This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

WorldCoin: Crypto’s holy path to mass adoption or a dystopian nightmare?

By Chadi El Adnani @SUN ZU Lab

August 2023

Worldcoin, the new cryptocurrency project co-founded in 2019 by OpenAI CEO Sam Altman, Alex Blania, and Max Novendstern, went live on July 24th with a bold aim to conquer the world. Sam, the creator of widely popular chatbot ChatGPT is looking to sign-up billions of users globally to use its cutting-edge iris-scanning and identity-verifying technology, in an effort to help solve what many have called a problem he actively contributed to creating: halting Generative AI’s hellish pace rise. The coming tsunami of AI-generated fake news and content is not an if but a when matter; Vitalik Buterin, Ethereum’s co-founder, was very clear about all the potential risks and what could go wrong with biometric proof-of-personhood solutions. He also acknowledged, however, that the efforts of teams tackling the problem, such as WorldCoin, could be humanity’s best chance against AI.

Weeks after its international launch, Worldcoin is drawing the attention of privacy watchdogs all around the globe, with Kenyan authorities going so far as to suspend the project’s activities in the country. We cover in this article Worldcoin’s fundamentals and tokenomics, trying to analyze whether it is indeed crypto’s holy path to mass adoption or a dystopian nightmare!

Questions and comments can be addressed to c.eladnani@sunzulab.com or research@sunzulab.com

Description & Value proposition:

According to the project’s white paper, Worldcoin aims to create a “globally-inclusive identity and financial network” that has the potential to “increase economic opportunity, scale a reliable solution for distinguishing humans from AI online while preserving privacy, enable global democratic processes, and show a potential path to AI-funded UBI.”

Worldcoin uses custom biometric imaging devices that scan users’ irises for Proof of Personhood (POP), an identity verification mechanism that uses unique attributes of individuals for Sybil resistance (preventing individuals from creating multiple fake identities). The team notes that irises are data-rich and offer strong fraud resistance beyond other biometrics like thumbprints and facial recognition. Since commercially available iris imaging devices did not meet the team’s needs, the Worldcoin team built their custom hardware known as “Orbs.” Users can register and verify their accounts by visiting an Orb operator (currently ~330 Orbs active in the last 30 days) and having their irises scanned to pass the humanness and uniqueness checks. A unique IrisCode is calculated on the Orb, which then gets verified using ZK proofs, allowing users to access their self-custodial World App wallets.

Regarding user privacy, the Worldcoin team claims they only use the data for the uniqueness check and do not collect PII such as names, phone numbers, or emails. Using ZK proofs enables users to pass the uniqueness check while retaining anonymity. Biometric data is processed locally on the Orb and then deleted by default once the IrisCode is created. However, users can opt into data custody to back up their biometric data with Worldcoin to reduce the times they may need to revisit an Orb.

For the project’s rollout, the Worldcoin team focuses on markets in the developing world, which could serve as launchpads for more significant regions. WLD token is used to incentivize user signups and the development of its Orb network through third-party manufacturers and operators. Currently, World ID has ~2.2 million signups with verified World ID users from 120 countries; 2,000 Orbs have been manufactured, and ~28 million WLD tokens have been claimed by users. At the current price of ~$1.3, WLD has a Market Capitalization of ~$160 million and a Fully Diluted Valuation (FDV, taking into account the total supply) of ~$12.7 bn, which would make one of the most valuable token across the entire crypto market few weeks after its launch. “Tools for Humanity”, the technology company behind Worldcoin, announced in May that it has raised $115 million in series C funding led by Blockchain Capital. The round also saw participation from major crypto investors a16z, Bain Capital Crypto, and Distributed Global.

Worldcoin is built over three pillars:

- World ID: a privacy-preserving digital identity designed to help solve important, identity-based challenges, including proving an individual’s unique personhood.

- Worldcoin token (WLD): a token providing utility and giving users a say over the direction of the Worldcoin protocol. WLD is the first token to be globally and freely distributed to people just for being a unique individual.

- World App: an app that enables payment, purchases and transfers globally using digital assets and traditional currencies

The project’s mission (from the whitepaper):

The mission of the Worldcoin project is to build the world’s largest identity and financial network as a public utility, giving ownership to everyone. A key component of the project is the development of the infrastructure that will be important for a world where AI plays an increasingly important role.

The project’s goals regarding the WLD token are as follows:

- The majority of WLD tokens will be given to individuals – simply for being a unique human.

- The majority of humans who are alive today will receive WLD tokens, making WLD the most widely distributed digital currency.

- The WLD token, alongside World ID, will be used for protocol governance.

- The WLD token will form the foundation of the largest privacy-preserving identity and financial network.

Tokenomics:

Worldcoin (WLD) is an ERC-20 token on Ethereum Mainnet and individuals will receive their user grants on Optimism Mainnet. Therefore, most WLD transactions will likely take place on the Optimism network. If needed, the token can be bridged back to Ethereum through the Optimism bridge.

The tokenomics of Worldcoin is laid out on its whitepaper on the website:

- The initial supply cap is 10 bn WLD.

- The maximum circulating supply at launch is 143 million WLD (1.43% of initial total supply), 100 million of which were loaned to market makers outside the US.

- Inflation: Up to 1.5% per year. Inflation can start at the earliest after 15 years. Inflation rate is set by protocol governance. Default inflation rate = 0%.

- 75% of total supply is allocated to the “Worldcoin Community”, 13.5% to investors, and 9.8% to the initial development team.

- Investor and development team tokens are locked for 12 months after launch, then unlocked on a daily basis evenly over the next 24 months.

- Circulating supply denotes the total amount of WLD tokens that are freely circulating, meaning they do not have any specific transfer restrictions imposed upon them. Unlocked supply denotes the total amount of WLD tokens that are either part of the circulating supply or are unlocked but subject to the protocol’s governance discretion on their rate of release into the circulating supply.

The “Liquidity Provisioning” section adds more details:

“World Assets Ltd. (a subsidiary of the Worldcoin Foundation) has entered into loan agreements with five market makers operating outside of the US. The goal of engaging these entities is to ensure sufficient liquidity for WLD traded on centralized exchanges outside the US, to facilitate price discovery, and to enhance price stability of WLD.

Collectively, the five entities have received loans of 100M WLD for a time period of 3 months after token launch. At the end of the three months, each entity must return its loan or alternatively it may elect to purchase any amount of tokens up to the loan amount it has received. The price per WLD for this purchase will be set according to the following formula: $2.00 + ($0.04 * X), with X being equal to (i) the amount of tokens being purchased, divided by (ii) one million.”

