By Chadi El Adnani @SUN ZU Lab

August 2023

Worldcoin, the new cryptocurrency project co-founded in 2019 by OpenAI CEO Sam Altman, Alex Blania, and Max Novendstern, went live on July 24th with a bold aim to conquer the world. Sam, the creator of widely popular chatbot ChatGPT is looking to sign-up billions of users globally to use its cutting-edge iris-scanning and identity-verifying technology, in an effort to help solve what many have called a problem he actively contributed to creating: halting Generative AI’s hellish pace rise. The coming tsunami of AI-generated fake news and content is not an if but a when matter; Vitalik Buterin, Ethereum’s co-founder, was very clear about all the potential risks and what could go wrong with biometric proof-of-personhood solutions. He also acknowledged, however, that the efforts of teams tackling the problem, such as WorldCoin, could be humanity’s best chance against AI.

Weeks after its international launch, Worldcoin is drawing the attention of privacy watchdogs all around the globe, with Kenyan authorities going so far as to suspend the project’s activities in the country. We cover in this article Worldcoin’s fundamentals and tokenomics, trying to analyze whether it is indeed crypto’s holy path to mass adoption or a dystopian nightmare!

Questions and comments can be addressed to c.eladnani@sunzulab.com or research@sunzulab.com

Description & Value proposition:

According to the project’s white paper, Worldcoin aims to create a “globally-inclusive identity and financial network” that has the potential to “increase economic opportunity, scale a reliable solution for distinguishing humans from AI online while preserving privacy, enable global democratic processes, and show a potential path to AI-funded UBI.”

Worldcoin uses custom biometric imaging devices that scan users’ irises for Proof of Personhood (POP), an identity verification mechanism that uses unique attributes of individuals for Sybil resistance (preventing individuals from creating multiple fake identities). The team notes that irises are data-rich and offer strong fraud resistance beyond other biometrics like thumbprints and facial recognition. Since commercially available iris imaging devices did not meet the team’s needs, the Worldcoin team built their custom hardware known as “Orbs.” Users can register and verify their accounts by visiting an Orb operator (currently ~330 Orbs active in the last 30 days) and having their irises scanned to pass the humanness and uniqueness checks. A unique IrisCode is calculated on the Orb, which then gets verified using ZK proofs, allowing users to access their self-custodial World App wallets.

Regarding user privacy, the Worldcoin team claims they only use the data for the uniqueness check and do not collect PII such as names, phone numbers, or emails. Using ZK proofs enables users to pass the uniqueness check while retaining anonymity. Biometric data is processed locally on the Orb and then deleted by default once the IrisCode is created. However, users can opt into data custody to back up their biometric data with Worldcoin to reduce the times they may need to revisit an Orb.

For the project’s rollout, the Worldcoin team focuses on markets in the developing world, which could serve as launchpads for more significant regions. WLD token is used to incentivize user signups and the development of its Orb network through third-party manufacturers and operators. Currently, World ID has ~2.2 million signups with verified World ID users from 120 countries; 2,000 Orbs have been manufactured, and ~28 million WLD tokens have been claimed by users. At the current price of ~$1.3, WLD has a Market Capitalization of ~$160 million and a Fully Diluted Valuation (FDV, taking into account the total supply) of ~$12.7 bn, which would make one of the most valuable token across the entire crypto market few weeks after its launch. “Tools for Humanity”, the technology company behind Worldcoin, announced in May that it has raised $115 million in series C funding led by Blockchain Capital. The round also saw participation from major crypto investors a16z, Bain Capital Crypto, and Distributed Global.

Worldcoin is built over three pillars:

- World ID: a privacy-preserving digital identity designed to help solve important, identity-based challenges, including proving an individual’s unique personhood.

- Worldcoin token (WLD): a token providing utility and giving users a say over the direction of the Worldcoin protocol. WLD is the first token to be globally and freely distributed to people just for being a unique individual.

- World App: an app that enables payment, purchases and transfers globally using digital assets and traditional currencies

The project’s mission (from the whitepaper):

The mission of the Worldcoin project is to build the world’s largest identity and financial network as a public utility, giving ownership to everyone. A key component of the project is the development of the infrastructure that will be important for a world where AI plays an increasingly important role.

The project’s goals regarding the WLD token are as follows:

- The majority of WLD tokens will be given to individuals – simply for being a unique human.

- The majority of humans who are alive today will receive WLD tokens, making WLD the most widely distributed digital currency.

- The WLD token, alongside World ID, will be used for protocol governance.

