This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

WorldCoin: Crypto’s holy path to mass adoption or a dystopian nightmare?

By Chadi El Adnani @SUN ZU Lab

August 2023

Worldcoin, the new cryptocurrency project co-founded in 2019 by OpenAI CEO Sam Altman, Alex Blania, and Max Novendstern, went live on July 24th with a bold aim to conquer the world. Sam, the creator of widely popular chatbot ChatGPT is looking to sign-up billions of users globally to use its cutting-edge iris-scanning and identity-verifying technology, in an effort to help solve what many have called a problem he actively contributed to creating: halting Generative AI’s hellish pace rise. The coming tsunami of AI-generated fake news and content is not an if but a when matter; Vitalik Buterin, Ethereum’s co-founder, was very clear about all the potential risks and what could go wrong with biometric proof-of-personhood solutions. He also acknowledged, however, that the efforts of teams tackling the problem, such as WorldCoin, could be humanity’s best chance against AI.

Weeks after its international launch, Worldcoin is drawing the attention of privacy watchdogs all around the globe, with Kenyan authorities going so far as to suspend the project’s activities in the country. We cover in this article Worldcoin’s fundamentals and tokenomics, trying to analyze whether it is indeed crypto’s holy path to mass adoption or a dystopian nightmare!

Questions and comments can be addressed to c.eladnani@sunzulab.com or research@sunzulab.com

Description & Value proposition:

According to the project’s white paper, Worldcoin aims to create a “globally-inclusive identity and financial network” that has the potential to “increase economic opportunity, scale a reliable solution for distinguishing humans from AI online while preserving privacy, enable global democratic processes, and show a potential path to AI-funded UBI.”

Worldcoin uses custom biometric imaging devices that scan users’ irises for Proof of Personhood (POP), an identity verification mechanism that uses unique attributes of individuals for Sybil resistance (preventing individuals from creating multiple fake identities). The team notes that irises are data-rich and offer strong fraud resistance beyond other biometrics like thumbprints and facial recognition. Since commercially available iris imaging devices did not meet the team’s needs, the Worldcoin team built their custom hardware known as “Orbs.” Users can register and verify their accounts by visiting an Orb operator (currently ~330 Orbs active in the last 30 days) and having their irises scanned to pass the humanness and uniqueness checks. A unique IrisCode is calculated on the Orb, which then gets verified using ZK proofs, allowing users to access their self-custodial World App wallets.

Regarding user privacy, the Worldcoin team claims they only use the data for the uniqueness check and do not collect PII such as names, phone numbers, or emails. Using ZK proofs enables users to pass the uniqueness check while retaining anonymity. Biometric data is processed locally on the Orb and then deleted by default once the IrisCode is created. However, users can opt into data custody to back up their biometric data with Worldcoin to reduce the times they may need to revisit an Orb.

For the project’s rollout, the Worldcoin team focuses on markets in the developing world, which could serve as launchpads for more significant regions. WLD token is used to incentivize user signups and the development of its Orb network through third-party manufacturers and operators. Currently, World ID has ~2.2 million signups with verified World ID users from 120 countries; 2,000 Orbs have been manufactured, and ~28 million WLD tokens have been claimed by users. At the current price of ~$1.3, WLD has a Market Capitalization of ~$160 million and a Fully Diluted Valuation (FDV, taking into account the total supply) of ~$12.7 bn, which would make one of the most valuable token across the entire crypto market few weeks after its launch. “Tools for Humanity”, the technology company behind Worldcoin, announced in May that it has raised $115 million in series C funding led by Blockchain Capital. The round also saw participation from major crypto investors a16z, Bain Capital Crypto, and Distributed Global.

Worldcoin is built over three pillars:

- World ID: a privacy-preserving digital identity designed to help solve important, identity-based challenges, including proving an individual’s unique personhood.

- Worldcoin token (WLD): a token providing utility and giving users a say over the direction of the Worldcoin protocol. WLD is the first token to be globally and freely distributed to people just for being a unique individual.

- World App: an app that enables payment, purchases and transfers globally using digital assets and traditional currencies

The project’s mission (from the whitepaper):

The mission of the Worldcoin project is to build the world’s largest identity and financial network as a public utility, giving ownership to everyone. A key component of the project is the development of the infrastructure that will be important for a world where AI plays an increasingly important role.

The project’s goals regarding the WLD token are as follows:

- The majority of WLD tokens will be given to individuals – simply for being a unique human.

- The majority of humans who are alive today will receive WLD tokens, making WLD the most widely distributed digital currency.

- The WLD token, alongside World ID, will be used for protocol governance.

- The WLD token will form the foundation of the largest privacy-preserving identity and financial network.

Tokenomics:

Worldcoin (WLD) is an ERC-20 token on Ethereum Mainnet and individuals will receive their user grants on Optimism Mainnet. Therefore, most WLD transactions will likely take place on the Optimism network. If needed, the token can be bridged back to Ethereum through the Optimism bridge.

The tokenomics of Worldcoin is laid out on its whitepaper on the website:

- The initial supply cap is 10 bn WLD.

- The maximum circulating supply at launch is 143 million WLD (1.43% of initial total supply), 100 million of which were loaned to market makers outside the US.

- Inflation: Up to 1.5% per year. Inflation can start at the earliest after 15 years. Inflation rate is set by protocol governance. Default inflation rate = 0%.