Vitalik Buterin’s take on biometric proof of personhood and risks related to Worldcoin (link)

Ethereum co-founder Vitalik carefully assessed the pros and cons of the different approaches to proving proof-of-personhood, raising several concerns around the hardware, accessibility, privacy, and security.

He asks what the consequences might be if an “adversary can forcibly (or secretly) scan your iris and compute your iris hash themselves.” He raises the specter of AI bots fighting back with “3D-printed fake people” that could hoodwink biometric scanners. And he posits that a malicious actor could Sybil attack WorldCoin by paying low-wage people for their iris scans.

“What are the major issues with Worldcoin’s construction?

There are four major risks that immediately come to mind:

- Privacy. The registry of iris scans may reveal information. At the very least, if someone else scans your iris, they can check it against the database to determine whether or not you have a World ID. Potentially, iris scans might reveal more information.

- Accessibility. World IDs are not going to be reliably accessible unless there are so many Orbs that anyone in the world can easily get to one.

- Centralization. The Orb is a hardware device, and we have no way to verify that it was constructed correctly and does not have backdoors. Hence, even if the software layer is perfect and fully decentralized, the Worldcoin Foundation still has the ability to insert a backdoor into the system, letting it create arbitrarily many fake human identities.

- Security. Users’ phones could be hacked, users could be coerced into scanning their irises while showing a public key that belongs to someone else, and there is the possibility of 3D-printing “fake people” that can pass the iris scan and get World IDs.

It’s important to distinguish between (i) issues specific to choices made by Worldcoin, (ii) issues that any biometric proof of personhood will inevitably have, and (iii) issues that any proof of personhood in general will have. For example, signing up to Proof of Humanity means publishing your face on the internet. Joining a BrightID verification party doesn’t quite do that, but still exposes who you are to a lot of people. And joining Circles publicly exposes your social graph. Worldcoin is significantly better at preserving privacy than either of those. On the other hand, Worldcoin depends on specialized hardware, which opens up the challenge of trusting the orb manufacturers to have constructed the orbs correctly – a challenge which has no parallels in Proof of Humanity, BrightID or Circles. It’s even conceivable that in the future, someone other than Worldcoin will create a different specialized-hardware solution that has different tradeoffs.”

He concludes, however, that, despite “dystopian vibez,” a solution like WorldCoin could “do quite a decent job of protecting privacy.” And that, given the AI risk, it’s probably worth trying: “A world with no proof-of-personhood seems more likely to be a world dominated by centralized identity solutions, money, small closed communities, or some combination of all three.”

MIT Technology Review: Deception, exploited workers, and cash handouts: How Worldcoin recruited its first half a million test users (link)

An April 2022 MIT Technology Review article claimed that Worldcoin used “deceptive marketing practices, collected more personal data than it acknowledged, and failed to obtain meaningful informed consent.”

The blistering report chronicles a shoddy operation rife with misinformation, data lapses and malfunctioning orbs. “Our investigation revealed wide gaps between Worldcoin’s public messaging, which focused on protecting privacy, and what users experienced,” write Eileen Guo and Adi Renaldi. “We found that the company’s representatives used deceptive marketing practices, collected more personal data than it acknowledged, and failed to obtain meaningful informed consent.”

The company issued a 25-page rebuttal to MIT Technology Review’s criticisms.

“We want to make it very clear that Worldcoin is not a data company and our business model does not involve exploiting or selling personal user data,” it wrote. “Worldcoin is only interested in a user’s uniqueness—i.e., that they have not signed up for Worldcoin before—not their identity.”

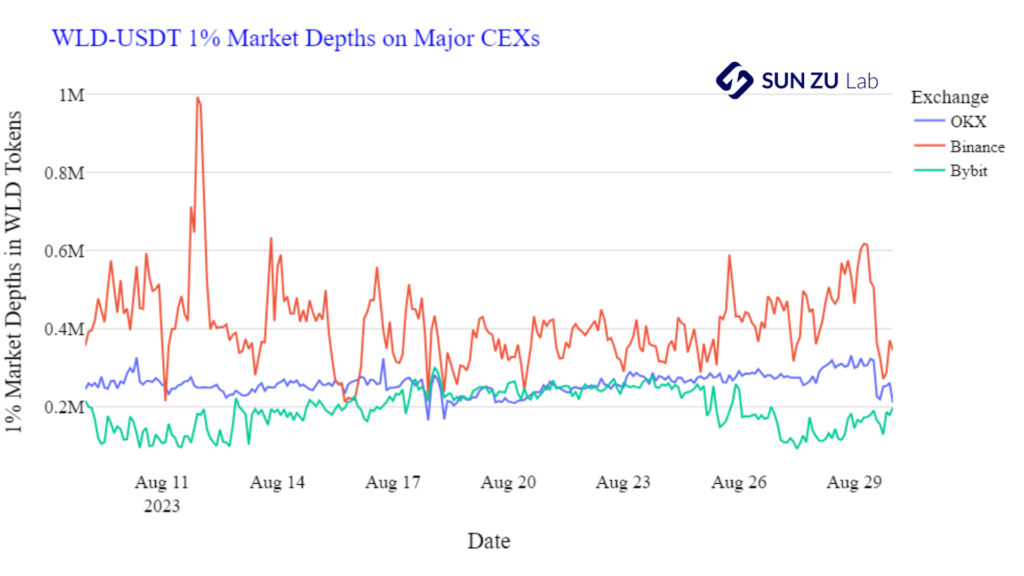

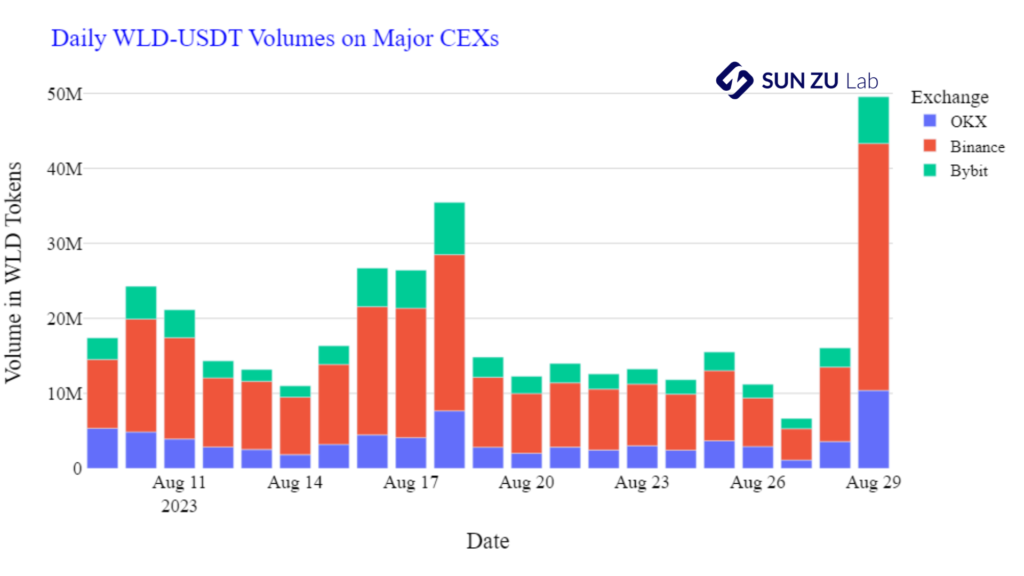

WLD Market Charts:

Source: SUN ZU Lab Data

Conclusion – SUN ZU Lab’s initial take on WorldCoin:

- Making only 1% of the total supply available for circulation initially and allocating it almost entirely (100 million tokens) to Market Makers is unusual and raises some questions. The 5 Market Makers are controlling WLD markets and liquidity at this early stage. The following clause from contracts with the MMs reveals why the price discovery process stabilized around $2 after the launch: “Collectively, the five entities have received loans of 100M WLD for a time period of 3 months after token launch. At the end of the three months, each entity must return its loan or alternatively it may elect to purchase any amount of tokens up to the loan amount it has received. The price per WLD for this purchase will be set according to the following formula: $2.00 + ($0.04 * X), with X being equal to (i) the amount of tokens being purchased, divided by (ii) one million.” The previous formula and the fact that 5 Market Makers control the entire WLD market mechanically sets a short-term floor price at $2 for WLD tokens and maintains the project’s impressive bloated FDV at ~$15-20 bn. (We covered Market Making practices in crypto vs TradFi in detail in this article). WLD’s price fell, however, below the $2 floor price over the last few days amid all the news around privacy concerns and a new wave of risk-averse sentiment sweeping through world markets. All things considered, WLD’s token launch and first trading days were one of the most organized in recent major token launches, and WLD’s cross-exchange mid-price spread remains highly tight, as can be seen from the chart above, mainly due to Market Makers’ high activity around the token.

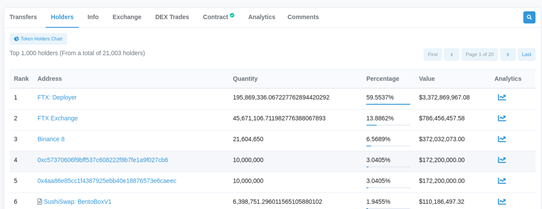

- Another point of contention is the token distribution, with the core team controlling 25% of the total allocation. This allocation, combined with the project’s low circulating supply and comparatively high fully diluted valuation (FDV) has led to concerns among experts. Additionally, questions have been raised regarding market making activity on the token, although no concrete evidence of malpractice has yet been presented. I am not comparing Sam Altman in any way to SBF! But experts and critics quickly made parallels between how the Worldcoin team set the tokenomics for WLD and how SBF used to manage some of his investments, known as “Sam coins”, including Serum, Raydium and FTT. We covered the principle of a flywheel mechanism in this previous article.

- Worldcoin has also been criticized for widely promoting the platform in the developing world. Many new users are in Asia and Africa, raising concerns about exploitation. “Most alarming to me is how the WorldCoin team has boasted about how many users they have. When in reality they have been exploiting people in developing countries,” tweeted pseudonymous crypto influencer ZachXBT. The bulk of user adoption seems to be driven by the financial incentive of receiving 25 WLD tokens upon sign-up (with a ~$35 value at today’s price). Although it is a small amount by occidental standards, $35-50 is reason enough for citizens in developing countries to take hours-long queues to scan their irises!

- Some of the above worries around privacy and protection of users’ personal data have already started to materialize as identity black markets have emerged, raising questions about the system’s overall security. Moreover, the low number of token holders at ~6k (source: Etherscan) has raised concerns about the accessibility of the project, particularly when contrasted with the reported millions of signups.

- There’s a lot at stake here with Worldcoin. Overall, Worldcoin’s launch represents a groundbreaking endeavor to solve the complex problem of digital human identity verification, but feedback from the crypto community so far has been resoundingly negative. Many critics voiced ethical concerns over the potential for data mismanagement and privacy leaks for sensitive iris biometrics. While we should not overlook the concerns and risks outlined by experts and the community, they do not necessarily foretell failure for the project. Many of these concerns primarily relate to the project’s implementation or are based on hypothetical future dystopian scenarios that assume the technology will be abused. However, they underscore the need for Worldcoin to address and resolve these concerns to fulfill its potential proactively. But in case of success, the project has the potential to bridge the entire human race in a way only Facebook got close to achieving at one point, transforming the way humans interact with blockchains and unlocking significant wealth for all of humanity.

About SUN ZU Lab:

SUN ZU Lab is a leading data solutions provider based in Paris, on a mission to bring better data to the global crypto ecosystem through independent quantitative analyses. We collect the most granular market data from major liquidity venues, analyze it, and deliver our solutions through real-time dashboards, API streams, and historical files. SUN ZU Lab provides crypto professionals with actionable data to monitor the market.

FTX Post-Mortem Analysis – Why Transparency Matters?

By Chadi El Adnani @SUN ZU Lab

November 2022

“In the midst of chaos, there is also opportunity”

Sun Tzu – 500 BC

This quote by our spiritual father, Sun Tzu, has never been more true in the crypto ecosystem as we all battle to survive the most significant blow ever to the nascent industry. FTX’s bankruptcy was described as crypto’s Lehman Brothers moment, or as more evidence came to light, more “Enron” than “Lehman” moment. Trying to cover this story as it unfolded before our shocked eyes was like trying to catch a bullet bare-handed. This article provides a preliminary post-mortem analysis of where the situation stands today. Unfortunately, we sincerely believe that we have only seen the tip of the iceberg, and we brace for many more casualties to be affected in the near future. We have already covered in SUN ZU Lab’s weekly insights (here & here) the story’s timeline and the significant headlines surrounding it. We will therefore move directly into a more technical analysis.

As a reminder, FTX and Alameda Research constituted the bulk of ex-crypto billionaire Sam Bankman-Fried’s empire. The former being the exchange arm and the latter being the trading firm.

Understand the man to understand his actions:

Sam Bankman-Fried (SBF) had a reputation for being very smart and a highly talented trader. However, as more revelations come to light, we are convinced now that his supposedly spectacular trading returns (as well as some of his peers) were mainly driven by 2020 and 2021’s bull run. His crypto empire’s implosion is due instead to his betting big philosophy! A leveraging strategy mainly fueled FTX and Alameda’s stratospheric rise in the last two years via deceptive fundraises and financial engineering before eventually using plain fraud, as was revealed by the preliminary investigation.

