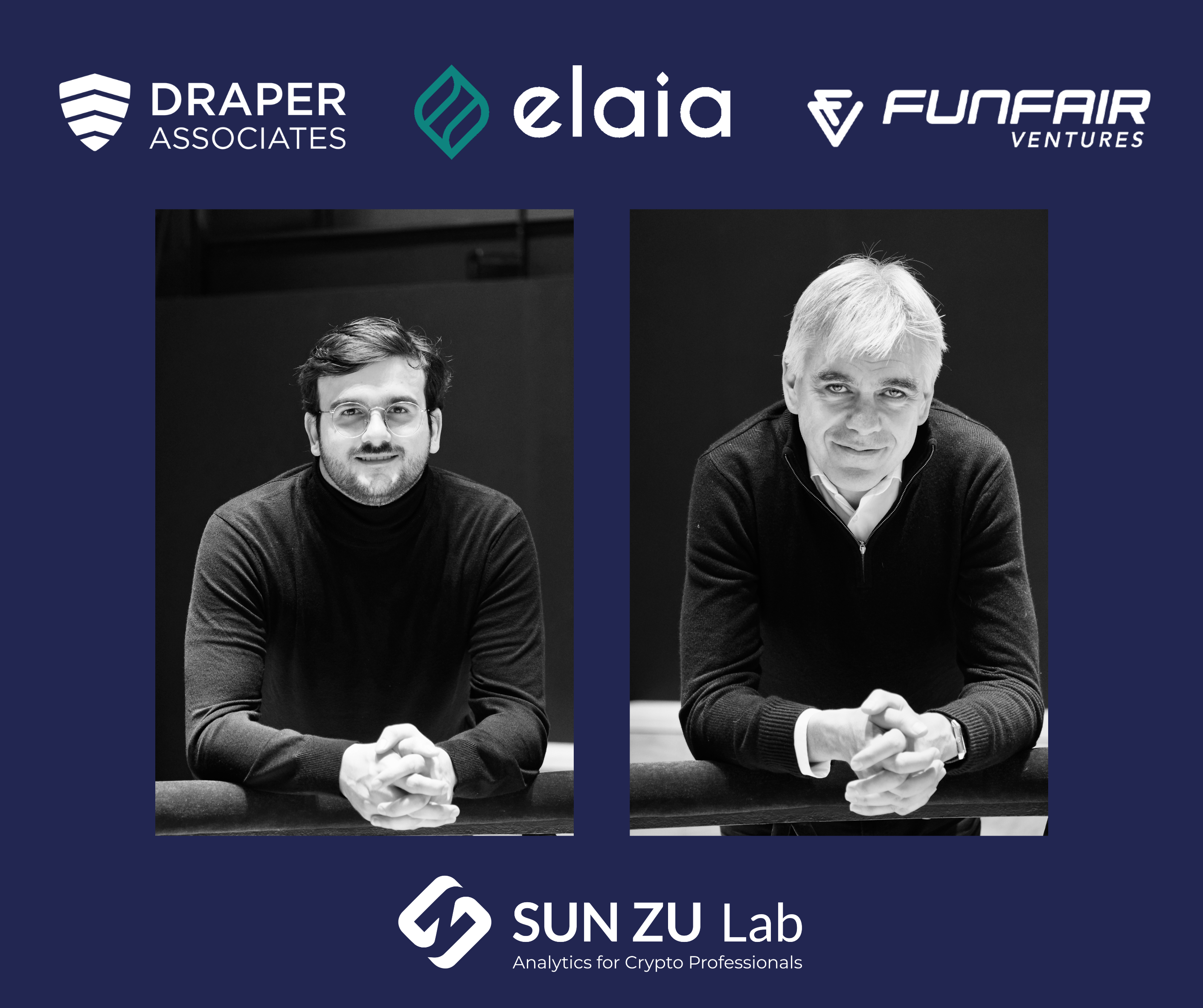

La startup française Sun Zu Lab lève 2 millions de dollars avec le soutien de Tim Draper

La startup française Sun Zu Lab, spécialisée dans l’analyse quantitative, vient de réaliser une levée de fonds de 2 millions de dollars avec la participation de l’investisseur renommé Tim Draper. Dirigée par Stéphane Reverre et Vincent Madrenas, la société...

Shaping the Future of Web3: SUN ZU Lab’s Vision for Transparent Digital Asset Markets

Summary: SUN ZU Lab, the Paris-based Digital Asset Data Solutions Provider, welcomes Tim Draper (Draper Associates) and Fun Fair Ventures to its capital. Elaia, the historic investor, renewed its trust in the team and the vision. Founded in 2020 by Stéphane Reverre...

Networking breakfast: #CeFi and #DeFi : Risks and Opportunities in 2023

We were pleased to organize a networking breakfast event and a panel around the theme #CeFi and #DeFi: Risks and Opportunities in 2023, co-hosted with Valk. Our amazing panelists, Salama Belghali, Global head of Business Development & partnership at BitMex; Yves...

SUN ZU Lab at the BPI’s Learn and Pick Mission Internationale

We had the pleasure to participate to the Learn and Pick Mission Internationale with Bpifrance and Team France during the Singapore Fintech Festival in November 2022. Watch Stéphane Reverre’s interview here! During this major event dedicated to Fintech, we...