- 75% of total supply is allocated to the “Worldcoin Community”, 13.5% to investors, and 9.8% to the initial development team.

- Investor and development team tokens are locked for 12 months after launch, then unlocked on a daily basis evenly over the next 24 months.

- Circulating supply denotes the total amount of WLD tokens that are freely circulating, meaning they do not have any specific transfer restrictions imposed upon them. Unlocked supply denotes the total amount of WLD tokens that are either part of the circulating supply or are unlocked but subject to the protocol’s governance discretion on their rate of release into the circulating supply.

The “Liquidity Provisioning” section adds more details:

“World Assets Ltd. (a subsidiary of the Worldcoin Foundation) has entered into loan agreements with five market makers operating outside of the US. The goal of engaging these entities is to ensure sufficient liquidity for WLD traded on centralized exchanges outside the US, to facilitate price discovery, and to enhance price stability of WLD.

Collectively, the five entities have received loans of 100M WLD for a time period of 3 months after token launch. At the end of the three months, each entity must return its loan or alternatively it may elect to purchase any amount of tokens up to the loan amount it has received. The price per WLD for this purchase will be set according to the following formula: $2.00 + ($0.04 * X), with X being equal to (i) the amount of tokens being purchased, divided by (ii) one million.”

Vitalik Buterin’s take on biometric proof of personhood and risks related to Worldcoin (link)

Ethereum co-founder Vitalik carefully assessed the pros and cons of the different approaches to proving proof-of-personhood, raising several concerns around the hardware, accessibility, privacy, and security.

He asks what the consequences might be if an “adversary can forcibly (or secretly) scan your iris and compute your iris hash themselves.” He raises the specter of AI bots fighting back with “3D-printed fake people” that could hoodwink biometric scanners. And he posits that a malicious actor could Sybil attack WorldCoin by paying low-wage people for their iris scans.

“What are the major issues with Worldcoin’s construction?

There are four major risks that immediately come to mind:

- Privacy. The registry of iris scans may reveal information. At the very least, if someone else scans your iris, they can check it against the database to determine whether or not you have a World ID. Potentially, iris scans might reveal more information.

- Accessibility. World IDs are not going to be reliably accessible unless there are so many Orbs that anyone in the world can easily get to one.

- Centralization. The Orb is a hardware device, and we have no way to verify that it was constructed correctly and does not have backdoors. Hence, even if the software layer is perfect and fully decentralized, the Worldcoin Foundation still has the ability to insert a backdoor into the system, letting it create arbitrarily many fake human identities.

- Security. Users’ phones could be hacked, users could be coerced into scanning their irises while showing a public key that belongs to someone else, and there is the possibility of 3D-printing “fake people” that can pass the iris scan and get World IDs.

It’s important to distinguish between (i) issues specific to choices made by Worldcoin, (ii) issues that any biometric proof of personhood will inevitably have, and (iii) issues that any proof of personhood in general will have. For example, signing up to Proof of Humanity means publishing your face on the internet. Joining a BrightID verification party doesn’t quite do that, but still exposes who you are to a lot of people. And joining Circles publicly exposes your social graph. Worldcoin is significantly better at preserving privacy than either of those. On the other hand, Worldcoin depends on specialized hardware, which opens up the challenge of trusting the orb manufacturers to have constructed the orbs correctly – a challenge which has no parallels in Proof of Humanity, BrightID or Circles. It’s even conceivable that in the future, someone other than Worldcoin will create a different specialized-hardware solution that has different tradeoffs.”

He concludes, however, that, despite “dystopian vibez,” a solution like WorldCoin could “do quite a decent job of protecting privacy.” And that, given the AI risk, it’s probably worth trying: “A world with no proof-of-personhood seems more likely to be a world dominated by centralized identity solutions, money, small closed communities, or some combination of all three.”

MIT Technology Review: Deception, exploited workers, and cash handouts: How Worldcoin recruited its first half a million test users (link)

An April 2022 MIT Technology Review article claimed that Worldcoin used “deceptive marketing practices, collected more personal data than it acknowledged, and failed to obtain meaningful informed consent.”

The blistering report chronicles a shoddy operation rife with misinformation, data lapses and malfunctioning orbs. “Our investigation revealed wide gaps between Worldcoin’s public messaging, which focused on protecting privacy, and what users experienced,” write Eileen Guo and Adi Renaldi. “We found that the company’s representatives used deceptive marketing practices, collected more personal data than it acknowledged, and failed to obtain meaningful informed consent.”

The company issued a 25-page rebuttal to MIT Technology Review’s criticisms.

“We want to make it very clear that Worldcoin is not a data company and our business model does not involve exploiting or selling personal user data,” it wrote. “Worldcoin is only interested in a user’s uniqueness—i.e., that they have not signed up for Worldcoin before—not their identity.”