In this Twitter thread, we get an interesting glimpse of SBF’s motives behind creating FTX; he explains, among others, that he was deeply frustrated by two things in the way other crypto exchanges operated. Contrary to TradFi, where an exchange focuses on managing its order book matching engine, leaving margin handling to the clearing house, a crypto exchange has to handle both responsibilities. He was therefore losing millions from what he called “socialized losses”, where the collectivity ends up paying the losses of a liquidated negative account. The second reason was that he viewed BTC’s price as being hit every time it suffered selling pressure from a cascade of liquidated accounts, which wasn’t fair from his point of view.

He initially addressed white papers proposing new ways of functioning to other exchanges before creating FTX as a new crypto derivatives exchange where, we cite: “The entire margin system is reworked to a way almost no exchanges in crypto work. We can take huge size & also have lots of leverage & have a solid blocker against ever having clawbacks.”

A trending video of Alameda’s CEO Caroline Ellison resurfaced where she was saying: “Being comfortable with risk is very important. We tend not to have things like stop-losses, I think those aren’t necessarily a great risk-management tool. I’m trying to think of a good example of a trade where I’ve lost a ton of money … well, I don’t know, I probably don’t want to go into specifics too much.”

We can see a recipe for disaster starting to take form.

A complicated SBF-Ellison / FTX-Alameda love story

Alameda Research and FTX were supposed to be entirely separate entities in theory. We instead learn that Alameda’s CEO Caroline Ellison has dated at times SBF. More shockingly, several top execs from FTX and Alameda lived in the same luxury penthouse in the Bahamas, where Ellison was rumoured to have access to FTX screens showing client trades. A recent Wall Street Journal report indicates that Alameda was frontrunning FTX token listings. Between the start of 2021 and March 2022, the trading firm held $60 million worth of 18 different tokens that were eventually listed on FTX.

This intimacy could also explain why SBF later allowed customer funds to be used to pay for Alameda’s loans, building a software backdoor to outwit FTX compliance systems.

FTX and Alameda’s Balance Sheets were bad, very bad!

The massive bank run suffered between November 6 and 11 drove FTX and Alameda eventually to the ground, and the word bank is chosen wisely as it appears FTX was more a bank than an exchange! They suffered as much as $6 billion of withdrawals in the final 72 hours, except they didn’t have customers’ money as FTX had loaned it to Alameda, which used it to make venture capital investments!!

Let us stop a moment on the last revelation. Every first-year finance student could tell you to never, never use extra-short-term liabilities (client funds, with a theoretical maturity of 0) to finance the riskiest and most illiquid investment in the spectrum (VC investments, with an expected maturity higher than ten years).

Ellison explains in an interview with the New York Times that lenders moved to recall their loans around the time the crypto market crashed this spring. But as the funds that Alameda had spent were no longer easily available, the company used FTX customer funds in an emergency procedure to make the payments.

Let’s go back first to where troubles began to appear. Anyone remotely familiar with the hedge fund space knows that the financials (P&L and Balance Sheet, among others) are protected at all costs. The fact that Coindesk managed to put their hands on that “secret sauce” leaves a place for a plethora of conspiracy theories. We refrain from venturing into that territory.

On November 2, CoinDesk published an article highlighting the following facts from a private document they reviewed:

- As of June 30, 2022, Alameda’s assets amounted to $14.6 billion. Its single most significant asset was a $3.7 billion pile of “unlocked FTT” and $2.2 billion of “FTT collateral”.

- Its c. $8 billion of liabilities are dominated by $7.4 billion of loans, but we also find $292 million of “locked FTT”.

To put things into perspective, this puts a total of $5.8 billion in FTT tokens on Alameda’s balance sheet as of June 30. The market capitalization of circulating FTT was around $3.3 billion that day. Indeed, a quick look at FTT’s page on Etherscan shows that over 74% of the token’s total supply is held by two addresses belonging to FTX and Alameda.

This partial information meant that most of Alameda’s net equity was comprised of FTT tokens, printed out of “thin air” by its sister company FTX.

In a volatile and fragile global crypto environment, rumours were quickly forming about how SBF could be just another flywheel / Ponzi scheme magician! Here is what we mean by a flywheel scheme in crypto:

- Create a token

- Artificially pump its price (wash trading through a market maker)

- Mark the artificial gains in the balance sheet

- lure the community and investors with “realized” gains

- Raise capital through equity sales, ICOs or loans

- the hype continues to fuel the token’s price, and the loop continues!

The fears were extreme, especially since the Celsius bankruptcy and the CEL token explosion still haunt most of us. Celsius was a multi-billion dollar crypto lending firm, or Ponzi scheme, which was destroyed in part by its own token, CEL!

As it appears, this is exactly what SBF was doing with some of his investments, known as “Sam coins”, including Serum, Raydium and FTT.

The way it would work with our exchange/trading firm duo is that Alameda would fund a project at a $50 million fully diluted valuation (considering the total number of tokens to be issued) with $5 million, for example. FTX would then list the token on its exchange, releasing only a tiny fraction of the total tokens to the market. Given the illiquidity of this token, Alameda could easily deploy a few millions to artificially inflate the fully diluted valuation 100x, increasing the stake’s value on its books to $500 million. This inflated figure is then used as collateral for borrowing purposes.

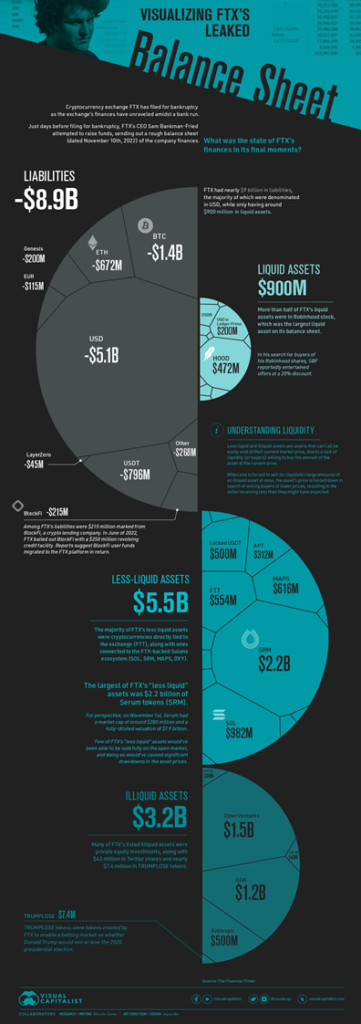

The Financial Times shared a copy of an FTX balance sheet dated November 10, shared with prospective investors one day before the company filed for bankruptcy.