- The WLD token will form the foundation of the largest privacy-preserving identity and financial network.

Tokenomics:

Worldcoin (WLD) is an ERC-20 token on Ethereum Mainnet and individuals will receive their user grants on Optimism Mainnet. Therefore, most WLD transactions will likely take place on the Optimism network. If needed, the token can be bridged back to Ethereum through the Optimism bridge.

The tokenomics of Worldcoin is laid out on its whitepaper on the website:

- The initial supply cap is 10 bn WLD.

- The maximum circulating supply at launch is 143 million WLD (1.43% of initial total supply), 100 million of which were loaned to market makers outside the US.

- Inflation: Up to 1.5% per year. Inflation can start at the earliest after 15 years. Inflation rate is set by protocol governance. Default inflation rate = 0%.

- 75% of total supply is allocated to the “Worldcoin Community”, 13.5% to investors, and 9.8% to the initial development team.

- Investor and development team tokens are locked for 12 months after launch, then unlocked on a daily basis evenly over the next 24 months.

- Circulating supply denotes the total amount of WLD tokens that are freely circulating, meaning they do not have any specific transfer restrictions imposed upon them. Unlocked supply denotes the total amount of WLD tokens that are either part of the circulating supply or are unlocked but subject to the protocol’s governance discretion on their rate of release into the circulating supply.

The “Liquidity Provisioning” section adds more details:

“World Assets Ltd. (a subsidiary of the Worldcoin Foundation) has entered into loan agreements with five market makers operating outside of the US. The goal of engaging these entities is to ensure sufficient liquidity for WLD traded on centralized exchanges outside the US, to facilitate price discovery, and to enhance price stability of WLD.

Collectively, the five entities have received loans of 100M WLD for a time period of 3 months after token launch. At the end of the three months, each entity must return its loan or alternatively it may elect to purchase any amount of tokens up to the loan amount it has received. The price per WLD for this purchase will be set according to the following formula: $2.00 + ($0.04 * X), with X being equal to (i) the amount of tokens being purchased, divided by (ii) one million.”

Vitalik Buterin’s take on biometric proof of personhood and risks related to Worldcoin (link)

Ethereum co-founder Vitalik carefully assessed the pros and cons of the different approaches to proving proof-of-personhood, raising several concerns around the hardware, accessibility, privacy, and security.

He asks what the consequences might be if an “adversary can forcibly (or secretly) scan your iris and compute your iris hash themselves.” He raises the specter of AI bots fighting back with “3D-printed fake people” that could hoodwink biometric scanners. And he posits that a malicious actor could Sybil attack WorldCoin by paying low-wage people for their iris scans.

“What are the major issues with Worldcoin’s construction?

There are four major risks that immediately come to mind:

- Privacy. The registry of iris scans may reveal information. At the very least, if someone else scans your iris, they can check it against the database to determine whether or not you have a World ID. Potentially, iris scans might reveal more information.

- Accessibility. World IDs are not going to be reliably accessible unless there are so many Orbs that anyone in the world can easily get to one.

- Centralization. The Orb is a hardware device, and we have no way to verify that it was constructed correctly and does not have backdoors. Hence, even if the software layer is perfect and fully decentralized, the Worldcoin Foundation still has the ability to insert a backdoor into the system, letting it create arbitrarily many fake human identities.

- Security. Users’ phones could be hacked, users could be coerced into scanning their irises while showing a public key that belongs to someone else, and there is the possibility of 3D-printing “fake people” that can pass the iris scan and get World IDs.

It’s important to distinguish between (i) issues specific to choices made by Worldcoin, (ii) issues that any biometric proof of personhood will inevitably have, and (iii) issues that any proof of personhood in general will have. For example, signing up to Proof of Humanity means publishing your face on the internet. Joining a BrightID verification party doesn’t quite do that, but still exposes who you are to a lot of people. And joining Circles publicly exposes your social graph. Worldcoin is significantly better at preserving privacy than either of those. On the other hand, Worldcoin depends on specialized hardware, which opens up the challenge of trusting the orb manufacturers to have constructed the orbs correctly – a challenge which has no parallels in Proof of Humanity, BrightID or Circles. It’s even conceivable that in the future, someone other than Worldcoin will create a different specialized-hardware solution that has different tradeoffs.”

He concludes, however, that, despite “dystopian vibez,” a solution like WorldCoin could “do quite a decent job of protecting privacy.” And that, given the AI risk, it’s probably worth trying: “A world with no proof-of-personhood seems more likely to be a world dominated by centralized identity solutions, money, small closed communities, or some combination of all three.”