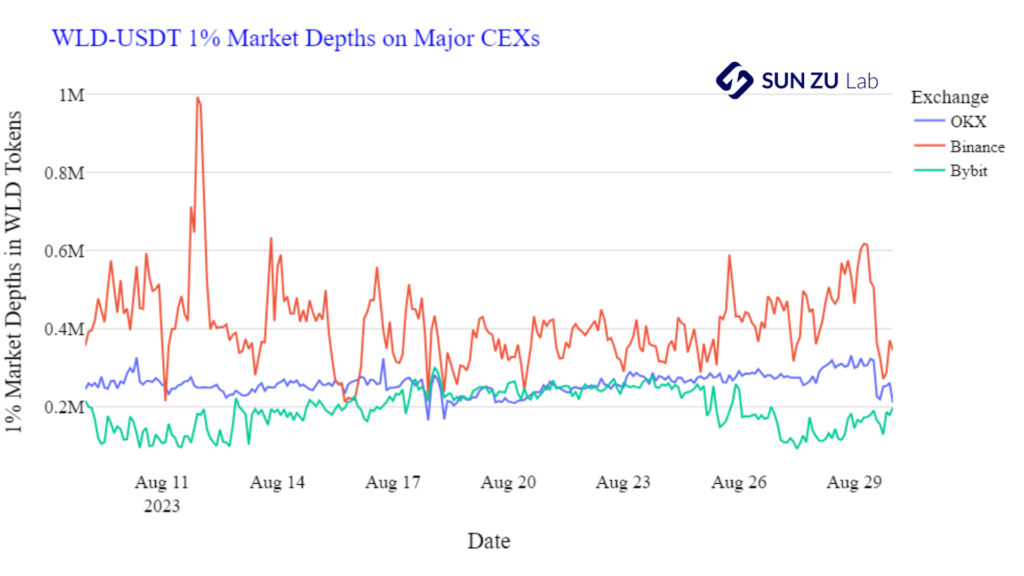

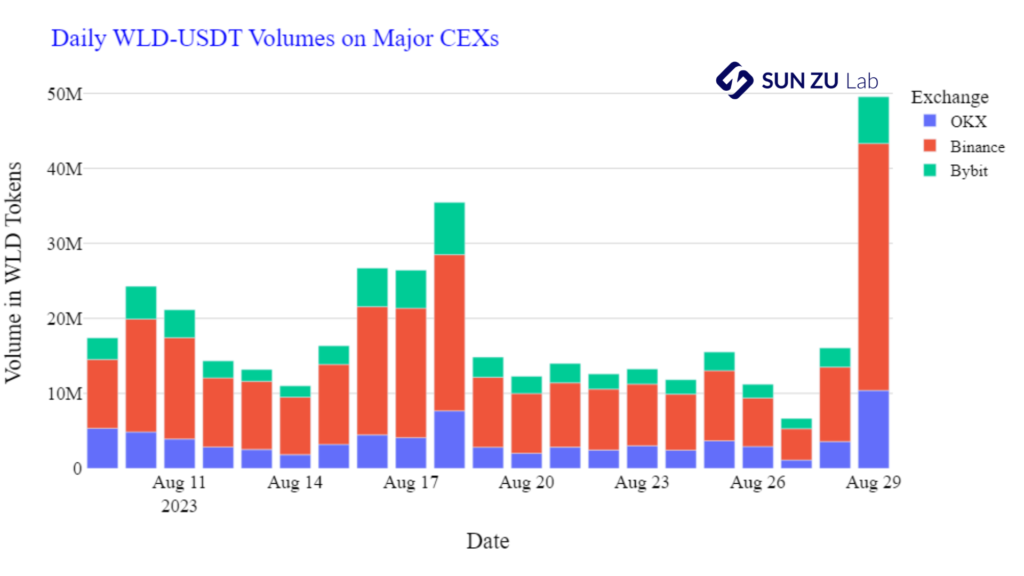

WLD Market Charts:

Source: SUN ZU Lab Data

Conclusion – SUN ZU Lab’s initial take on WorldCoin:

- Making only 1% of the total supply available for circulation initially and allocating it almost entirely (100 million tokens) to Market Makers is unusual and raises some questions. The 5 Market Makers are controlling WLD markets and liquidity at this early stage. The following clause from contracts with the MMs reveals why the price discovery process stabilized around $2 after the launch: “Collectively, the five entities have received loans of 100M WLD for a time period of 3 months after token launch. At the end of the three months, each entity must return its loan or alternatively it may elect to purchase any amount of tokens up to the loan amount it has received. The price per WLD for this purchase will be set according to the following formula: $2.00 + ($0.04 * X), with X being equal to (i) the amount of tokens being purchased, divided by (ii) one million.” The previous formula and the fact that 5 Market Makers control the entire WLD market mechanically sets a short-term floor price at $2 for WLD tokens and maintains the project’s impressive bloated FDV at ~$15-20 bn. (We covered Market Making practices in crypto vs TradFi in detail in this article). WLD’s price fell, however, below the $2 floor price over the last few days amid all the news around privacy concerns and a new wave of risk-averse sentiment sweeping through world markets. All things considered, WLD’s token launch and first trading days were one of the most organized in recent major token launches, and WLD’s cross-exchange mid-price spread remains highly tight, as can be seen from the chart above, mainly due to Market Makers’ high activity around the token.

- Another point of contention is the token distribution, with the core team controlling 25% of the total allocation. This allocation, combined with the project’s low circulating supply and comparatively high fully diluted valuation (FDV) has led to concerns among experts. Additionally, questions have been raised regarding market making activity on the token, although no concrete evidence of malpractice has yet been presented. I am not comparing Sam Altman in any way to SBF! But experts and critics quickly made parallels between how the Worldcoin team set the tokenomics for WLD and how SBF used to manage some of his investments, known as “Sam coins”, including Serum, Raydium and FTT. We covered the principle of a flywheel mechanism in this previous article.