Here is a visualization of this balance sheet provided by Visual Capitalist:

We fell from our seats when we first saw this balance sheet! And we wouldn’t put it better than Bloomberg’s Matt Levine:

“It’s an Excel file full of the howling of ghosts and the shrieking of tortured souls. If you look too long at that spreadsheet, you will go insane.”

Citing the FT, we learn that “A spreadsheet listing FTX international’s assets and liabilities, seen by the Financial Times, point at the issues that brought Bankman-Fried crashing back down to earth. It references $5bn of withdrawals last Sunday, and a negative $8bn entry described as “hidden, poorly internally labled ‘fiat@’ account”.

“Bankman-Fried told the Financial Times the $8bn related to funds “accidentally” extended to his trading firm, Alameda, but declined to comment further.”

When we look at the “less-liquid assets” category, the most considerable number is $2.2 billion of SRM, the Serum DEX native token (we will talk later about Serum). This is a clear example of the flywheel scheme described above in the article. As of November 17, CoinMarketCap shows a $70 million market cap for SRM (market cap of circulating tokens) against a $2.7 billion fully diluted market cap (theoretical figure taking into account the token’s max supply). The FTX team are basing their $2.2 billion valuation on an impossible illiquid scenario.

Okay, but one big question remains: how did they manage to burn through more than $10-15 billion of “realized” profits?

In our eyes, the bad VC investments and mishandling of client funds don’t explain alone the $8 billion hole in the balance sheet, especially when taking into account FTX and Alameda’s extremely profitable history due to high trading fees and lucrative venture deals. The only plausible explanation we see is that Alameda was bleeding money for a long time in 2022’s harsh bear market and possibly long before that, slowly decaying from its market-neutral market-making strategies into taking losing directional bets.

This seems to be exactly what we learned from a recent motion filed in the Delaware district court handling the bankruptcy procedure. The entities’ 2021 tax returns collectively showed a net operating loss carryover of $3.7 billion, meaning that the main entities (FTX & Alameda) had posted that much in losses since their inception. This completely contradicts the image SBF was circulating of his businesses and is quite shocking when considering that several competing crypto exchanges and trading firms, such as Wintermute or Coinbase, have realized significant gains over 2020 and 2021’s roaring crypto bull runs!

We end this paragraph on the wise words of newly appointed FTX CEO John Ray III: “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.”

The biggest winners & losers:

Losers:

It is tough to choose one big loser from the FTX fiasco. There is obviously SBF himself, whose net fortune went from $26 billion at its peak to less than $1 billion. FTX employees are set to lose big, having most of their wealth linked to the exchange. VC and institutional investors have bet big on the disgraced young prodigy: between 2021 and 2022, SBF raised more than $1.5 billion from esteemed investors such as SoftBank, Sequoia Capital, Temasek, Tiger Global Management, Paradigm or the Ontario Teachers’ Pension Plan. Without forgetting the more than a million creditors still waiting to see how this insolvency will be unpicked. It was typically revealed in a court filing that FTX owes almost $3.1 billion to its top 50 creditors.

We want to focus on the Solana ecosystem as one major casualty. The Solana Foundation declared days after the bankruptcy that it held 134.54m SRM tokens and 3.43m FTT tokens on FTX when withdrawals went dark on November 6. Those assets were worth around $107m and $83m one day before the freeze. It also held a 3.2 million common stock ownership in FTX.

As we can see, Solana and FTX maintained deep financial ties. The problem gets bigger when considering Serum, a DEX created by SBF and at the centre of much of Solana-based DeFi. SBF even went on to call Serum the “truly, fully trustless” backbone of Defi on the Solana blockchain. DeFi protocols across the Solana ecosystem were rushing to unplug from Serum after the post-bankruptcy hack at FTX. It was reported that the true power over Serum rested with FTX and SBF, which continue to hold the program update authority keys. This led the Solana community to move to create a new version of Serum that they could govern without influence from FTX.

The total value locked (TVL) on the Solana network has seen a 70% drop in November 2022 alone, reaching lows of $300 million from a $10 billion peak in November 2021. SOL is down more than 60% since the start of the month and the Coindesk article release.

In a previous article by SUN ZU Lab titled “What is Tokenomics and why does it matter?”, we interestingly took the Solana case study to highlight the importance of good governance practices that protect users. One of the main questions we left our readers to reflect upon was the following: Is it really that decentralized? – We now have our answer!

Winners:

There aren’t many winners from this situation, except maybe DEX’s, which are seeing an impressive peak in interest since FTX’s implosion. Uniswap, in particular, has risen to become the world’s second-largest venue for trading Ethereum, having recorded more than $1 billion in ETH trades in 24h, surpassing Coinbase (c. $0.6bn). Since the news that Binance was about to bail out FTX, DEXs around the crypto ecosystem saw $31 billion in trade volumes, with Uniswap alone accounting for $20 billion.

We want to highlight, however, that while DeFi’s “permissionless, trustless self-custody” ideology seems to be winning short term, we don’t bet a lot on new institutional money going directly into DeFi, mainly for KYC and AML reasons, among others.

How did crypto markets react to all this?

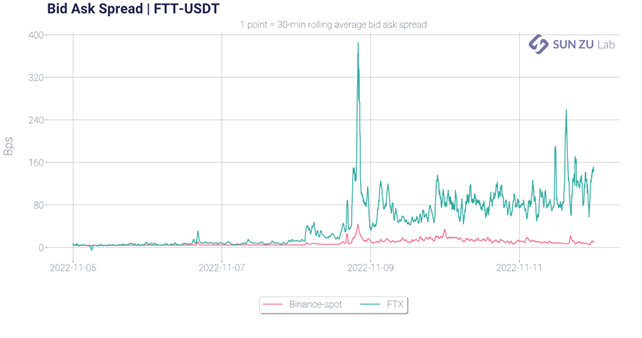

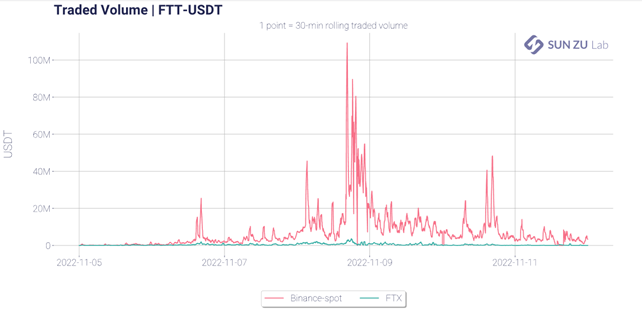

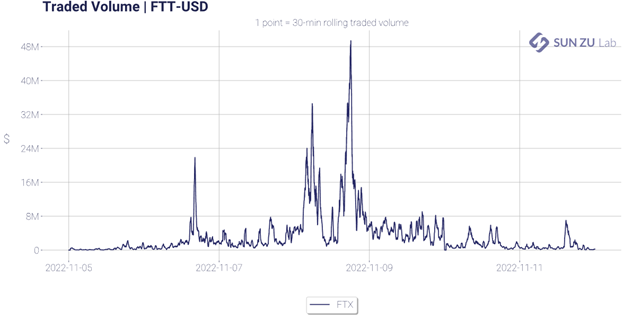

Whether we analyze crypto markets from a price, bid-ask spread or volume perspective, we see that the turning point in FTX’s downfall was the announcement of Binance’s non-binding offer to buy its rival (11/08/22 around 5 PM UTC). It was the first major event that worried the markets that something was off. FTT’s price dropped by more than 80% in the following hours, while bid-ask spreads on FTT briefly reached 400 bps.

