchange (ICE) acquired NYSE Euronext (2013, $11 bn); Euronext spun off from ICE in a $1.2 bn IPO in 2014;

- Euronext acquired Borsa Italiana from the London Stock Exchange Group (LSEG) (2021, $5 bn).

Even though it is not exactly the same industry, The FDIC’s website provides additional valuable information on the evolution of the banking industry in the US. Between 1990 and 2022, the number of commercial banks insured with the FDIC went from 12,347 to 4,136, with the number of newly issued charters virtually near zero since 2008. As the retail and corporate segments increased significantly over the same period, the major remaining banks enjoyed the full benefits of consolidation and economies of scale with minimal efforts!

The list of exchanges’ failed M&A deals is even longer:

- Deutsche Boerse offered $1.6 bn for LSE before withdrawing its proposition in 2005;

- LSE rejected a $4 bn offer from Nasdaq in 2007;

- A merger between NYSE Euronext and Deutsche Borse failed in 2011;

- A merger between LSE and TMX Group died in 2011;

- Singapore Exchange terminated its $8 bn bid for Australia’s ASX after the Australian government formally rejected the offer;

- An attempted merger between Deutsche Boerse and the LSE was struck down by EU regulators in 2017;

- Hong Kong exchange dropped its $39 bn bid to buy the LSE in 2019.