- Worldcoin has also been criticized for widely promoting the platform in the developing world. Many new users are in Asia and Africa, raising concerns about exploitation. “Most alarming to me is how the WorldCoin team has boasted about how many users they have. When in reality they have been exploiting people in developing countries,” tweeted pseudonymous crypto influencer ZachXBT. The bulk of user adoption seems to be driven by the financial incentive of receiving 25 WLD tokens upon sign-up (with a ~$35 value at today’s price). Although it is a small amount by occidental standards, $35-50 is reason enough for citizens in developing countries to take hours-long queues to scan their irises!

- Some of the above worries around privacy and protection of users’ personal data have already started to materialize as identity black markets have emerged, raising questions about the system’s overall security. Moreover, the low number of token holders at ~6k (source: Etherscan) has raised concerns about the accessibility of the project, particularly when contrasted with the reported millions of signups.

- There’s a lot at stake here with Worldcoin. Overall, Worldcoin’s launch represents a groundbreaking endeavor to solve the complex problem of digital human identity verification, but feedback from the crypto community so far has been resoundingly negative. Many critics voiced ethical concerns over the potential for data mismanagement and privacy leaks for sensitive iris biometrics. While we should not overlook the concerns and risks outlined by experts and the community, they do not necessarily foretell failure for the project. Many of these concerns primarily relate to the project’s implementation or are based on hypothetical future dystopian scenarios that assume the technology will be abused. However, they underscore the need for Worldcoin to address and resolve these concerns to fulfill its potential proactively. But in case of success, the project has the potential to bridge the entire human race in a way only Facebook got close to achieving at one point, transforming the way humans interact with blockchains and unlocking significant wealth for all of humanity.

About SUN ZU Lab:

SUN ZU Lab is a leading data solutions provider based in Paris, on a mission to bring better data to the global crypto ecosystem through independent quantitative analyses. We collect the most granular market data from major liquidity venues, analyze it, and deliver our solutions through real-time dashboards, API streams, and historical files. SUN ZU Lab provides crypto professionals with actionable data to monitor the market.

The Future of Trustless and Decentralized Cross-Chain DeFi – Focus on Interlay

By Chadi El Adnani @SUN ZU Lab

January 2023

This article was part of a broader report on the following theme: “Challenges and opportunities: The future of DeFi in TradFi”. Crypto Valley Association selected it among the top 5 pieces for its 2022 Call For Papers challenge.

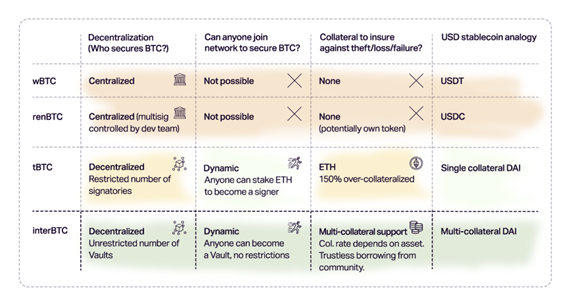

Interlay came into existence based on the observation that all current existing cross-chain Bitcoin, and other digital tokens, are all centralized and custodial, like the major USD-pegged stablecoins USDT and USDC. These bridges make users give up control over their assets and trust a third party to maintain the bridge, thus creating a weak centralized link in the overall decentralized chain. DeFi Llama data shows that several dollar billions are locked in protocols that bridge tokens from one network to another, the majority of them being centralized, custodial bridges (wBTC, renBTC…), putting the whole crypto ecosystem in a catastrophic situation in case these custodial bridges are hacked, lose keys or commit fraud. Following a previous article on how Polkadot is tackling the complex blockchain interoperability problem, we analyze in this article Interlay’s potential to deliver a rock-solid decentralized cross-chain bridge.

Questions and comments can be addressed to c.eladnani@sunzulab.com or research@sunzulab.com

Introduction:

Blockchain bridges have already suffered several hack attacks, exceeding $1 billion in cryptocurrency stolen. The latest significant episodes include Axie Infinity’s Ronin bridge $600 million hack, Harmony’s Horizon bridge hack for $100 million, and the $190 million Nomad bridge hack in August 2022, described as one of the most chaotic hacks web3 has ever seen. In a much-publicized tweet earlier in 2022, Vitalik Buterin voiced his opposition to using cross-chain solutions in the blockchain ecosystem in favour of a multi-chain future, arguing that the former increase the security risks in the process of transferring assets. Indeed, the attack vectors of the assets are increased across a more comprehensive network surface area as it is moved across an increasing number of chains and dApps with different security architectures. We believe at SUN ZU Lab that a minimum of standardization is required for blockchains to co-exist in parallel. Several organizations (IEEE, ANSI…) are doing this very well, so why shouldn’t the core blockchain teams start integrating these organizations?

We will cover in this next part the specifics of Interlay, its technical design, and how it differentiates from its centralized peers.

What is Interlay?