MIT Technology Review: Deception, exploited workers, and cash handouts: How Worldcoin recruited its first half a million test users (link)

An April 2022 MIT Technology Review article claimed that Worldcoin used “deceptive marketing practices, collected more personal data than it acknowledged, and failed to obtain meaningful informed consent.”

The blistering report chronicles a shoddy operation rife with misinformation, data lapses and malfunctioning orbs. “Our investigation revealed wide gaps between Worldcoin’s public messaging, which focused on protecting privacy, and what users experienced,” write Eileen Guo and Adi Renaldi. “We found that the company’s representatives used deceptive marketing practices, collected more personal data than it acknowledged, and failed to obtain meaningful informed consent.”

The company issued a 25-page rebuttal to MIT Technology Review’s criticisms.

“We want to make it very clear that Worldcoin is not a data company and our business model does not involve exploiting or selling personal user data,” it wrote. “Worldcoin is only interested in a user’s uniqueness—i.e., that they have not signed up for Worldcoin before—not their identity.”

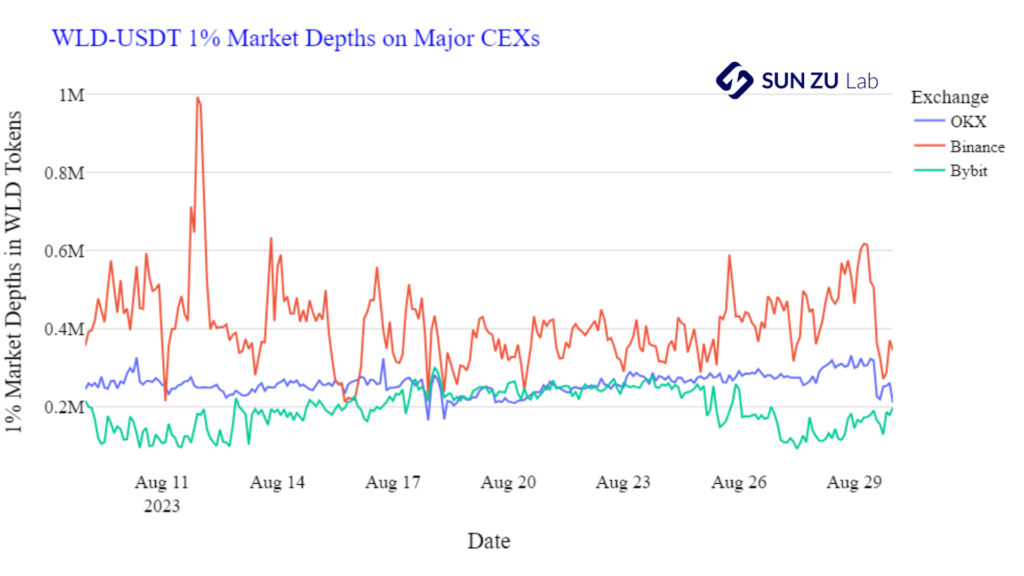

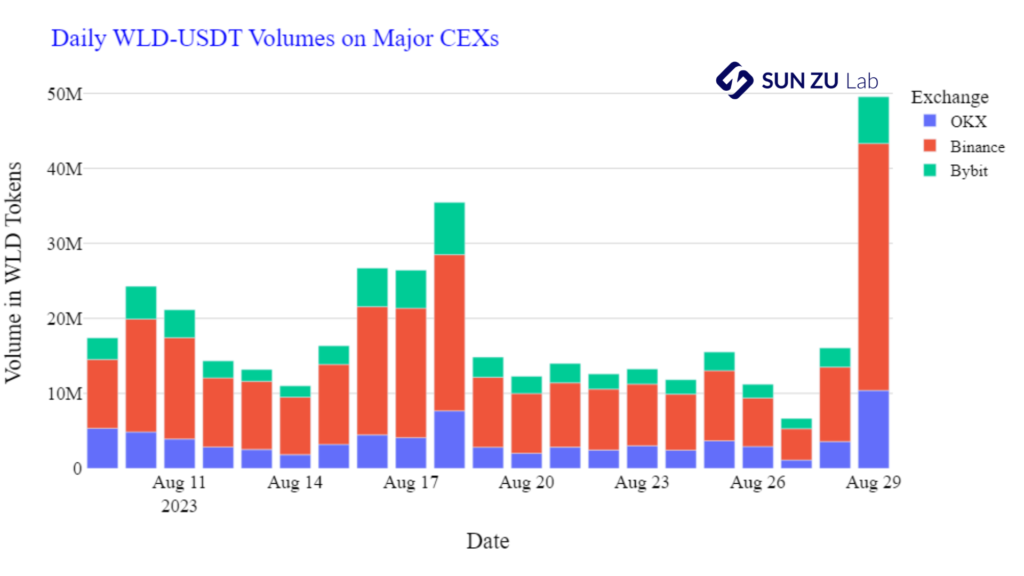

WLD Market Charts:

Source: SUN ZU Lab Data

Conclusion – SUN ZU Lab’s initial take on WorldCoin:

- Making only 1% of the total supply available for circulation initially and allocating it almost entirely (100 million tokens) to Market Makers is unusual and raises some questions. The 5 Market Makers are controlling WLD markets and liquidity at this early stage. The following clause from contracts with the MMs reveals why the price discovery process stabilized around $2 after the launch: “Collectively, the five entities have received loans of 100M WLD for a time period of 3 months after token launch. At the end of the three months, each entity must return its loan or alternatively it may elect to purchase any amount of tokens up to the loan amount it has received. The price per WLD for this purchase will be set according to the following formula: $2.00 + ($0.04 * X), with X being equal to (i) the amount of tokens being purchased, divided by (ii) one million.” The previous formula and the fact that 5 Market Makers control the entire WLD market mechanically sets a short-term floor price at $2 for WLD tokens and maintains the project’s impressive bloated FDV at ~$15-20 bn. (We covered Market Making practices in crypto vs TradFi in detail in this article). WLD’s price fell, however, below the $2 floor price over the last few days amid all the news around privacy concerns and a new wave of risk-averse sentiment sweeping through world markets. All things considered, WLD’s token launch and first trading days were one of the most organized in recent major token launches, and WLD’s cross-exchange mid-price spread remains highly tight, as can be seen from the chart above, mainly due to Market Makers’ high activity around the token.

- Another point of contention is the token distribution, with the core team controlling 25% of the total allocation. This allocation, combined with the project’s low circulating supply and comparatively high fully diluted valuation (FDV) has led to concerns among experts. Additionally, questions have been raised regarding market making activity on the token, although no concrete evidence of malpractice has yet been presented. I am not comparing Sam Altman in any way to SBF! But experts and critics quickly made parallels between how the Worldcoin team set the tokenomics for WLD and how SBF used to manage some of his investments, known as “Sam coins”, including Serum, Raydium and FTT. We covered the principle of a flywheel mechanism in this previous article.

- Worldcoin has also been criticized for widely promoting the platform in the developing world. Many new users are in Asia and Africa, raising concerns about exploitation. “Most alarming to me is how the WorldCoin team has boasted about how many users they have. When in reality they have been exploiting people in developing countries,” tweeted pseudonymous crypto influencer ZachXBT. The bulk of user adoption seems to be driven by the financial incentive of receiving 25 WLD tokens upon sign-up (with a ~$35 value at today’s price). Although it is a small amount by occidental standards, $35-50 is reason enough for citizens in developing countries to take hours-long queues to scan their irises!

- Some of the above worries around privacy and protection of users’ personal data have already started to materialize as identity black markets have emerged, raising questions about the system’s overall security. Moreover, the low number of token holders at ~6k (source: Etherscan) has raised concerns about the accessibility of the project, particularly when contrasted with the reported millions of signups.

- There’s a lot at stake here with Worldcoin. Overall, Worldcoin’s launch represents a groundbreaking endeavor to solve the complex problem of digital human identity verification, but feedback from the crypto community so far has been resoundingly negative. Many critics voiced ethical concerns over the potential for data mismanagement and privacy leaks for sensitive iris biometrics. While we should not overlook the concerns and risks outlined by experts and the community, they do not necessarily foretell failure for the project. Many of these concerns primarily relate to the project’s implementation or are based on hypothetical future dystopian scenarios that assume the technology will be abused. However, they underscore the need for Worldcoin to address and resolve these concerns to fulfill its potential proactively. But in case of success, the project has the potential to bridge the entire human race in a way only Facebook got close to achieving at one point, transforming the way humans interact with blockchains and unlocking significant wealth for all of humanity.

About SUN ZU Lab:

SUN ZU Lab is a leading data solutions provider based in Paris, on a mission to bring better data to the global crypto ecosystem through independent quantitative analyses. We collect the most granular market data from major liquidity venues, analyze it, and deliver our solutions through real-time dashboards, API streams, and historical files. SUN ZU Lab provides crypto professionals with actionable data to monitor the market.