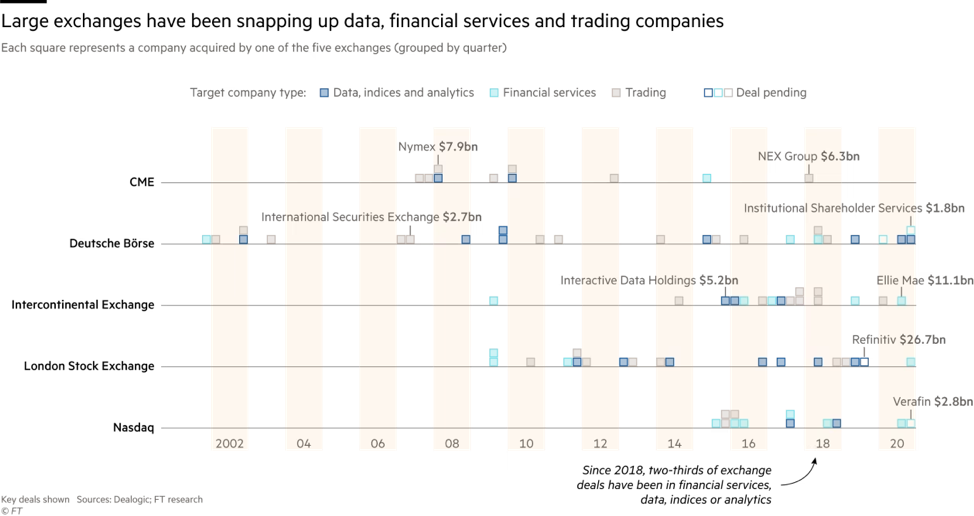

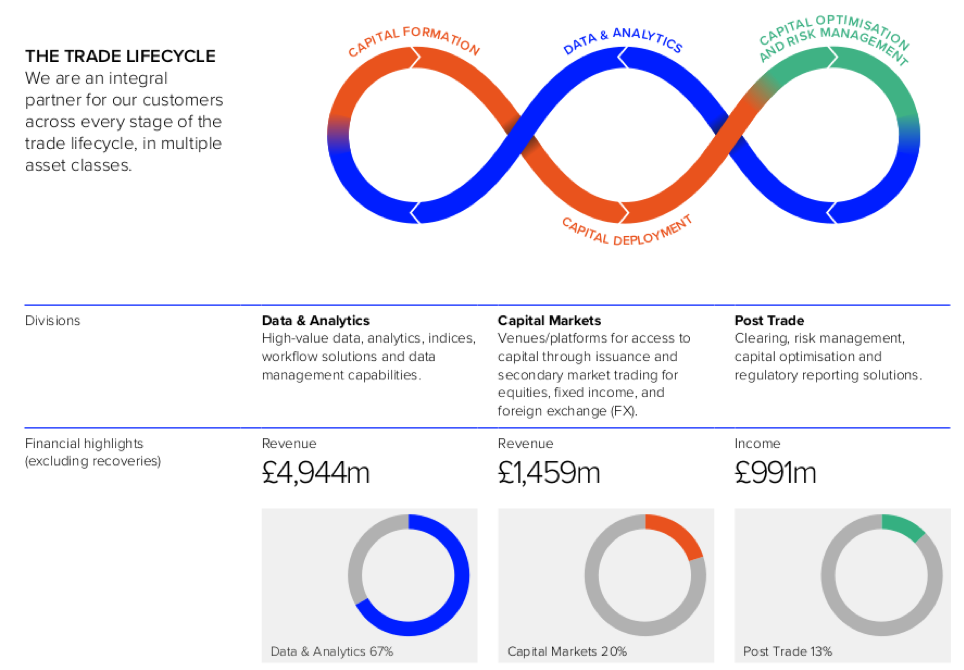

The remaining big five exchanges have also gone on an acquisition spree for data, analytics, indices, execution, settlement, and other infrastructure providers, as can be seen in the graph below, with the crown going to LSEG for its $27 bn acquisition of data and trading group Refinitiv, approved by EU regulators in 2021.

Overall, the exchange business in Tradfi has seen many agitations up to the 2000s. This was followed by an accelerated consolidation wave, leading to the current market state post-2008’s GFC (“Global Financial Crisis”), where there is virtually no room for another newcomer due to the heavy regulation and high cost of capital (unless through an acquisition). The exact cause having the same effects, we expect the same level of consolidation to happen over the next couple of years for centralized crypto exchanges. This trend should be accelerated with the recent rise of “institutional” crypto trading venues, the latest being the launch of EDX Markets, backed by Citadel Securities, Charles Schwab, & Fidelity. EDX will operate as a non-custodial exchange, serving only institutional clients with plans to launch EDX Clearing to settle trades matched on the exchange, a feature still absent from nearly all CEXs.

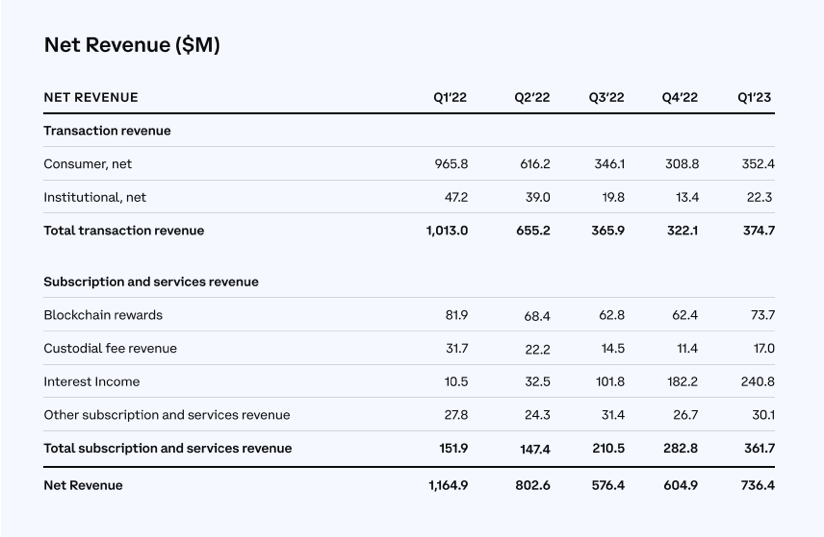

Coinbase, the first crypto exchange to go public, provides us with a valuable sneak peek into its financials through regulatory filings:

We can notice that, disregarding a slight uptick in Q1 23, transaction revenues have been free-falling since 2022, with total revenues divided by three over the period. However, revenues from subscriptions and other services more than doubled to $362 million. The compensation from diversification channels wasn’t enough to compensate for the loss from transaction revenues, as Net Revenue fell 37% YoY. Coinbase also introduced in May 2023 a new subscription service called “Coinbase One,” available for a monthly fee of $29.99 and providing a range of features that include zero trading fees, increased staking rewards, and round-the-clock customer support. The service was launched in the US, UK, Ireland, and Germany, with plans to extend its availability to 35 countries. Coinbase’s race and doubling down on revenue diversification is a strong distress signal for all other centralized crypto exchanges, which we are sure are in a far worse state than the leader Coinbase.