Interlay’s flagship product, iBTC, is a 1:1 Bitcoin-backed stablecoin that can be used to invest, earn and pay with BTC across the DeFi ecosystem on Polkadot at first, with future deployment plans on Ethereum, Cosmos and many other blockchains. Interlay also deployed Kintsugi, iBTC’s canary network, a testnet with real economic value deployed on Kusama (Polkadot’s canary network). Kintsugi and iBTC share the same code base, with the difference that the former will always be two to three releases ahead with more experimental features. Interlay won Polkadot’s 10th parachain slot auction, while Kintsugi won Kusama’s parachain slot 11.

Interlay was created in 2020 by Alexei Zamyatin and Dominik Harz, who met in October 2017 as the first two PhDs in the Imperial College’s cryptocurrency research lab. They have worked together since, publishing more than 20 papers on specific problems such as blockchain security, scalability, interoperability and DeFi.

After the successful launch of its flagship product, iBTC, the company now sets its eyes on becoming a one-stop-shop for Bitcoin DeFi with a new roadmap that includes decentralized lending, borrowing and trading for BTC.

Tokenomics:

Interlay and Kintsugi will be governed by their communities via INTR and KINT, their governance tokens on Polkadot and Kusama, respectively. INTR and KINT tokens’ primary purposes are:

- Governance: token holders vote on governance proposals.

- Staking: To participate in governance, holders stake INTR/KINT and earn INTR/KINT staking rewards in return.

- Utility: Interlay will support transaction fee payments in INTR/KINT.

- Outlook: tokens will be tightly integrated into the bridge, offering token holders additional security and product benefits.

- Collateral: INTR and KINT tokens can also be used as collateral to back iBTC and kBTC.

INTR and KINT have an unlimited supply with the following emission schedule:

- 1 billion INTR and 10 million KINT emitted over the first four years.

- 2% annual inflation afterwards, indefinitely.

The project emphasizes community, with 70% of tokens distributed as airdrops and block rewards. Moreover, starting from the 5th year, only the community will receive newly minted KINT and INTR tokens.

Technology:

The Interlay network operates as follows: collateralized vaults hold BTC locked on Bitcoin, while iBTC is minted on the parachain. These vaults can be individuals or service providers who lock collateral in a MakerDAO-inspired multi-collateral system to protect users against theft and BTC loss, and receive BTC into custody for safekeeping while iBTC exists.

There are four main phases in each iBTC life-cycle:

1. Lock: users can run their vault or pick one to lock BTC. BTC is always backed by the vault’s collateral

2. Mint: iBTC is created at a 1:1 ratio to locked BTC

3. BTC DeFi: iBTC could be used as collateral for lending or yield farming, for example, on Polkadot, Kusama, Cosmos, Ethereum and other major DeFi platforms

4. Redeem: iBTC is eventually redeemed for physical BTC on Bitcoin in a trustless manner

iBTC’s main difference from existing wrapped Bitcoin products is its trustless and decentralized aspect. It is secured by insurance as vaults lock collateral on the iBTC parachain in a multi-collateral system. In case of misbehaviour, the network slashes their collateral and reimburses users. Moreover, it is radically open, meaning anyone could become a vault and help secure iBTC. However, running a vault is currently a highly technical role, requiring advanced proficiency in computer system administration, which constitutes a high barrier to entry. The Interlay team is working on democratizing this role by making it simpler to run a vault.

Comparison between different wrapped BTC asset

Source: Interlay documentation

Use case: BTC DeFi on Karura with Kintsugi:

Karura is Kusama’s central DeFi hub, built as Acala’s sister network (Polkadot’s first parachain winner). Karura offers a suite of financial primitives: a multi-collateralized stablecoin (kUSD) backed by cross-chain assets like Kusama and Bitcoin, a trustless staking derivative, and a DEX to increase liquidity.

Kintsugi suggests many use cases for using kBTC with Karura’s DeFi products, for example:

- HODLing BTC with interest: users can mint kBTC by locking BTC on the Kintsugi bridge, then transfer it to Karura and open a kUSD loan with kBTC. This kUSD amount can be put into another yield-generating DeFi protocol (Sushi LP pool on Moonriver, Basilisk LPs, …).

- Incentivizing kBTC pools on Karura’s AMM: kBTC can be traded against any other listed asset on Karura AMM DEX. Liquidity providers to kBTC pools could earn rewards in KAR and KINT.

- kBTC as kUSD Collateral: kUSD could be minted using kBTC, making it the first stablecoin backed by genuinely trustless and decentralized BTC.

- Arbitrage kBTC vs. renBTC on Karura’s DEX: renBTC will also be listed on Karura. While renBTC and kBTC are pegged to Bitcoin, they have different security properties and demands. This situation leads to slightly varying prices and offers arbitrage opportunities.

- Coming soon: Interlay is working on adding reward-general tokens (such as LP tokens) as collateral and releasing other types of wrapped BTC.

Conclusion

These were just a few examples of what is possible with Interlay products today, and use cases will explode shortly as the DotSama ecosystem continues to grow and Interlay expands to other protocols. Overall, Interlay has a promising future in tackling the complex decentralized cross-chain bridge problem within the blockchain ecosystem. Its founders’ solid research background, combined with its unique decentralized and trustless network, gives it a considerable advantage over its peers. However, it still has a long way to go to compete against centralized, custodial wrapped bitcoin leaders wBTC and hBTC.