Could we have seen this coming?

Yes! We have already voiced our opinions and concerns over crypto risk assessment in general and how crypto venues should be managed and audited in these previous articles: “Everything you’ve always wanted to ask your crypto exchange” and “Crypto Risk Assessment: Way to Go“. FTX was ranked among the top crypto exchanges, just days before its fall, by major industry players, non of which were able to underline the significant governance, operational or counterpart risks surrounding FTX and Alameda. We believe the crypto industry now has few shots “to get this right” after this spectacular failure.

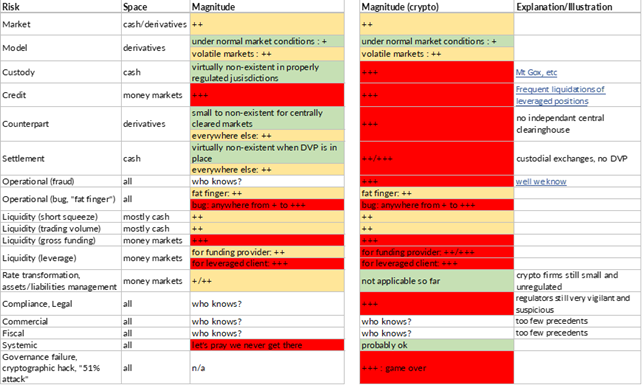

We put the emphasis again on this table from the Crypto Risk Assessment article, which summarizes, in our opinion, the significant risks that should be closely monitored and audited regarding crypto exchanges.

The magnitude scale is as follows (applied to capital at risk, whether it is a nominal amount for cash products or notional amounts for derivatives):

+ (very small to small): a fraction of a percent to a few percents

++ (medium to significant): a few percents to a few tens of percents

+++ (high to very high): up to 100% and beyond. The vital prognostic of the firm may be engaged

who knows? This one is exactly what it reads; possible losses range from trivial to life-threatening

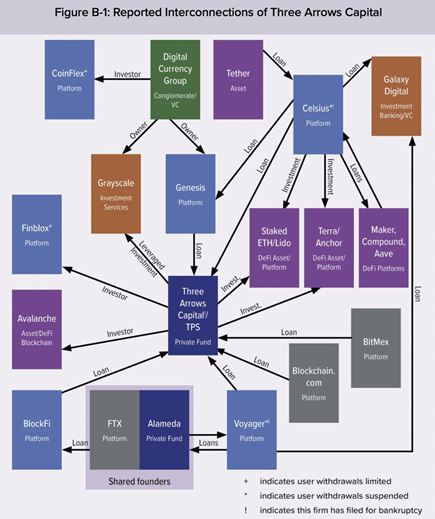

We also highlight this chart from the Financial Stability Oversight Council’s (FSOC) latest report, released in early October 2022. It highlights the major parties related to loans or investments made by 3AC, where we can see all the now-troubled actors following the explosion of the Terra ecosystem.

Where do we see things going from here?

For one thing, the FTX and Alameda implosion will hurt crypto liquidity badly. Alameda was one of the largest market makers in a space dominated by a handful of actors, among which we can cite Wintermute, B2C2 or Genesis. More disturbing, 56 market makers and fund managers reported FTX exposures of up to $500 million in an invite-only Telegram chat reviewed by TechCrunch.

As of November 24, the expanding list of FTX casualties now accounts for crypto-giants Genesis and Grayscale, BlockFi, Gemini, Multicoin and CoinHouse to cite a few. Genesis Global announced having lent around $2.8 billion to various crypto firms, including large loans to its parent company DCG. It confirmed that it had hired investment bank Moelis & Co to explore how to shore up its crypto-lending business’ liquidity and address clients’ needs days after halting withdrawals.

The bankruptcy procedure will surely be a long, drawn-out court case in which depositors will try to recoup their losses. But at which cost and after how many years?

FTX’s failure is unsurprisingly sparking a massive regulatory response, with several US state and federal agencies launching or expanding investigations into the company, including the DoJ, the SEC, the Securities Commission of the Bahamas and the Bahamas’ Financial Crimes Investigation Branch. More globally, crypto regulation in most markets has been slow to materialize. We see that changing in the wake of these recent events, with MiCA regulation in Europe heading for final approvals in 2023.

As this situation continues to evolve, we can’t yet draw final lessons and conclusions, except repeating our core message and belief at SUN ZU Lab: liquidity and transparency are core constituents to every efficient market worthy of the name. Remove one or both, and even “Too Big To Fail” giants start to shake.

We would be happy to hear your thoughts. You can address questions and comments to c.eladnani@sunzulab.com or research@sunzulab.com

About SUN ZU Lab

SUN ZU Lab is a leading data solutions provider based in Paris, on a mission to bring transparency to the global crypto ecosystem through independent quantitative analyses. We collect the most granular market data from major liquidity venues, analyze it, and deliver our solutions through real-time dashboard & API stream or customized reporting. SUN ZU Lab provides crypto professionals with actionable data to monitor the market and optimize investment decisions.

What is Tokenomics and why does it matter?

A brief historical perspective to better understand the stakes behind tokenomics

Let’s start this article with the famous experience of Philip II, King of Spain in the 16th century, with the Eldorado discovery and the massive rise in inflation that followed throughout the entirety of Europe!

In the 16th century, Spain conquered Latin America and discovered an immeasurable wealth within gold and silver mines. The kingdom hit the jackpot, and its financial deficits appeared long behind it. Nevertheless, this wasn’t the case; the problem came from the Crown of Spain being over-indebted to many European creditors, leading the massive silver and gold discoveries to only make a quick passage through Spain before enriching the coffers of its French and Dutch neighbors. The European market ended up flooded with coins, so the immense Spanish wealth was diminished relative to other European kingdoms.

In the end, the excessive amount of silver and gold imported, and above all distributed, in Europe caused a substantial devaluation of what Philip II could think of as his Eldorado. A better financial management could have allowed him to preserve his reserves of invaluable minerals and thus be able to develop on a more critical scale of time his fabulous treasure.