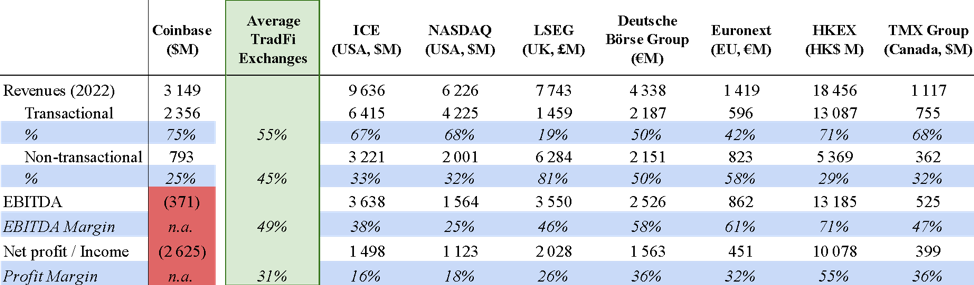

To put matters into perspective, here is a financial performance comparison in 2022 between Coinbase and the major TradFi exchanges around the world:

The proportion of non-transactional revenues for TradFi exchanges (45% on average) is way higher than Coinbase’s figure. TradFi exchanges are also impressive cash cows, with an average EBITDA margin of 49% and an average profit margin of 31%. The fact that the leader of crypto centralized exchanges is nowhere near these profitability levels is one major alarming sign for the whole sector. The only path to recovery is through revenue diversification, and one surprisingly unexplored gold mine is data monetization!

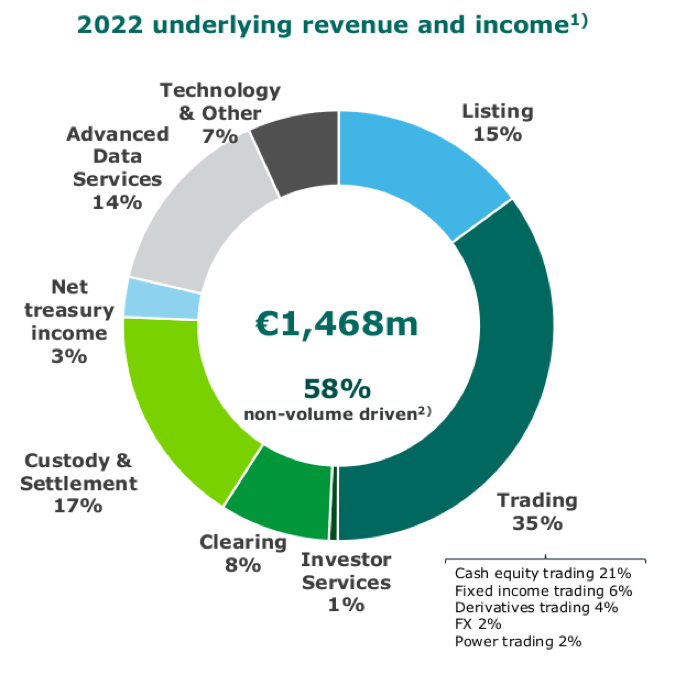

Below are two examples of how Euronext and LSEG diversify their revenue streams:

Centralized crypto venues should realize the magnitude of the problem and face the fact: if the market leader still hasn’t found a magic formula to profitability, maybe the solution isn’t different from what has been a major success in TradFi for years!

The path to recovery and survival, in our view, starts with asking the right questions:

- Do you know your client base?

- Do you know your liquidity patterns and those of your competitors?

- Do you know the strength and limits of your technology?

- Do you do what it takes to improve the quality of your data and monetize it?

A thorough internal process revue around the previous questions should give the first movers among CEXs the opportunity to:

- Adapt your marketing efforts to attract investors according to their trading patterns (retail, institutional, high frequency, etc.);

- Adapt your commission schedule to your clients’ trading patterns;

- Attract the structure and mandate of market makers on your platform;

- Diversify revenue: one natural resource still not explored by many CEXs is to make your market data valuable and find the business model to monetize it;

- Anticipate regulators’ questions about governance and manipulation;

- Position for industry concentration, as an acquirer or as a target. The few exchanges that make it through this harsh consolidation period will be profitable beyond their wildest dreams, but you must take action today!

We have been connected to 40+ major centralized crypto exchanges at SUN ZU Lab for years. Our cutting-edge technology and deep market microstructure expertise provide us with a sharp view of tick-level order book activity in these exchanges, most often giving us a better understanding of their trading dynamics than management teams lacking internal resources. We have the right combination to accompany a centralized crypto venue to answer the previous problems before it is too late!

Let’s discuss

About SUN ZU Lab:

SUN ZU Lab is a leading data solutions provider based in Paris, on a mission to bring better data to the global crypto ecosystem through independent quantitative analyses. We collect the most granular market data from major liquidity venues, analyze it, and deliver our solutions through real-time dashboards, API streams, and historical files. SUN ZU Lab provides crypto professionals with actionable data to monitor the market.