References

- Understanding Crypto Bridges and $1 Billion in Thefts, by Olga Kharif (link)

- Interlay & Kintsugi Documentation (link)

- From Academia to Start-up — Looking back at 2020, by Alexei Zamyatin (link)

- Featured Use Case: Chaotic BTC DeFi with Kintsugi & Karura (link)

- Interlay FAQ (link)

Disclaimer

No Investment Advice

The contents of this document are for informational purposes only and do not constitute an offer or solicitation to invest in units of a fund. They do not constitute investment advice or a proposal for financial advisory services and are subject to correction and modification. They do not constitute trading advice or any advice about cryptocurrencies or digital assets. SUN ZU Lab does not recommend that any cryptocurrency should be bought, sold, or held by you. You are strongly advised to conduct due diligence and consult your financial advisor before making investment decisions.

Accuracy of Information

SUN ZU Lab will strive to ensure the accuracy of the information in this report, although it will not hold any responsibility for any missing or wrong information. SUN ZU Lab provides all information in this report and on its website.

You understand that you are using any information available here at your own risk.

Non Endorsement

The appearance of third-party advertisements and hyperlinks in this report or on SUN ZU Lab’s website does not constitute an endorsement, guarantee, warranty, or recommendation by SUN ZU Lab. You are advised to conduct your due diligence before using any third-party services.

About SUN ZU Lab

SUN ZU Lab is a leading data solutions provider based in Paris, on a mission to bring transparency to the global crypto ecosystem through independent quantitative analyses. We collect the most granular market data from major liquidity venues, analyze it, and deliver our solutions through real-time dashboards & API streams or customized reporting. SUN ZU Lab provides crypto professionals with actionable data to monitor the market and optimize investment decisions.

What is Tokenomics and why does it matter?

A brief historical perspective to better understand the stakes behind tokenomics

Let’s start this article with the famous experience of Philip II, King of Spain in the 16th century, with the Eldorado discovery and the massive rise in inflation that followed throughout the entirety of Europe!

In the 16th century, Spain conquered Latin America and discovered an immeasurable wealth within gold and silver mines. The kingdom hit the jackpot, and its financial deficits appeared long behind it. Nevertheless, this wasn’t the case; the problem came from the Crown of Spain being over-indebted to many European creditors, leading the massive silver and gold discoveries to only make a quick passage through Spain before enriching the coffers of its French and Dutch neighbors. The European market ended up flooded with coins, so the immense Spanish wealth was diminished relative to other European kingdoms.

In the end, the excessive amount of silver and gold imported, and above all distributed, in Europe caused a substantial devaluation of what Philip II could think of as his Eldorado. A better financial management could have allowed him to preserve his reserves of invaluable minerals and thus be able to develop on a more critical scale of time his fabulous treasure.

This story shows the importance of the quantity put into circulation on the valuation of an asset. This analysis works perfectly for the cryptocurrency market as well; any analysis of an asset’s ecosystem requires careful attention to the notions of quantity in circulation, total quantity, and inflation management.

Inflation and the importance of tokenomics

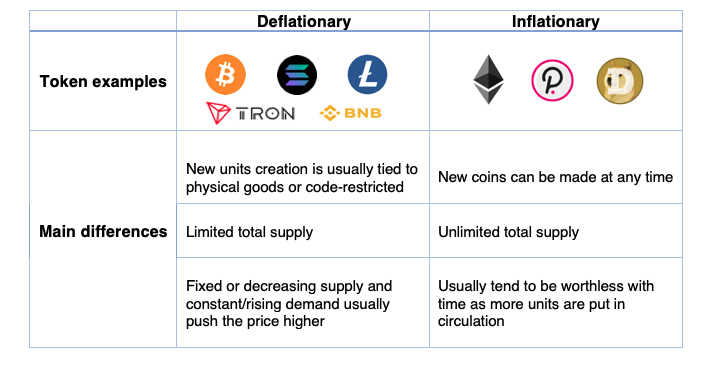

While the media usually describes inflation as a rise in the price of everyday consumer goods, it is, in reality, the value of money that tends to fall rather than prices getting higher. This notion of inflation is at the heart of tokenomics, a merger of “token” and “economics” used to refer to all the elements that make a particular cryptocurrency valuable and exciting to investors. In this regard, two predominant models exist: deflationary and inflationary tokens.

- The limited quantity deflationary model:

This is the model Bitcoin uses, i.e. a fixed total supply and less and less money issued over time. Many cryptocurrencies are governed under this model, like Solana, Litecoin, Tron, and many others, alongside the king of cryptos.

In the case of Bitcoin, for example, a block is mined about every 10 minutes, rewarding the miner 6.25 BTC (when Bitcoin started, it was 50 BTC per block, then 25, 12.5, 6.25, etc). The reward is halved every 210K blocks, leading to a halving every 4 years with the 10 minutes mining-time per block assumption. Without changes to the protocol, the final Bitcoin will be mined around the year 2140.

- The balanced inflation model:

Many blockchains have been coded without incorporating a limited amount of token issuance. This choice can be made for a variety of reasons, usually involving the use to be made of the blockchain in question. The Ethereum protocol, for example, operates under this model. However, some mechanisms are put in place to limit inflation or even to create a deflationary system.

This is the objective of implementing future updates of the Ethereum network. While the annual rate of ETH token issuance is currently equal to nearly 4.5%, the switch from Proof of Work to Proof of Stake should allow developers to reduce this rate to less than 1%. The network also introduced a burn mechanism, meaning that part of the fees paid by Ethereum users in the future will not be returned to validators, but will be removed altogether. This could not only achieve a balance with the issuance rate, but potentially lead to a decrease in the number of tokens in circulation in case of high network usage.