This story shows the importance of the quantity put into circulation on the valuation of an asset. This analysis works perfectly for the cryptocurrency market as well; any analysis of an asset’s ecosystem requires careful attention to the notions of quantity in circulation, total quantity, and inflation management.

Inflation and the importance of tokenomics

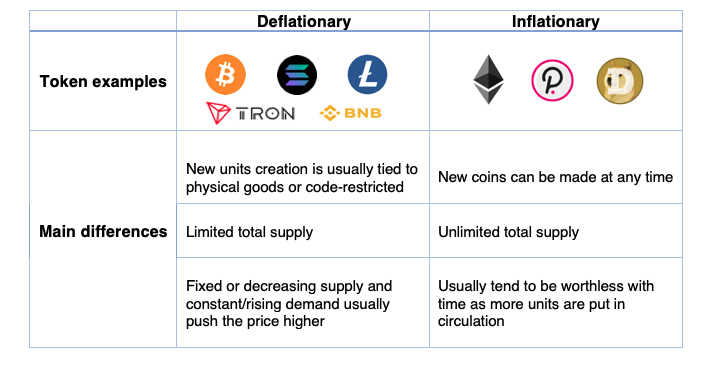

While the media usually describes inflation as a rise in the price of everyday consumer goods, it is, in reality, the value of money that tends to fall rather than prices getting higher. This notion of inflation is at the heart of tokenomics, a merger of “token” and “economics” used to refer to all the elements that make a particular cryptocurrency valuable and exciting to investors. In this regard, two predominant models exist: deflationary and inflationary tokens.

- The limited quantity deflationary model:

This is the model Bitcoin uses, i.e. a fixed total supply and less and less money issued over time. Many cryptocurrencies are governed under this model, like Solana, Litecoin, Tron, and many others, alongside the king of cryptos.

In the case of Bitcoin, for example, a block is mined about every 10 minutes, rewarding the miner 6.25 BTC (when Bitcoin started, it was 50 BTC per block, then 25, 12.5, 6.25, etc). The reward is halved every 210K blocks, leading to a halving every 4 years with the 10 minutes mining-time per block assumption. Without changes to the protocol, the final Bitcoin will be mined around the year 2140.

- The balanced inflation model:

Many blockchains have been coded without incorporating a limited amount of token issuance. This choice can be made for a variety of reasons, usually involving the use to be made of the blockchain in question. The Ethereum protocol, for example, operates under this model. However, some mechanisms are put in place to limit inflation or even to create a deflationary system.

This is the objective of implementing future updates of the Ethereum network. While the annual rate of ETH token issuance is currently equal to nearly 4.5%, the switch from Proof of Work to Proof of Stake should allow developers to reduce this rate to less than 1%. The network also introduced a burn mechanism, meaning that part of the fees paid by Ethereum users in the future will not be returned to validators, but will be removed altogether. This could not only achieve a balance with the issuance rate, but potentially lead to a decrease in the number of tokens in circulation in case of high network usage.

Both models have strengths and weaknesses, with reasonable justifications behind their use. For example, the Ethereum white paper indicates that a stable issuance rate would prevent the excessive concentration of wealth in the hands of a few actors/validators. Whereas Bitcoin’s deflationary system, as previously stated, allowed for the growing development of its ecosystem by paying miners large amounts of Bitcoin when it was not worth the tens of thousands of dollars it is worth today.

More generally, looking into a project’s tokenomics before getting involved is always a good idea. This can help answer questions like:

- What is the current token supply as well as total supply?

- Does the token have an inflationary or deflationary model?

- What is the real-world use case?

- Who owns the majority of coins? Is it well spread out or concentrated?

Main differences between deflationary and inflationary tokens:

Solana case study

Let’s take a deep dive into one of the most prominent blockchains’ tokenomics. Solana has a native token called SOL that has two primary use cases within the network:

- Staking: users can stake their SOL either directly on the network or delegate their holding to an active validator to help secure the network. In return, stakers will receive inflation rewards.

- Transaction Fees: users can use SOL to pay fees related to transaction processing or running smart contracts.

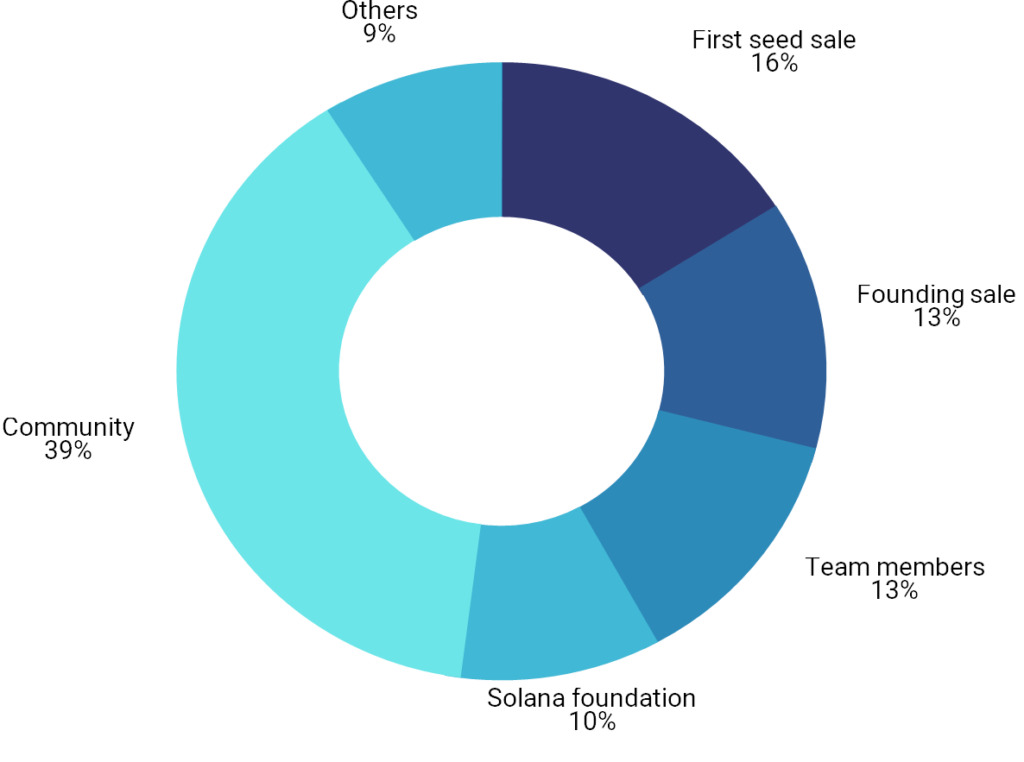

The Solana team distributed tokens in five different funding rounds, four of which were private sales. These private sales began in Q1 2019 and culminated in a $20 million Series A led by Multicoin Capital, announced in July 2019. Additional participants included Distributed Global, BlockTower Capital, Foundation Capital, Blockchange VC, Slow Ventures, NEO Global Capital, Passport Capital, and Rockaway Ventures. The firms received SOL tokens in exchange for their investments, although the number of tokens allocated to investors was not disclosed.

