This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

What we do

We provide exchanges, liquidity venues, blockchains, asset managers and hedge funds with unprecedented quantitive analytics to help them:

Monitor Crypto Markets

Benchmark Trading Venues

Analyse

Liquidity

Save Money on Impact Costs

How we work

Data collection

Data analysis

Augmented analytics delivery

What you get

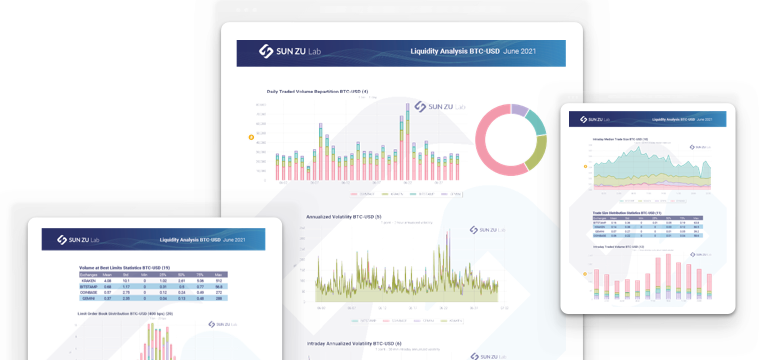

Access 100+ quantitative indicators on-demand

Liquidity

100+Indicators to assess the liquidity of digital asset tokens and portfolios

Volatility

- Spread Analysis

- Volume (traded/available)

- Venues Aggregated Data...

Execution

- Slippage Analysis

- Participation Ratio

- Optimal strategies...

Microstructure

- Limit Order Book Analysis

- Manipulation Detection

- Order Flow Modeling...

Market anomalies

- Global Arbitrage Monitoring

- Volume Anomalies

- Volatilities Anomalies...

Derivatives

- Open Interest

- Greeks

- Volatility Index...

Data delivery channels

Get comprehensive PDF, JSON, or CSV reports files designed according to your needs

Monitor your crypto on a bespoke platform

Our experts can help you in designing bespoke crypto projects

- Assess the robustness and resilience of your order book

- Benchmark the liquidity of your order book

- Assess the capacity of your trading strategy

- Assess the pre-trade depth of your execution

Get your indicators directly on your investment tools

-

Monitor your crypto on a bespoke platform

-

Monitor your crypto on a bespoke platform

-

Get your indicators directly on your investement tools

-

Our experts can help you in designing bespoke crypto projects

- Assess the robustness and resilience of your order book

- Benchmark the liquidity of your order book

- Assess the capacity of your trading strategy

- Assess the pre-trade depth of your execution

* Coming soon

Your benefits

Customizable dashboard

Value

added data