Both models have strengths and weaknesses, with reasonable justifications behind their use. For example, the Ethereum white paper indicates that a stable issuance rate would prevent the excessive concentration of wealth in the hands of a few actors/validators. Whereas Bitcoin’s deflationary system, as previously stated, allowed for the growing development of its ecosystem by paying miners large amounts of Bitcoin when it was not worth the tens of thousands of dollars it is worth today.

More generally, looking into a project’s tokenomics before getting involved is always a good idea. This can help answer questions like:

- What is the current token supply as well as total supply?

- Does the token have an inflationary or deflationary model?

- What is the real-world use case?

- Who owns the majority of coins? Is it well spread out or concentrated?

Main differences between deflationary and inflationary tokens:

Solana case study

Let’s take a deep dive into one of the most prominent blockchains’ tokenomics. Solana has a native token called SOL that has two primary use cases within the network:

- Staking: users can stake their SOL either directly on the network or delegate their holding to an active validator to help secure the network. In return, stakers will receive inflation rewards.

- Transaction Fees: users can use SOL to pay fees related to transaction processing or running smart contracts.

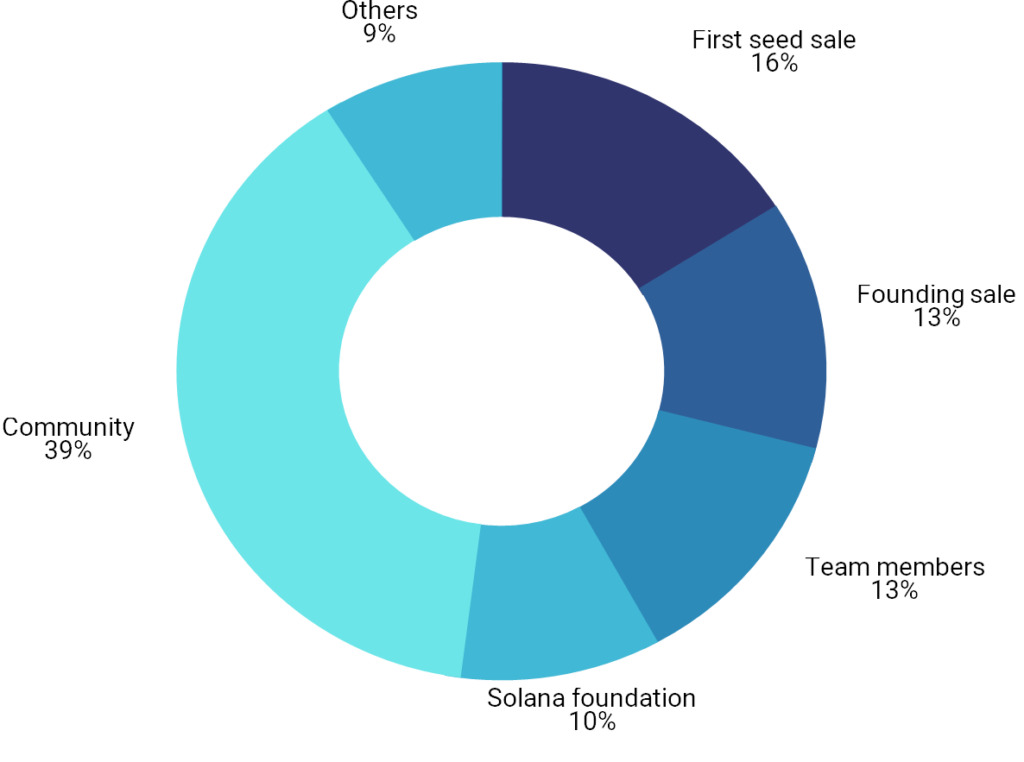

The Solana team distributed tokens in five different funding rounds, four of which were private sales. These private sales began in Q1 2019 and culminated in a $20 million Series A led by Multicoin Capital, announced in July 2019. Additional participants included Distributed Global, BlockTower Capital, Foundation Capital, Blockchange VC, Slow Ventures, NEO Global Capital, Passport Capital, and Rockaway Ventures. The firms received SOL tokens in exchange for their investments, although the number of tokens allocated to investors was not disclosed.

The initial distribution of SOL tokens was as follows:

According to Messari data, vesting schedules were as follows: Solana’s three pre-launch private sales all came with a nine-month lockup after the network launched. The project’s public auction sale (held in March 2020) did not come with a lockup schedule, and the SOL tokens distributed in that sale were fully liquid once the network launched. The founder’s allocation (13% of the initial supply) was also subject to a nine-month lockup post-network launch. After the lockup period ends, these tokens will vest monthly for another two years (expected to fully vest by January 2023). This last clause is a good protection for investors as team members’ tokens are locked-up for a longer period. The Grant Pool and Community Reserve (both overseen by the Solana Foundation) contain ~39% of the initial SOL supply combined. These allocations began to vest in small amounts since Solana’s mainnet launch.