The initial distribution of SOL tokens was as follows:

According to Messari data, vesting schedules were as follows: Solana’s three pre-launch private sales all came with a nine-month lockup after the network launched. The project’s public auction sale (held in March 2020) did not come with a lockup schedule, and the SOL tokens distributed in that sale were fully liquid once the network launched. The founder’s allocation (13% of the initial supply) was also subject to a nine-month lockup post-network launch. After the lockup period ends, these tokens will vest monthly for another two years (expected to fully vest by January 2023). This last clause is a good protection for investors as team members’ tokens are locked-up for a longer period. The Grant Pool and Community Reserve (both overseen by the Solana Foundation) contain ~39% of the initial SOL supply combined. These allocations began to vest in small amounts since Solana’s mainnet launch.

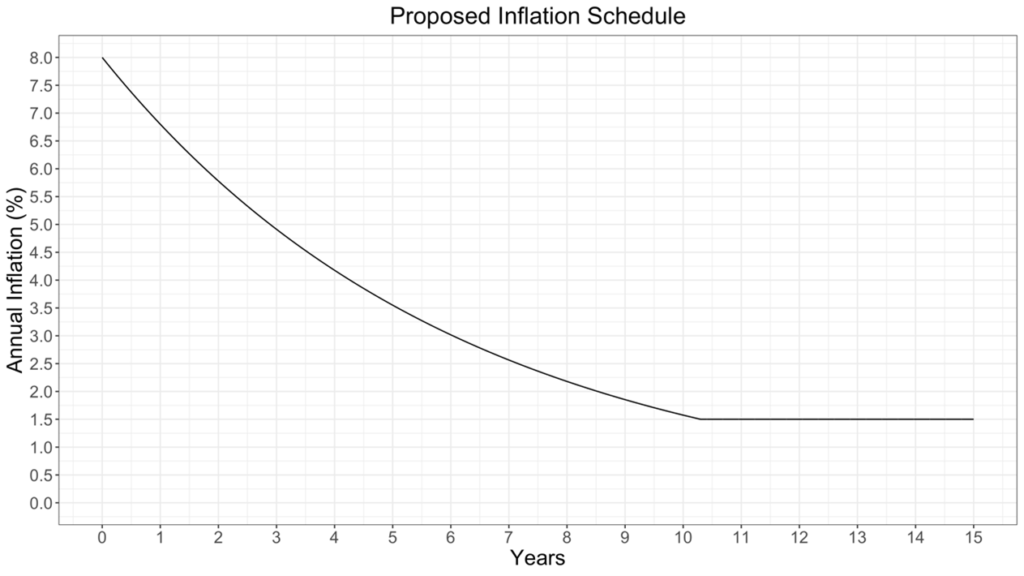

Inflation stands at an initial annual inflation rate of 8%. However, this inflation rate will decrease at an annual rate of 15% (“dis-inflation rate”). The inflation decrease is thus non-linear and much more important in the first years. Solana’s inflation rate will continue to decrease until it reaches an annual rate of 1.5%, which the network should reach in about ten years or 2031. 1.5% will remain the long-term inflation rate for Solana unless the network’s governance system votes to change it.

Major identified issues with current projects’ tokenomics

- Is it really that decentralised?

Using the Solana example, we can see that more than 50% of the tokens in circulation are concentrated, during a long period after the project’s launch, in the hands of the core team, VCs and early investors. This is hardly an exception to Solana as similar distributions are very common within the blockchain ecosystem projects. Can we talk seriously about the benefits of blockchain decentralization with such capital and governance concentration, without forgetting technical knowledge concentration as well?

- What happens after the end of the lock-up period?

Blockchain projects often come with varying lock-up periods that can last from less than a year to five years for early investors and the founding team, who usually cash out their investments after this period. What we identify as a significant issue after the end of the lock-up period is the huge and asymmetric risk-return transfer between this first group, which realized a pretty good return on their initial investments and are completely de-risked at this stage, and retail investors joining the project at a stage where core decision-makers are no longer incentivised to ensure the well-functioning of the project.

- What rights for token investors?

Cryptocurrency projects often use ICOs (Initial Coin Offering), among other fundraising techniques, to raise funds through the issue of crypto-assets in exchange for either fiat currency or an established cryptocurrency like bitcoin or ether. The issuing entity usually accounts for digital assets collected as an intangible asset, or as a financial instrument in the case of stablecoins for example as they are redeemable for cash. The accounting for tokens distributed on the other hand depends on the promise given to investors under the terms of the ICO, which could include: free or discounted access to the entity’s goods or services for a specified or indefinite period of time; a share of the profits of the entity or access to an exchange through which it can transact with other users of the exchange in buying goods or services. Digital asset projects may also offer equity tokens, which are a type of security tokens that work more like a traditional stock asset, giving their holders some form of ownership in their investments. The use of these equity instruments remains restricted nevertheless, raising the question of the rights and guarantees given to retail investors in particular in exchange for the funds given to the cryptocurrency project?

- VC Double-dipping practices

What we refer to as double-dipping practices, in this case, relates to VCs investing in cryptocurrency projects and realising important capital gains on their equity shares as well as digital token holdings. This privilege is almost unique to the cryptocurrency ecosystem, raising some questions again about asymmetric information advantages against retail investors: compared to traditional VC funding, crypto VC investors enjoy a double economic as well as governance advantage, having control over token and equity.

Conclusion:

Tokenomics is an important aspect of cryptocurrency which covers almost anything to do with the token. Professional as well as retail investors should spend a lot of time studying a project’s tokenomics before investing to be well aware of the financial and governance rights attributed to them via the token purchase. There is an absolute need in our view for regulation on this particular topic to evolve in order to provide better transparency and eventually protection levels for investors.

This article has been written by Chadi El Adnani – Crypto Research Analyst @SUN ZU Lab

About SUN ZU Lab

SUN ZU Lab is a leading independent provider of liquidity analysis for investors already active or crypto-curious. We provide quantitative research on the liquidity of all digital assets to help investors improve their execution strategies and source the highest level of liquidity at the lowest cost.

Our product line includes research reports, software tools, and bespoke developments to fulfil the needs of the most demanding digital investor.

Questions can be addressed to research@sunzulab.com or c.eladnani@sunzulab.com