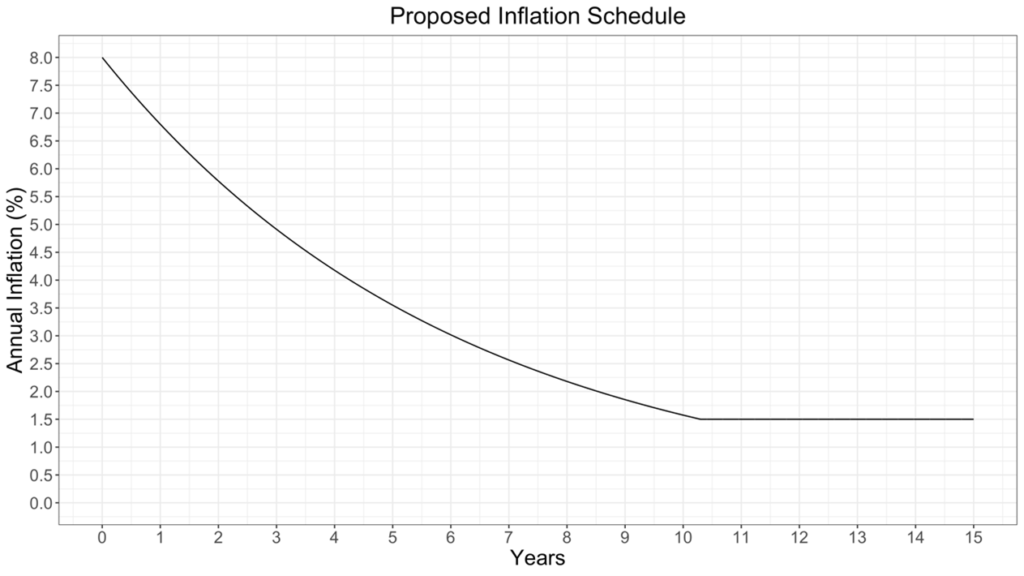

Inflation stands at an initial annual inflation rate of 8%. However, this inflation rate will decrease at an annual rate of 15% (“dis-inflation rate”). The inflation decrease is thus non-linear and much more important in the first years. Solana’s inflation rate will continue to decrease until it reaches an annual rate of 1.5%, which the network should reach in about ten years or 2031. 1.5% will remain the long-term inflation rate for Solana unless the network’s governance system votes to change it.

Major identified issues with current projects’ tokenomics

- Is it really that decentralised?

Using the Solana example, we can see that more than 50% of the tokens in circulation are concentrated, during a long period after the project’s launch, in the hands of the core team, VCs and early investors. This is hardly an exception to Solana as similar distributions are very common within the blockchain ecosystem projects. Can we talk seriously about the benefits of blockchain decentralization with such capital and governance concentration, without forgetting technical knowledge concentration as well?

- What happens after the end of the lock-up period?

Blockchain projects often come with varying lock-up periods that can last from less than a year to five years for early investors and the founding team, who usually cash out their investments after this period. What we identify as a significant issue after the end of the lock-up period is the huge and asymmetric risk-return transfer between this first group, which realized a pretty good return on their initial investments and are completely de-risked at this stage, and retail investors joining the project at a stage where core decision-makers are no longer incentivised to ensure the well-functioning of the project.

- What rights for token investors?

Cryptocurrency projects often use ICOs (Initial Coin Offering), among other fundraising techniques, to raise funds through the issue of crypto-assets in exchange for either fiat currency or an established cryptocurrency like bitcoin or ether. The issuing entity usually accounts for digital assets collected as an intangible asset, or as a financial instrument in the case of stablecoins for example as they are redeemable for cash. The accounting for tokens distributed on the other hand depends on the promise given to investors under the terms of the ICO, which could include: free or discounted access to the entity’s goods or services for a specified or indefinite period of time; a share of the profits of the entity or access to an exchange through which it can transact with other users of the exchange in buying goods or services. Digital asset projects may also offer equity tokens, which are a type of security tokens that work more like a traditional stock asset, giving their holders some form of ownership in their investments. The use of these equity instruments remains restricted nevertheless, raising the question of the rights and guarantees given to retail investors in particular in exchange for the funds given to the cryptocurrency project?

- VC Double-dipping practices

What we refer to as double-dipping practices, in this case, relates to VCs investing in cryptocurrency projects and realising important capital gains on their equity shares as well as digital token holdings. This privilege is almost unique to the cryptocurrency ecosystem, raising some questions again about asymmetric information advantages against retail investors: compared to traditional VC funding, crypto VC investors enjoy a double economic as well as governance advantage, having control over token and equity.

Conclusion:

Tokenomics is an important aspect of cryptocurrency which covers almost anything to do with the token. Professional as well as retail investors should spend a lot of time studying a project’s tokenomics before investing to be well aware of the financial and governance rights attributed to them via the token purchase. There is an absolute need in our view for regulation on this particular topic to evolve in order to provide better transparency and eventually protection levels for investors.

This article has been written by Chadi El Adnani – Crypto Research Analyst @SUN ZU Lab

About SUN ZU Lab

SUN ZU Lab is a leading independent provider of liquidity analysis for investors already active or crypto-curious. We provide quantitative research on the liquidity of all digital assets to help investors improve their execution strategies and source the highest level of liquidity at the lowest cost.

Our product line includes research reports, software tools, and bespoke developments to fulfil the needs of the most demanding digital investor.

Questions can be addressed to research@sunzulab.com or c.eladnani@sunzulab.com